- United States

- /

- Oil and Gas

- /

- NYSE:VLO

How Recent Stock Fluctuations and Oil Market Shifts Are Impacting Valero’s 2025 Outlook

Reviewed by Bailey Pemberton

Thinking about what to do with Valero Energy stock? You are not alone. With all eyes on energy, it is only natural to wonder if now is the right time to buy, sell, or simply hold. Valero’s stock has been on an interesting ride lately, showing just how lively this sector can be. Over the last 30 days, shares have surged 6.8%. In just the past week, the stock slipped by 5.6%. Still, the big picture is hard to ignore: Valero is up a stunning 33.7% year-to-date and an eye-catching 350.6% over the past five years. Those numbers alone make a strong case for long-term potential and suggest that changing market dynamics, including evolving oil demand and shifts in export flows, might be altering how investors view risk and opportunity in the refining space.

Despite this growth, when you take a closer look at Valero’s valuation, things get interesting. Based on six different valuation checks, Valero scores a 2 out of 6 for being undervalued. There is some evidence the stock is attractively priced, but also some reason to be cautious. Is this where the story ends, or is there more beneath the surface? Let’s break down the major valuation approaches first, then see if there is a smarter way to weigh whether Valero is truly a deal or not.

Valero Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Valero Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts them back to today’s value to estimate intrinsic worth. For Valero Energy, this approach starts with its latest reported Free Cash Flow (FCF) of $3.35 billion. Analysts provide FCF estimates for the next several years, and after that, further projections are extrapolated to round out a decade-long view.

Looking ahead, Valero’s FCF is expected to climb to $4.41 billion by 2029, based on consensus and extension estimates. These projections account for expected market conditions in refining, energy demand, and macro trends. The model used, known as the 2 Stage Free Cash Flow to Equity, provides a comprehensive framework that allows for shifting growth rates over time. All cash flow figures are calculated in USD dollars for an apples-to-apples comparison.

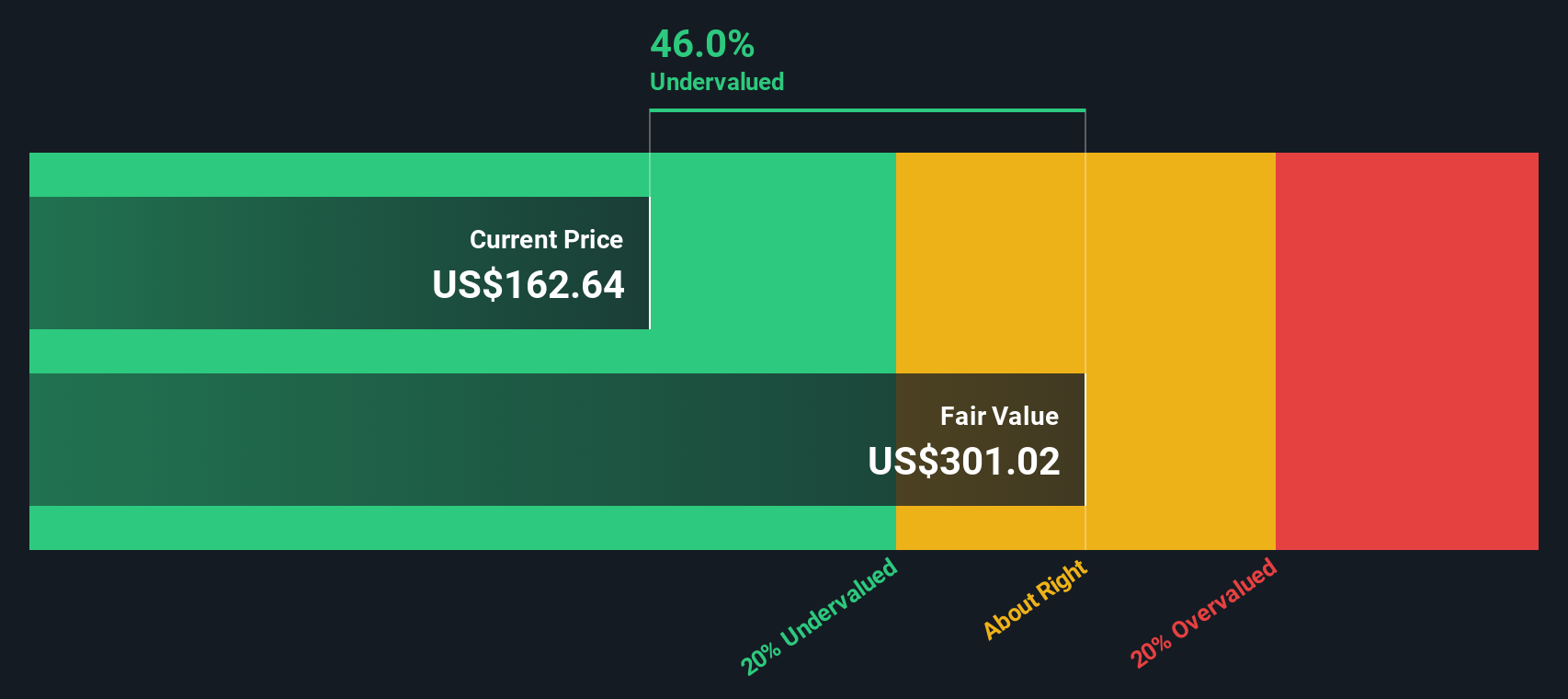

Crunching the numbers, the DCF technique calculates an intrinsic value of $275.62 per share for Valero. With the DCF-based calculation showing the stock trading at a 40.2% discount to its fair value, this suggests that Valero may be significantly undervalued at current market prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Valero Energy is undervalued by 40.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Valero Energy Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used measure for valuing profitable companies like Valero Energy, as it relates a company’s current share price to its per-share earnings. This ratio gives investors a quick sense of how much they are paying for each dollar of earnings, serving as a sensible starting point for a mature, earnings-generating business.

Growth expectations and the perceived risk profile of a company both heavily influence what is considered a "normal" or "fair" PE ratio. Companies with strong growth prospects and stable earnings typically justify a higher PE multiple, while those with uncertain outlooks or greater risk often trade at lower ratios, reflecting more cautious sentiment.

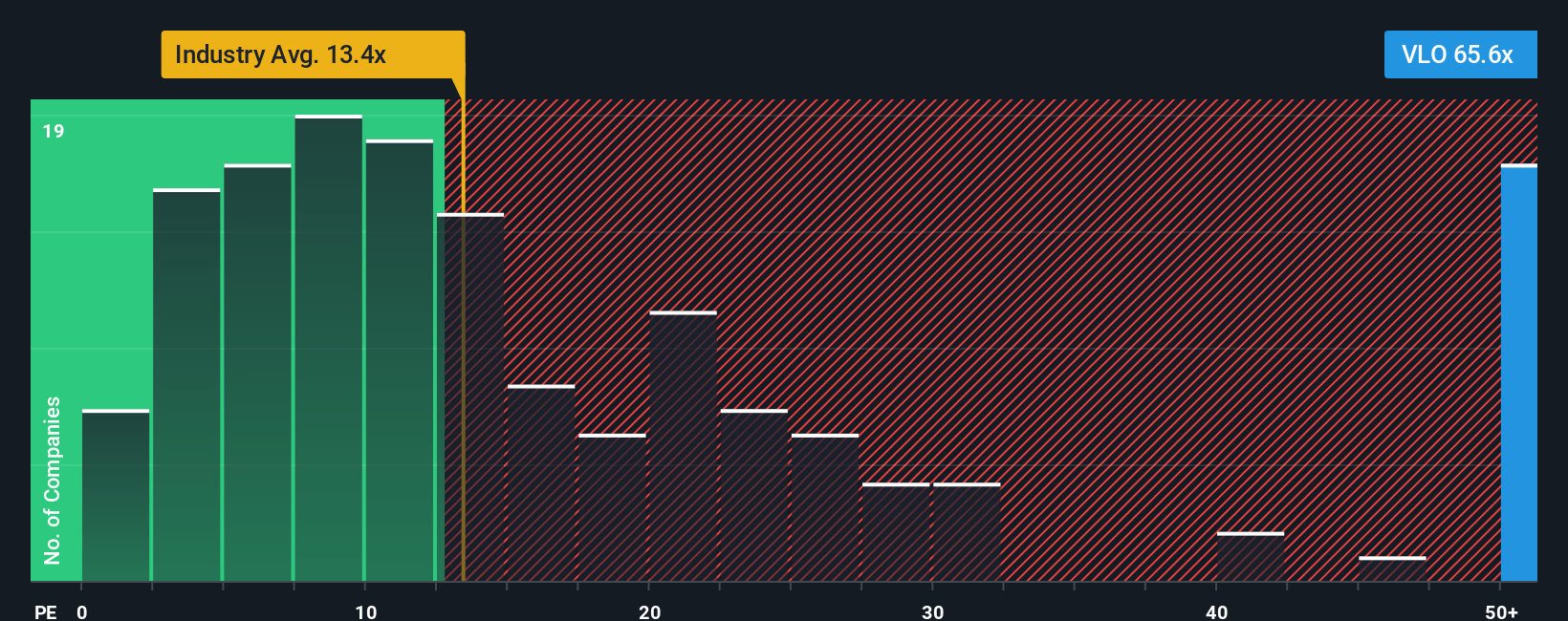

Currently, Valero Energy trades at a PE ratio of 67.32x. For comparison, the average for its oil and gas industry peers is 27.23x, and the broader sector shows an industry average of just 13.13x. At first glance, Valero’s multiple appears much higher than most benchmarks.

However, Simply Wall St’s “Fair Ratio” offers a more personalized benchmark. For Valero, this fair PE ratio is set at 23.60x. This proprietary measure is designed to reflect not just industry averages or peer behavior, but also incorporates a company’s earnings growth prospects, profit margins, risk factors, industry context, and market capitalization. As a result, it offers a more holistic view of what an appropriate multiple should be for Valero specifically, rather than just for the average company in its sector.

With Valero trading at 67.32x and the Fair Ratio at 23.60x, the current valuation appears significantly higher than what would be expected given the company’s fundamentals. On this basis, Valero Energy’s stock looks overvalued using the PE ratio.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Valero Energy Narrative

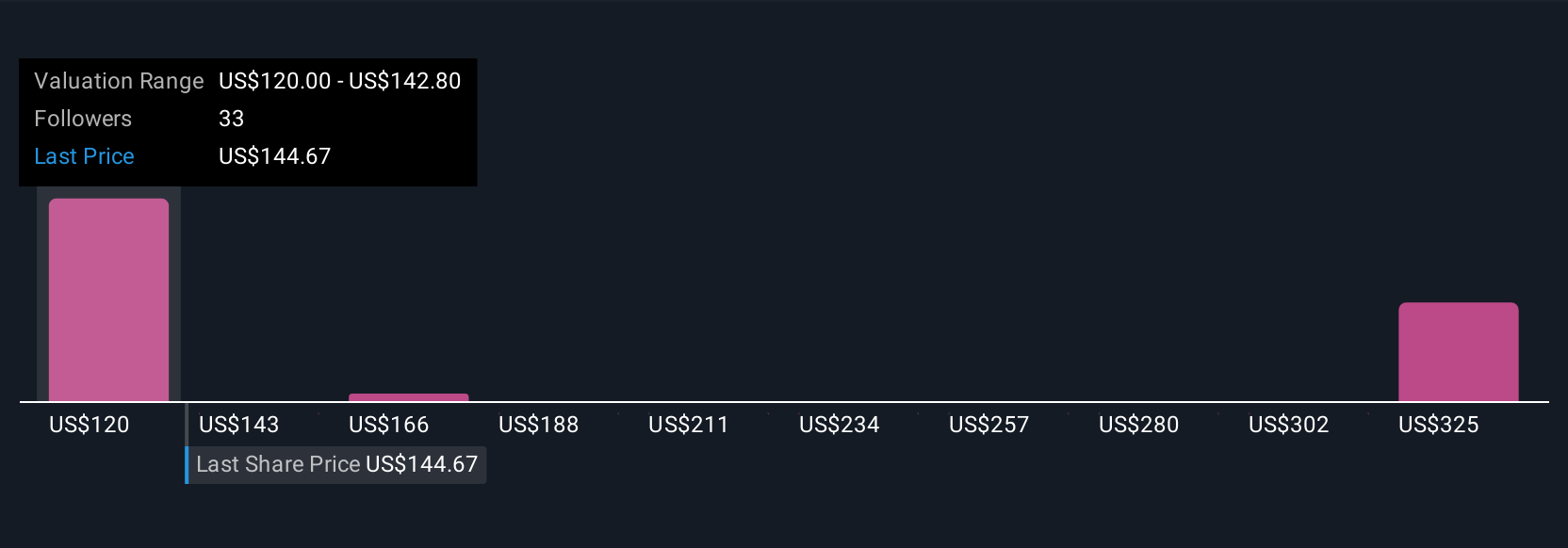

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your way of telling the story behind a company's numbers by combining your outlook on its future revenue, profits, margins, and risk factors with your own estimate of fair value. Essentially, this approach links what you believe about Valero’s future to a defensible, real-world price.

On Simply Wall St’s Community page, Narratives make it easy and accessible for anyone to shape, update, and share their views, with millions of investors already using this tool. Narratives are powerful because they connect what’s happening in the real world, such as new projects or changing market conditions, to a dynamic financial forecast, which then generates an up-to-date fair value estimate.

This process helps provide clear guidance by allowing you to compare your fair value directly to the current market price. Narratives are automatically refreshed as soon as new data or news arrives. For Valero Energy, some investors see significant potential, backing their fair value estimates with confidence based on aggressive margin improvements and high product demand. Others are more cautious, highlighting regulatory risks and potential earnings headwinds, which can result in much lower value estimates. Narratives help you decide which story makes the most sense for you.

Do you think there's more to the story for Valero Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives