- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Is Valero’s Expanded Credit Facility Reshaping the Long-Term Investment Case for VLO?

Reviewed by Sasha Jovanovic

- On October 16, 2025, Valero Energy Corporation announced it had amended and restated its revolving credit agreement, extending the maturity to October 16, 2030 and raising the total potential commitment to US$5.5 billion.

- This expanded credit facility bolsters Valero’s liquidity position, potentially increasing its ability to fund future initiatives and support ongoing operations.

- We’ll examine how Valero’s improved access to credit may reshape its investment narrative and support long-term financial flexibility.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Valero Energy Investment Narrative Recap

Being a Valero Energy shareholder often comes down to believing in the resilience of its refining business and its ability to generate cash flow, even as regulatory and market changes create headwinds. The recent expansion and extension of Valero’s revolving credit facility to US$5.5 billion provides added short-term liquidity, but does not appear to materially change the most important near-term catalyst, refining margin trends, or the biggest risk, which is exposure to asset impairments tied to West Coast operations.

The company’s latest dividend announcement, maintaining a quarterly payout of US$1.13 per share, reinforces a commitment to shareholder returns. While regular dividends may appeal to income-oriented investors, the sustainability of these payouts still depends on stable earnings, which can be pressured by regulatory risks and operational costs.

However, investors should carefully consider the ongoing uncertainty around possible asset impairments, as this remains a risk that could significantly affect future earnings…

Read the full narrative on Valero Energy (it's free!)

Valero Energy's outlook anticipates $116.8 billion in revenue and $3.8 billion in earnings by 2028. This scenario is based on a -0.2% annual revenue decline and a $3.04 billion increase in earnings from the current $760 million.

Uncover how Valero Energy's forecasts yield a $169.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

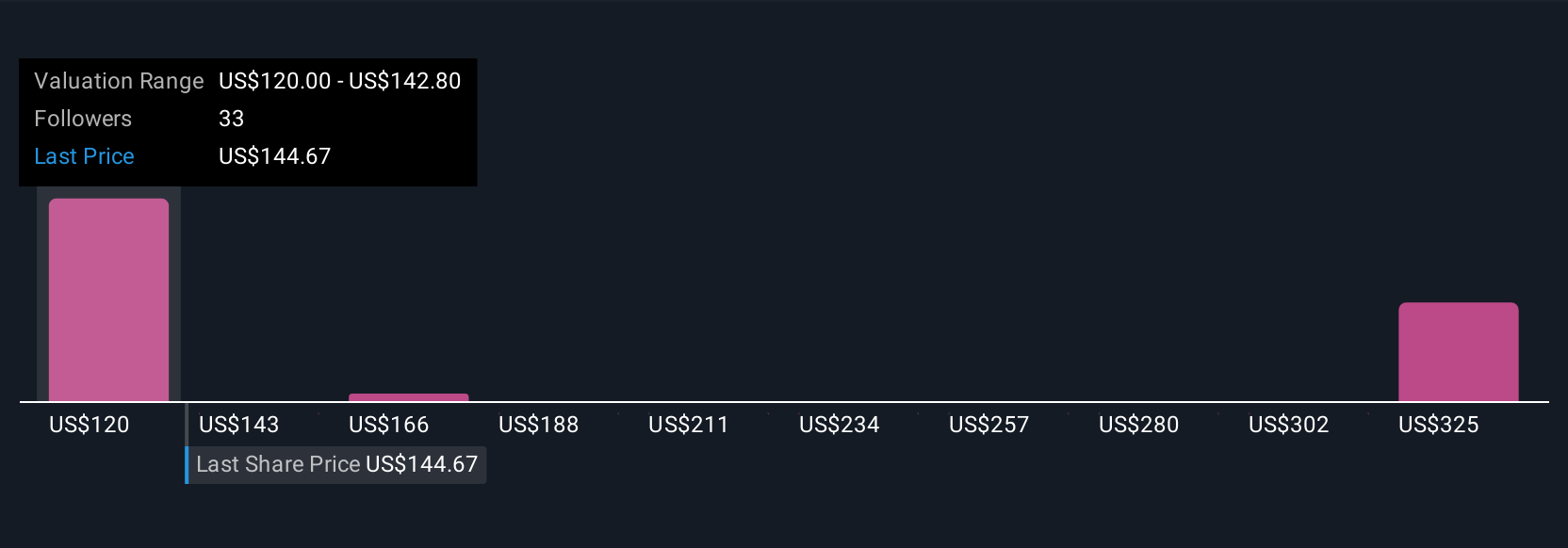

Five Simply Wall St Community members have offered fair value estimates for Valero Energy ranging from US$120 to US$274.82 per share. With regulatory risks around asset impairments still present, your view on long-term earnings potential could be influenced by which perspective you find most convincing.

Explore 5 other fair value estimates on Valero Energy - why the stock might be worth 24% less than the current price!

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives