- United States

- /

- Energy Services

- /

- NYSE:VAL

Will Valaris' (VAL) Egypt Drillship Deal With BP Reinforce Its Long-Term Earnings Narrative?

Reviewed by Sasha Jovanovic

- Valaris Limited announced it has secured a five-well contract with BP Exploration Delta Limited for the VALARIS DS-12 drillship in Egypt, expected to begin in the second quarter of 2026 and last approximately 350 days with an estimated total value of US$140 million, including a mobilization fee.

- This contract builds on Valaris’ commercial relationship with BP in the Egyptian offshore market and features the possibility of three additional option wells, underscoring continued demand for high-specification offshore drilling assets.

- We’ll examine how the multi-well Egypt contract with BP strengthens Valaris’ contract backlog and supports its long-term earnings narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Valaris Investment Narrative Recap

To be a shareholder in Valaris, you need confidence in sustained demand for advanced offshore drilling, supported by the company's sizable contract backlog and the global energy requirements driving offshore activity. The newly announced US$140 million, five-well BP contract adds visibility to future revenue, but does not fundamentally shift the most immediate catalyst, the pace of new contract awards and fleet utilization, nor does it alleviate the persistent risk of overcapacity and day rate competition in the coming years.

Among the recent announcements, the July contract extensions with Anadarko, which total nearly US$760 million and stretch well into 2028, are especially relevant as they reinforce Valaris’ position in securing long-cycle contracts for its drillships. These multi-year agreements, along with the latest BP award, contribute to the company’s growing contract backlog, a central catalyst for revenue stability and long-term earnings potential, though not without heightening fleet management demands.

However, investors should also be aware that while backlog growth signals opportunity, it does little to shield earnings if...

Read the full narrative on Valaris (it's free!)

Valaris is projected to generate $2.4 billion in revenue and $453.7 million in earnings by 2028. This outlook is based on an expected annual revenue decline of 1.2% and an earnings increase of $178.2 million from current earnings of $275.5 million.

Uncover how Valaris' forecasts yield a $52.10 fair value, a 8% upside to its current price.

Exploring Other Perspectives

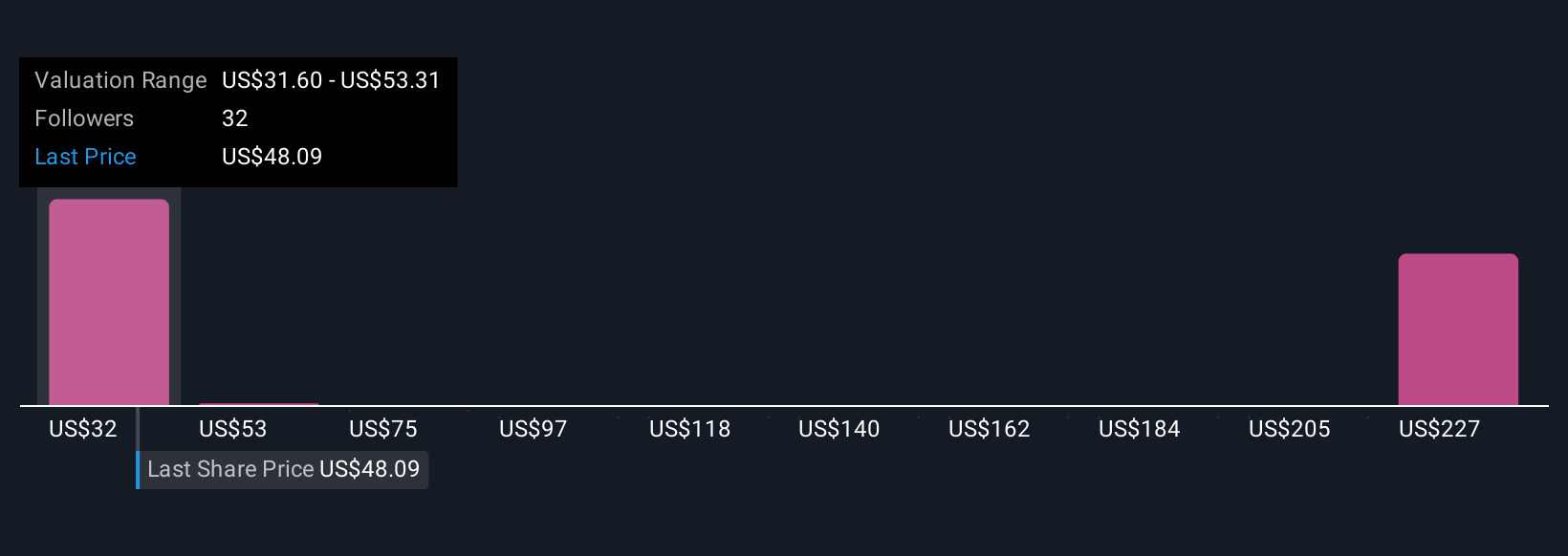

Eight Simply Wall St Community fair value estimates for Valaris range widely from US$31.60 to US$249.50 per share. As the company benefits from robust contract wins, issues like future day rate pressure remain on many investors’ radar, check out more perspectives for a fuller picture.

Explore 8 other fair value estimates on Valaris - why the stock might be worth over 5x more than the current price!

Build Your Own Valaris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valaris' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives