- United States

- /

- Oil and Gas

- /

- NYSE:VG

Venture Global (VG): Assessing Valuation After 20-Year Tokyo Gas LNG Supply Deal and Expanding Contract Backlog

Reviewed by Simply Wall St

Venture Global (VG) just locked in a 20 year LNG supply deal with Tokyo Gas, extending a string of recent contracts that effectively pre sell a large slice of its future production capacity.

See our latest analysis for Venture Global.

The new Tokyo Gas contract, on top of a recently affirmed dividend, has not yet turned sentiment around. Venture Global’s year to date share price return is a steep negative 71.29 percent, suggesting momentum is still weak despite a stronger growth narrative.

If you like the idea of locking in long term energy demand but want more options, this could be a good moment to explore aerospace and defense stocks as another area where multi year contracts drive value.

With the stock down sharply but trading at nearly a 100 percent discount to consensus targets and backed by multi decade LNG contracts, is Venture Global a mispriced turnaround story, or is the market already discounting its future growth?

Price-to-Earnings of 8.2x: Is it justified?

On a price-to-earnings ratio of 8.2 times, Venture Global screens as undervalued versus both its peer group and the broader US oil and gas industry at the latest close of $6.89.

The price-to-earnings multiple compares the current share price with the company’s earnings per share, which is a common way investors gauge how much they are paying for every dollar of profit in capital-intensive sectors like LNG.

In Venture Global’s case, a single-digit price-to-earnings ratio suggests the market is assigning a discounted value to current earnings power despite rapid recent profit growth and improving net margins. This may potentially reflect concerns about the sustainability of those earnings, the company’s leverage, and uneven forward profit forecasts.

That discount looks stark when stacked against the US oil and gas industry average of 13.6 times earnings and a peer average of 23.2 times. It also appears notable relative to an estimated fair price-to-earnings ratio of 12.3 times, which signals room for the valuation multiple to expand if sentiment and earnings quality improve.

Explore the SWS fair ratio for Venture Global

Result: Price-to-Earnings of 8.2x (UNDERVALUED)

However, persistent net income contraction, combined with heavy capital needs for Gulf Coast expansion, could keep pressure on both valuation multiples and investor confidence.

Find out about the key risks to this Venture Global narrative.

Another View: Discounted Cash Flow Check

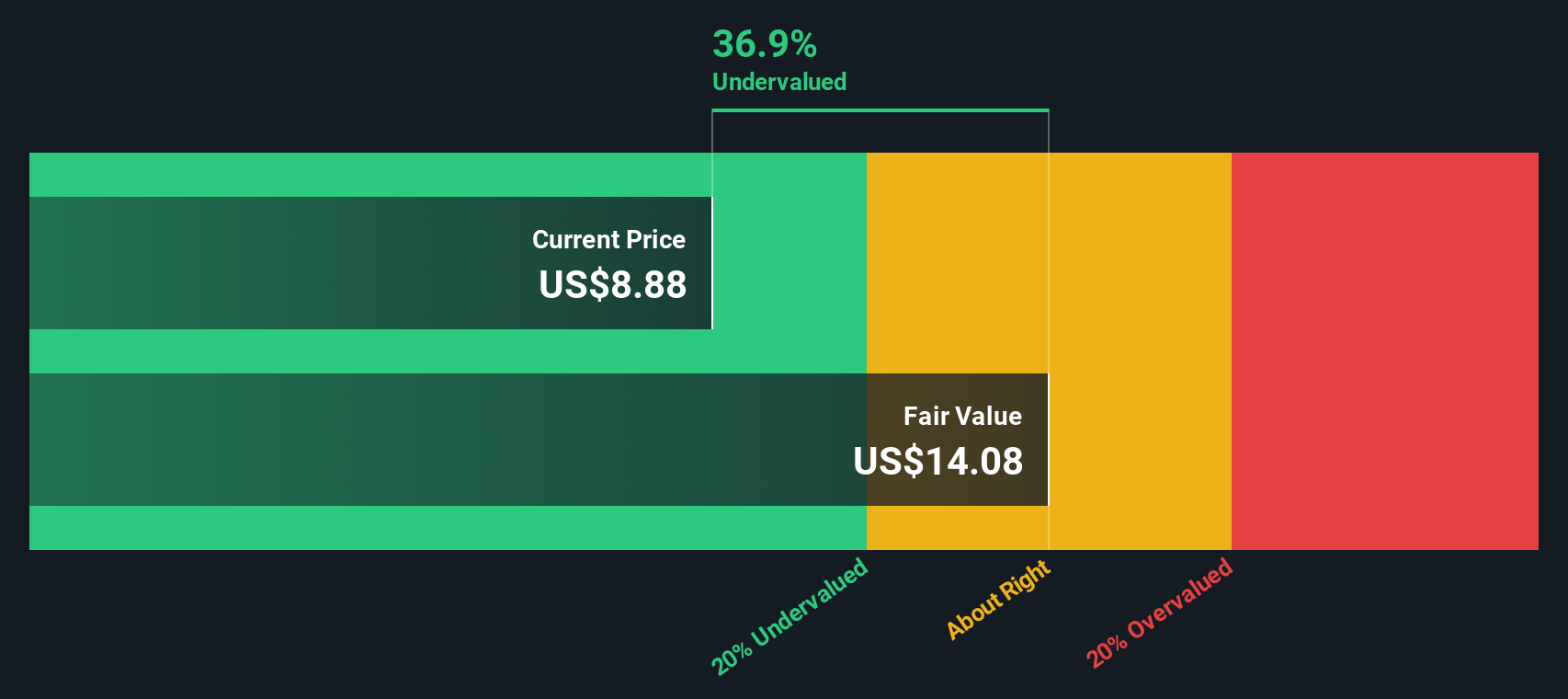

Our DCF model also points to upside, with a fair value of about $10.08 a share versus the current $6.89 price, implying Venture Global trades around 31.6 percent below that estimate. If both earnings and cash flow indicate a low valuation, what exactly is the market worried about?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Venture Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Venture Global Narrative

If you want to dig into the numbers yourself instead of relying on this view, you can quickly build a custom storyline in under three minutes: Do it your way.

A great starting point for your Venture Global research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas right now?

Turn this analysis into action by using the Simply Wall Street Screener to uncover fresh opportunities before others notice them and position your portfolio for the next move.

- Capture powerful momentum stories by targeting these 25 AI penny stocks that could reshape industries with real-world machine learning breakthroughs and accelerating demand.

- Strengthen your income stream through these 14 dividend stocks with yields > 3% that combine solid yields with the potential for long term capital appreciation.

- Position yourself early in emerging digital infrastructure with these 81 cryptocurrency and blockchain stocks poised to benefit as blockchain adoption and tokenized finance scale up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026