- United States

- /

- Energy Services

- /

- NYSE:USAC

USA Compression Partners (USAC): Examining Valuation as Investor Sentiment Cools After Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for USA Compression Partners.

Despite a dip in the past month, with a 1-month share price return of -8.62%, USA Compression Partners has still managed to deliver a robust 8.0% total shareholder return over the past year. Momentum has cooled recently; however, the company’s long-term results remain solid, highlighted by a 263% total return for investors over five years as revenue and net income have steadily climbed.

If pipeline momentum has you thinking about what else could help diversify your portfolio, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

This raises a key question: Is USA Compression Partners currently undervalued given its upside to analyst targets and fundamentals, or is the market already factoring in the company’s future growth potential, leaving little room for buyers?

Most Popular Narrative: 16.8% Undervalued

Analyst consensus suggests USA Compression Partners could be worth significantly more than the last close, despite slower revenue growth than the overall market. The fair value embedded in their view sits well above the current share price, hinting that upside could remain if key assumptions play out.

Robust growth in natural gas demand fueled by AI, cloud computing, and massive new data center investments is driving a sustained need for reliable, high-horsepower compression solutions. This positions USAC for ongoing contract wins and steady revenue growth.

What is the engine behind these bold projections? Analysts are banking on higher profit margins and a growth turnaround reminiscent of market disruptors in adjacent sectors. Want the details on which financial levers need to fire for this valuation to become reality? The full narrative unpacks every assumption. Find out how it all ties together.

Result: Fair Value of $26.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on a few key customers and rising operating costs could quickly turn sentiment if contract stability or margin growth begins to falter.

Find out about the key risks to this USA Compression Partners narrative.

Another View: What Do Market Multiples Say?

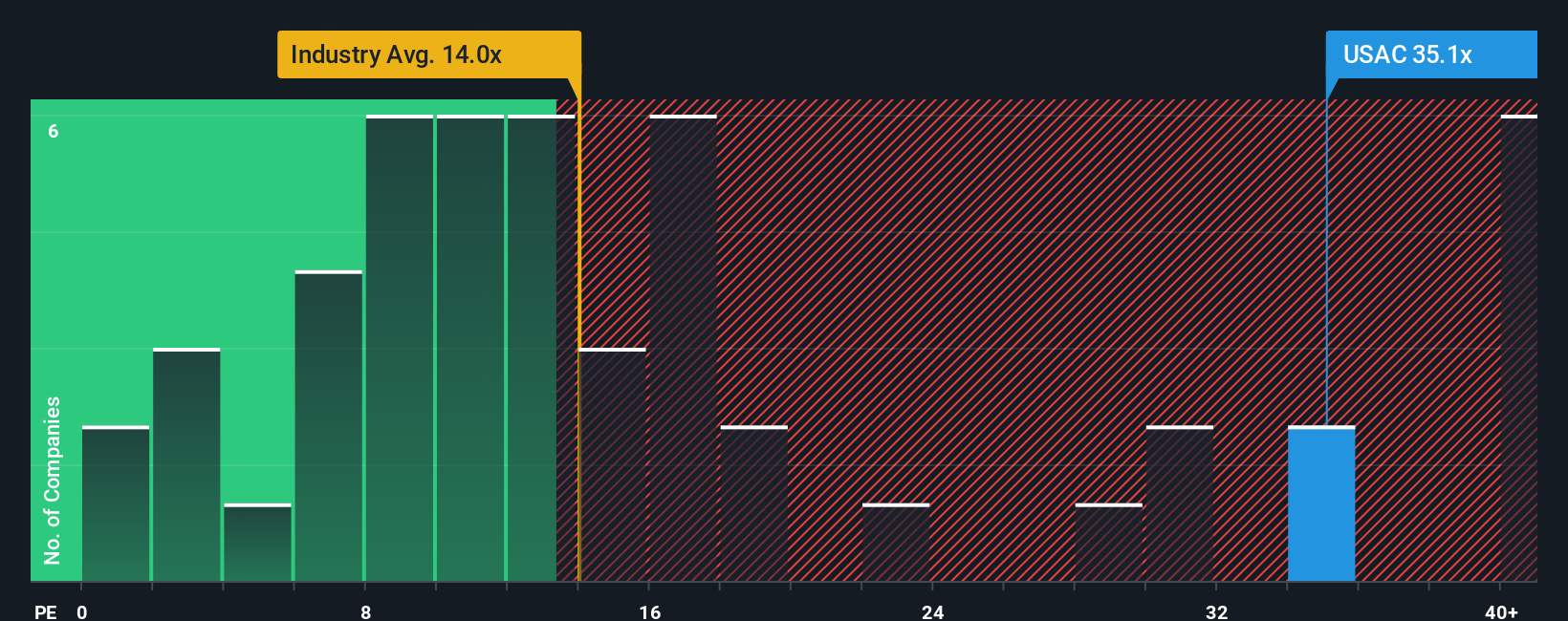

Taking a different approach, current market valuation metrics for USA Compression Partners paint a more cautious picture. The company trades at 34.4 times earnings, which is noticeably higher than both the industry average of 16.3 and its own fair ratio estimate of 20.3. This premium suggests the market may already be pricing in much of the expected growth, leaving little margin for error if forecasts fall short. Could the stock's high multiple signal greater risk than the consensus price target implies?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own USA Compression Partners Narrative

If you want to challenge the consensus or follow your own trail through the numbers, you can assemble a personal narrative in just a few minutes. Do it your way.

A great starting point for your USA Compression Partners research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Use the Simply Wall Street Screener to find stocks with strong potential and tailor your strategy to your ambitions.

- Target potential bargains by reviewing these 854 undervalued stocks based on cash flows that stand out for value rooted in their cash flow, not market hype.

- Tap into the rise of robotics and automation by analyzing these 26 AI penny stocks as they push boundaries in artificial intelligence and real-world applications.

- Start building reliable income with these 21 dividend stocks with yields > 3% featuring robust yields above 3% and long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USAC

USA Compression Partners

Provides natural gas compression services in the United States.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives