- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Does Valero Energy’s 400% Five-Year Surge Signal More Room to Run in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Valero Energy stock right now? You are not alone. Whether you are already holding shares or keeping an eye on the energy sector, Valero has probably grabbed your attention with its striking mix of momentum and complexity. Over the last year, the company's stock has climbed an impressive 20.0%, and if you look back five years, the gains skyrocket to a massive 400.2%. That kind of long-term growth naturally makes investors wonder if there is still room to run.

Of course, it has not been a straight shot upward. Shorter-term numbers paint a more nuanced picture. The stock is down 2.8% over the last week and off 3.0% for the month, even as its year-to-date return stands at a robust 28.0%. Recent news around shifting global fuel demand and ongoing industry consolidation have created both tailwinds and uncertainties for Valero, which helps explain these quick pivots in sentiment. The market seems to be wrestling with how to value the company amid these changes. Are investors appropriately discounting risks, or is there hidden upside waiting to be unleashed?

To help put things in perspective, Valero currently scores a 2 on our valuation scale, which rewards companies that look deeply undervalued according to multiple methods. Out of the six key valuation checks we use, Valero meets two, which is not bad, but not overwhelmingly cheap either. Yet, as you will see, the best way to judge value is not just to tally up metrics. Next, we will break down what these valuation scores actually mean and, even more importantly, explore the single most useful way to understand whether Valero’s current price makes sense.

Valero Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Valero Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a foundational valuation approach that estimates a company’s worth by projecting its future cash flows and then discounting them back to today’s value. The basic idea is to understand how much all those dollars Valero Energy expects to generate in the years ahead are really worth at this moment in time.

Currently, Valero’s trailing twelve-month Free Cash Flow sits at around $3.35 Billion. Analyst consensus forecasts continue to paint a growth story, as Free Cash Flow is projected to reach approximately $4.41 Billion by 2029. Estimates only extend a few years out from analysts, but projections further into the future are modeled using historical performance and reasonable growth assumptions.

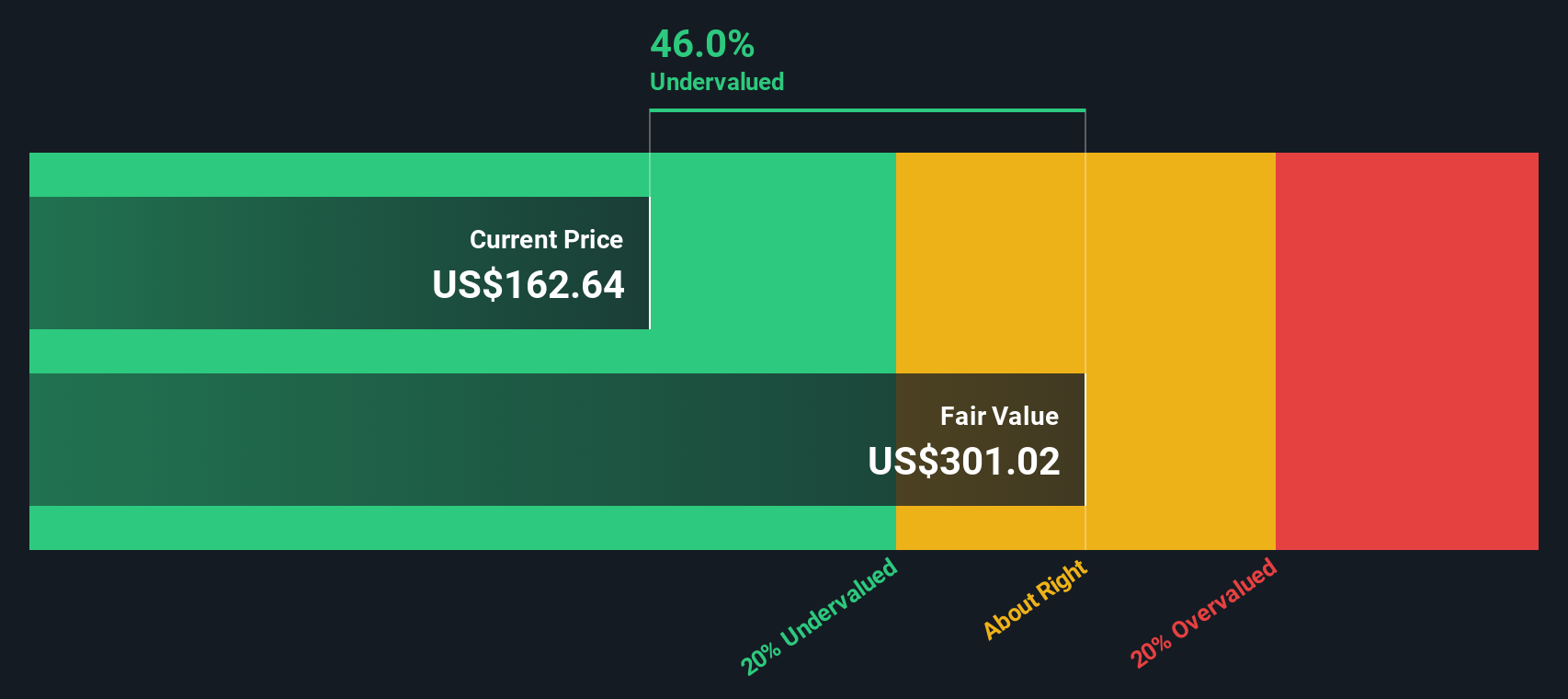

Simply Wall St’s DCF analysis uses these projections, applying a 2 Stage Free Cash Flow to Equity model to arrive at an estimated fair value of $275.64 per share. This is notably higher than where the stock is currently trading, implying the share price is 42.8% below what the cash flow projections suggest is fair.

Bottom line, based on this DCF model, Valero Energy appears meaningfully undervalued at today’s price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Valero Energy is undervalued by 42.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Valero Energy Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Valero Energy. It helps investors understand how much they are paying for each dollar of current earnings, making it especially meaningful when a company is consistently generating profits.

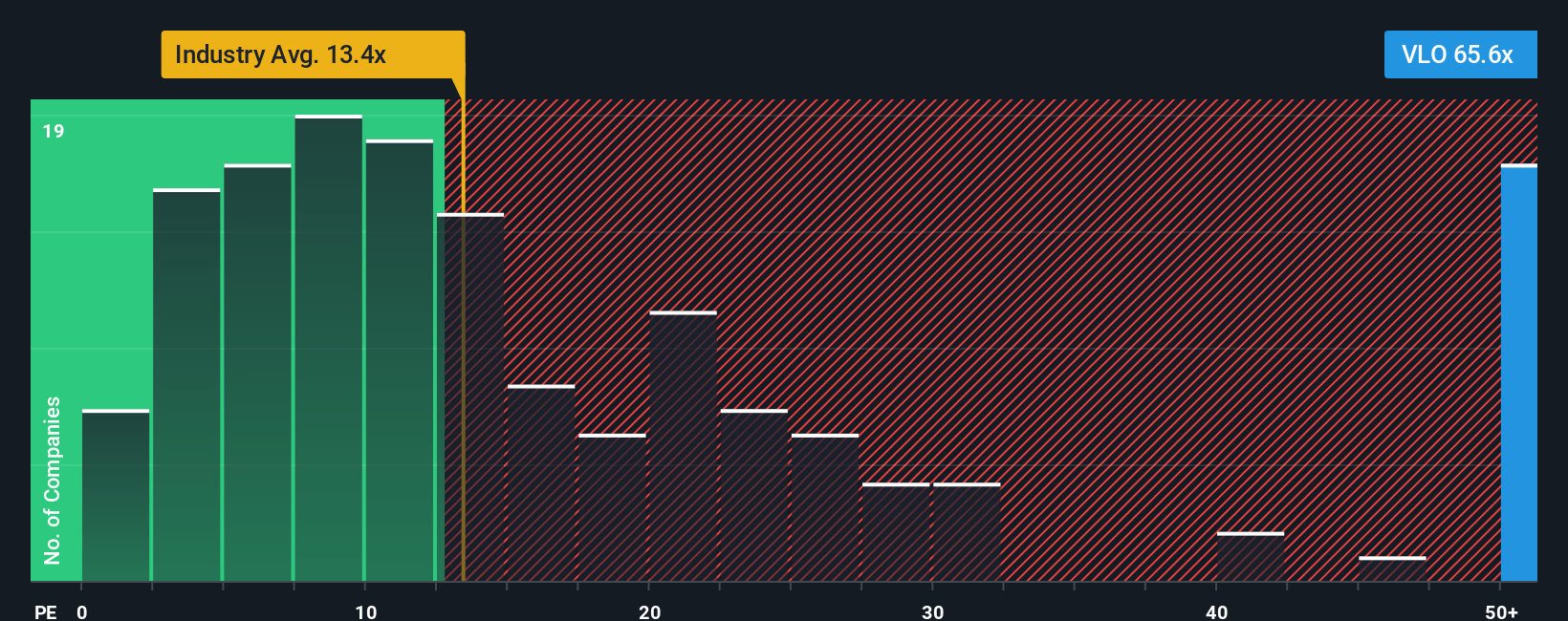

Growth expectations and risk play a big role in what constitutes a “normal” or “fair” PE ratio. Higher expected earnings growth can justify a higher PE, while greater risks typically require a lower PE to compensate investors. For Valero, the current PE ratio is 64x, which stands out when compared to the Oil and Gas industry average of around 13x and the average among its peers of about 26x.

Rather than focusing only on these comparisons, Simply Wall St’s proprietary “Fair Ratio” methodology provides a more tailored benchmark. The Fair Ratio for Valero Energy is 23x, incorporating not just earnings growth, but also factors like profit margins, specific industry dynamics, market cap, and company risk. This nuanced approach allows for a more accurate appraisal than a simple peer or industry average because it reflects the company’s unique profile and potential.

When you weigh Valero’s current 64x PE ratio against its Fair Ratio of 23x, the stock appears meaningfully overvalued on this metric alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Valero Energy Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, an intuitive tool that lets you connect Valero Energy’s story to real numbers and a meaningful fair value.

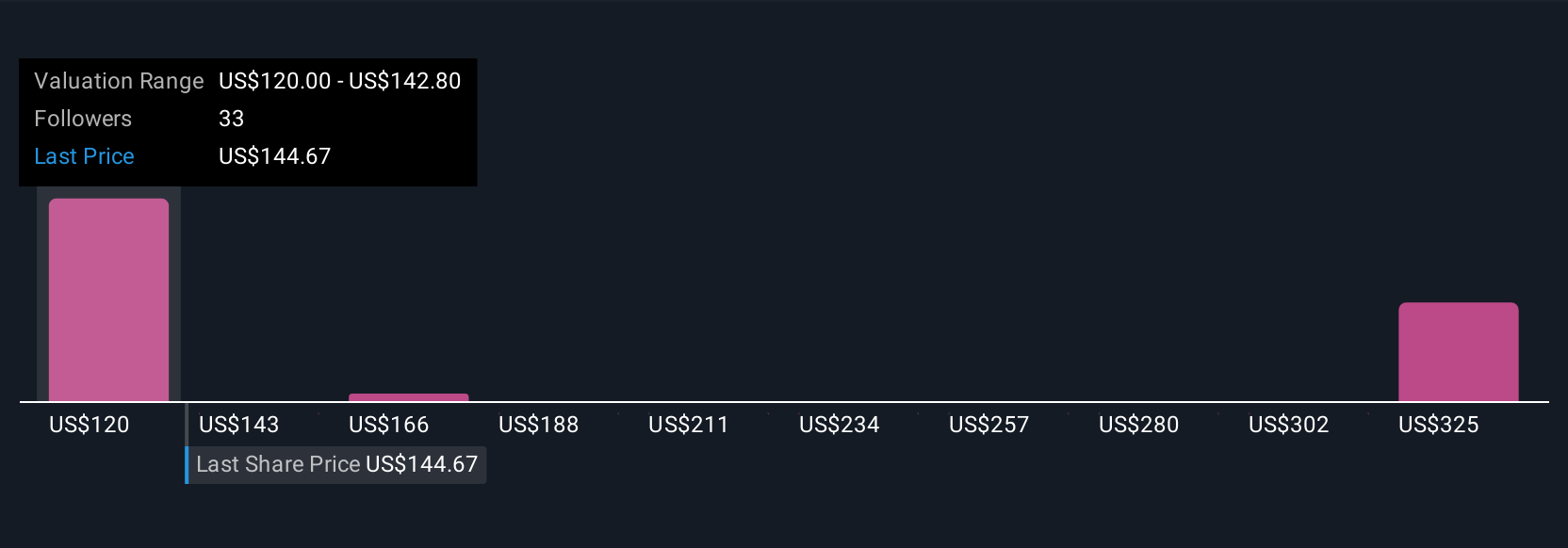

A Narrative starts with your perspective on Valero's future, from revenue and margin trends to industry changes. It then turns your outlook into a personal financial forecast and a fair value estimate. On Simply Wall St’s platform, Narratives are easy to create and compare within the Community page, making this approach accessible to millions of investors.

With Narratives, you can see not just what you believe Valero is worth today, but why. You can compare your own view with others, and everything is dynamically updated whenever news or earnings change the company’s outlook. This helps you decide whether to buy or sell by weighing your Fair Value against the current Price, instead of just relying on static metrics.

For example, some investors think Valero’s strong refining margins and share buybacks justify a fair value as high as $181 per share. Others, focusing on regulatory and renewable segment risks, estimate a fair value as low as $133 per share. Narratives capture these differences, so you can invest with a story, not just a number.

Do you think there's more to the story for Valero Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives