- United States

- /

- Energy Services

- /

- NYSE:VAL

Assessing Valaris (VAL) Valuation After Strong Financials and Relative Strength Rating Upgrade

Reviewed by Kshitija Bhandaru

Valaris (NYSE:VAL) is gaining attention after receiving a Relative Strength Rating upgrade, which reflects stronger technical performance. The company’s return on equity is well above industry averages, due to significant profit growth and effective capital reinvestment.

See our latest analysis for Valaris.

Valaris has attracted fresh interest as its technical momentum builds, highlighted by a 7.16% 7-day share price return and nearly 16.2% share price gain year-to-date. While the 1-year total shareholder return is slightly negative, the steady price climb and recent profit strength suggest that sentiment could be shifting in anticipation of future gains.

If you’re looking to expand your watchlist beyond Valaris, now is an ideal moment to discover fast growing stocks with high insider ownership.

But with investors taking note of Valaris’ steady rebound, the key question is whether the current share price understates the company’s true potential, or if the market has already factored in expectations for further growth.

Most Popular Narrative: 0% Overvalued

The consensus narrative places fair value almost exactly at Valaris’s last close, pointing to a market priced for future operational shifts and sector tailwinds.

Persistent global energy demand growth, especially from emerging markets and the prioritization of long-cycle offshore developments by oil majors and national oil companies, is leading to a healthy pipeline of more than 30 floater opportunities planned to commence in 2026 and 2027. This positions Valaris for sustained contract awards and potential revenue and EBITDA growth.

What is really fueling that valuation? The narrative hinges on sharp earnings expansion, rising profit margins, and a future profit multiple lower than its industry peers. Want to know which financial forecasts must play out? Discover which bold projections set this price target.

Result: Fair Value of $52.1 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating energy transition or industry overcapacity could challenge Valaris’s growth story and put pressure on future earnings if market conditions shift unexpectedly.

Find out about the key risks to this Valaris narrative.

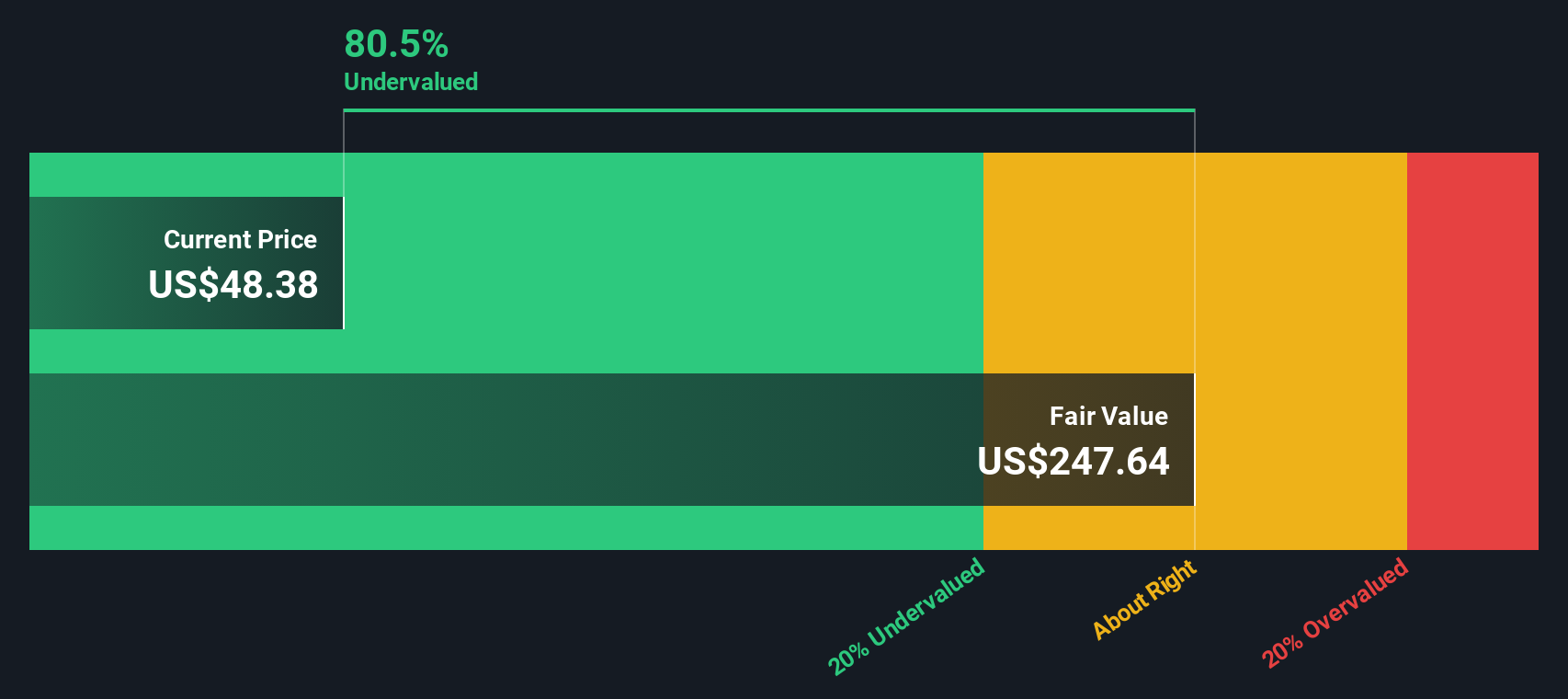

Another View: SWS DCF Model Tells a Different Story

While current analyst targets see Valaris as fairly priced, our DCF model offers a strikingly different view. It calculates fair value at $262.31, which suggests shares could be trading at a massive discount. Is the market missing something, or is there a reason for this significant gap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valaris Narrative

If you see things differently or want to dig deeper into the fundamentals yourself, it's simple to craft your own view using the same data. Create your own narrative in just a few minutes. Do it your way

A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Serious about spotting the next breakout stock? You’re just a few clicks from uncovering high-potential opportunities you probably haven’t seen anywhere else.

- Uncover hidden market gems by checking out these 895 undervalued stocks based on cash flows to get ahead of the crowd on undervalued companies with strong underlying cash flows.

- Tap into unstoppable tech trends, including next-level automation and digital breakthroughs, when you browse these 25 AI penny stocks.

- Secure reliable returns for your portfolio by seeing which companies are rewarding investors with healthy yields in these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives