- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Did Valero Energy's (VLO) Latest Dividend Declaration Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- Valero Energy’s Board of Directors has declared a regular quarterly cash dividend of US$1.13 per share, payable on September 2, 2025 to shareholders of record at the close of business on July 31, 2025.

- This continued commitment to dividends reinforces the company's ongoing focus on supporting shareholder returns through consistent cash distributions.

- We’ll assess how Valero’s latest dividend declaration may underscore its focus on shareholder returns within the broader investment narrative.

Valero Energy Investment Narrative Recap

To be a Valero Energy shareholder today, you need to believe in the company’s ability to generate steady cash flow and deliver consistent shareholder returns despite recent earnings volatility and sector headwinds. The latest quarterly dividend declaration confirms Valero’s ongoing commitment to shareholder payouts, but it does not materially change the most important short-term catalyst, refining margins supported by tight product supply, nor does it address the biggest near-term risk of further asset impairments from regulatory pressures, especially on the West Coast.

One recent announcement aligning with this dividend news is Valero’s completion of a substantial share repurchase program, reflecting ongoing efforts to return capital beyond just dividends. Together with the consistent dividend and buyback activity, these actions may appeal to investors focused on yield, but they do not directly mitigate risks tied to potential losses from operational challenges or regulatory shifts.

In contrast, while shareholder returns remain a focus, the risk of significant asset impairments, particularly tied to regulatory actions in California, is something investors should be mindful of...

Read the full narrative on Valero Energy (it's free!)

Valero Energy is forecast to achieve $122.9 billion in revenue and $4.5 billion in earnings by 2028. This outlook reflects a slight annual revenue decline of 0.1% and a $3.6 billion increase in earnings from the current $924.0 million.

Exploring Other Perspectives

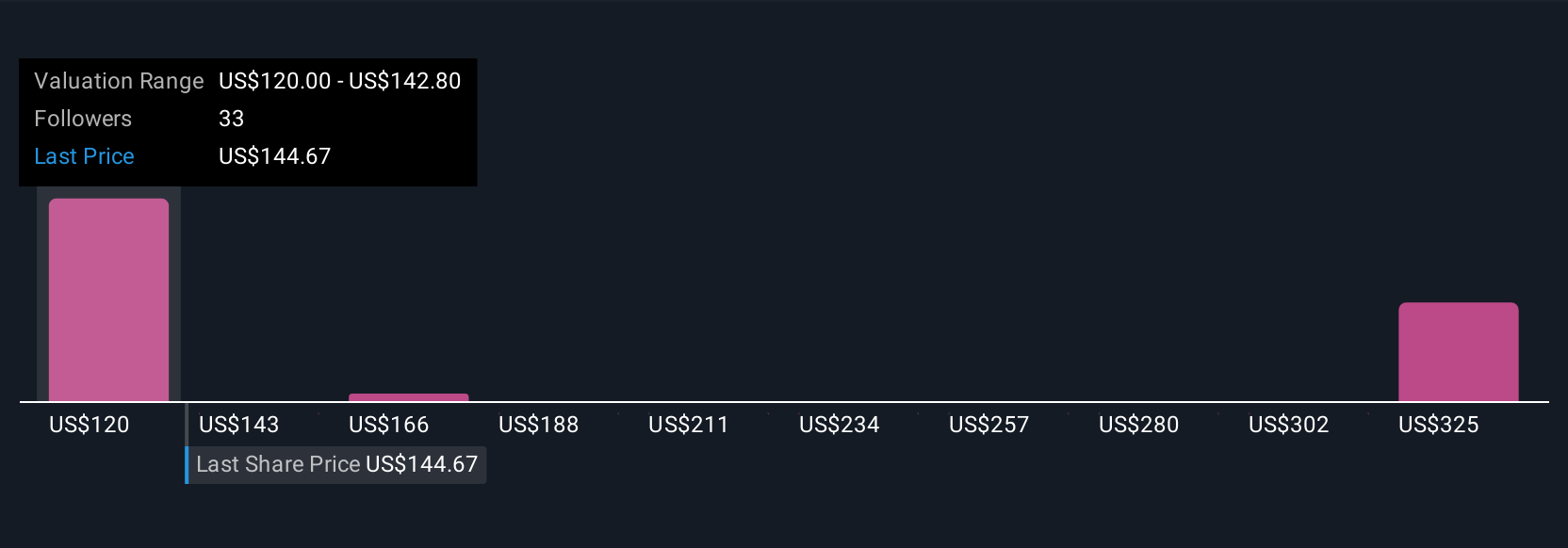

Simply Wall St Community members provided five fair value estimates for Valero, spanning from US$120 to US$347. The wide range of opinions contrasts with concerns about sustainability of cash payouts should further asset impairments occur, highlighting the importance of reviewing multiple market viewpoints before making a decision.

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives