- United States

- /

- Energy Services

- /

- NYSE:TTI

Will TETRA Technologies (TTI) New Growth Focus Redefine Its Long-Term Investment Narrative?

Reviewed by Simply Wall St

- TETRA Technologies, Inc. recently hosted an Investor Day at the New York Stock Exchange, presenting its operational performance, innovative technologies, growth initiatives, and financial outlook to in-person and virtual attendees amid heightened industry interest.

- The event’s high demand underscored increased market attention, reflecting strong investor interest in TETRA’s expansion into energy services, critical minerals, and low-carbon solutions.

- We’ll explore how sharing new details on operational performance and growth initiatives at Investor Day may reshape TETRA’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

TETRA Technologies Investment Narrative Recap

To be a shareholder in TETRA Technologies, an investor needs to believe in the company's ability to drive long-term growth by expanding into energy services, critical minerals, and low-carbon solutions, while also managing margin and revenue volatility tied to deepwater completions and industrial chemical demand. The recent Investor Day event offered transparency on operating performance and growth initiatives, but does not immediately alter the key short-term catalyst: the ramp-up of zinc-bromide electrolyte demand, nor the biggest risk, which remains potential disruption or delays in major project execution. Among recent announcements, the successful drilling results for bromine and lithium extraction in the Evergreen Unit directly relate to TETRA's exposure to critical minerals, an area spotlighted during Investor Day. This tangible progress strengthens the narrative around future revenue streams, especially as utility-scale energy storage demand could accelerate the monetization of these resources if industry trends and customer uptake continue as expected. In contrast, it's important for investors to also keep an eye on the risk from significant capital commitments like the Arkansas bromine facility, as delays or demand shortfalls could ...

Read the full narrative on TETRA Technologies (it's free!)

TETRA Technologies' narrative projects $661.4 million in revenue and $1.8 million in earnings by 2028. This requires 2.9% yearly revenue growth and a $118.6 million decrease in earnings from the current $120.4 million.

Uncover how TETRA Technologies' forecasts yield a $6.33 fair value, a 19% upside to its current price.

Exploring Other Perspectives

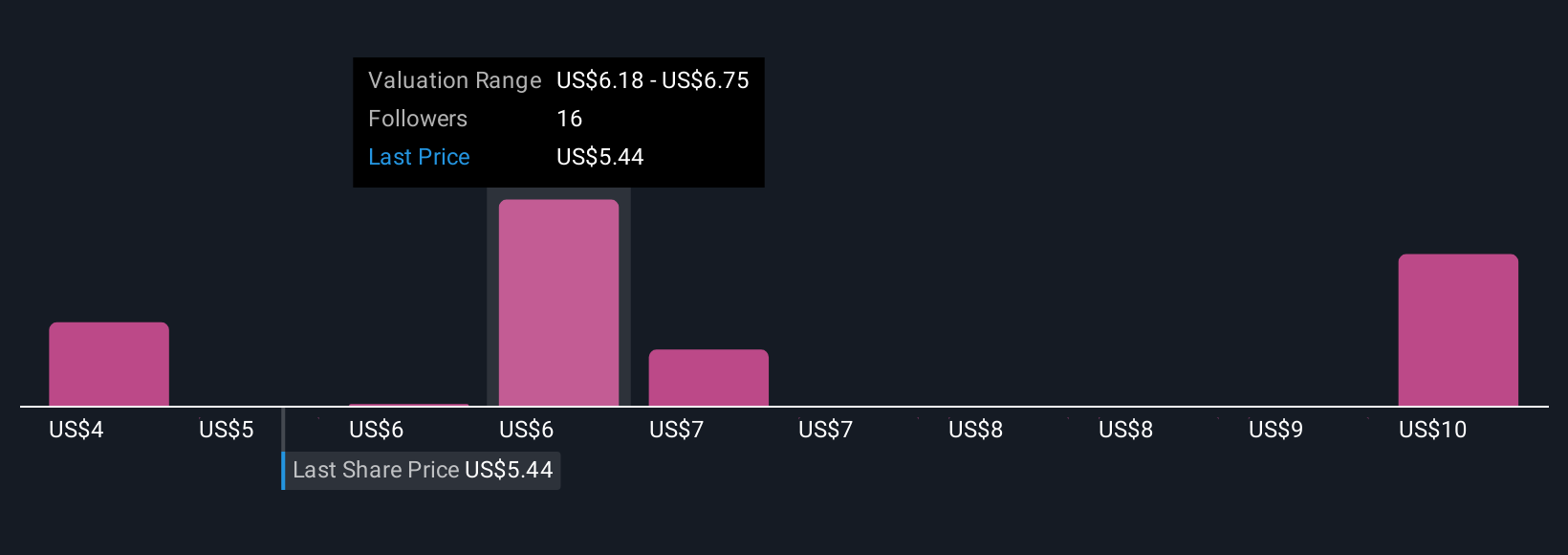

Six recent fair value estimates from the Simply Wall St Community put TETRA shares between US$4.45 and US$10.21, with opinions spanning over a US$5.75 range. Against this variety, project ramp-up delays still loom large for TETRA and could significantly affect the company's future returns, inviting you to review multiple outlooks before forming your own view.

Explore 6 other fair value estimates on TETRA Technologies - why the stock might be worth 16% less than the current price!

Build Your Own TETRA Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TETRA Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TETRA Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TETRA Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TETRA Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTI

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives