- United States

- /

- Oil and Gas

- /

- NYSE:TPL

Texas Pacific Land (TPL) Margin Moderation Reinforces Debate Over Sustainability of Premium Valuation

Reviewed by Simply Wall St

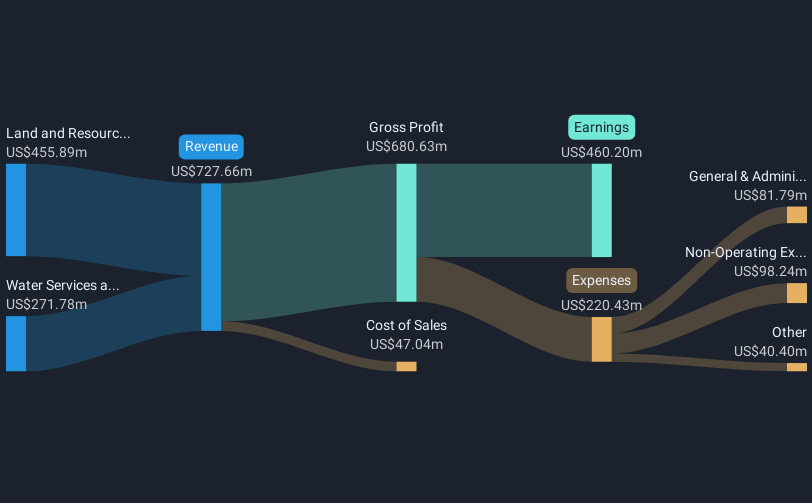

Texas Pacific Land (TPL) posted a net profit margin of 61.7%, down from last year’s 65.3%, with annual earnings growth slowing to 6.2% from its five-year average of 17.2%. Despite this moderation, the stock trades at $1,011.13 and commands a steep 48.8x earnings multiple. This is well above the US oil and gas industry average of 12.8x and the peer average of 15x, and far exceeds a modeled fair value of $544.63. While the company’s robust long-term earnings track record stands out, high non-cash earnings and a premium valuation shape investor sentiment as growth normalizes.

See our full analysis for Texas Pacific Land.Next up, we’ll measure these headline numbers against the most widely followed market narratives to see which stories are backed up and which might be under the microscope this quarter.

See what the community is saying about Texas Pacific Land

Profit Margin Holds Firm Near 63%

- Analysts forecast profit margins rising from 63.2% today to 68.2% in three years, highlighting expectations for even stronger profitability ahead.

- Consensus narrative points to several balancing forces for margin stability:

- Stable royalty income streams and new infrastructure initiatives support the argument for resilience, while analysts note that decarbonization and stricter ESG trends introduce risks to sustained high margins over the long run.

- Concentration of activity in the Permian Basin provides margin strength today, but if regulatory or environmental headwinds intensify, future margin expansion could stall.

- Despite risks, the analysts’ consensus view is that Texas Pacific Land’s high-margin royalty and infrastructure business offsets some long-term concerns and supports current optimism. See how margin performance shapes the full story in the consensus view: 📊 Read the full Texas Pacific Land Consensus Narrative.

High Non-Cash Earnings Draw Scrutiny

- Non-cash earnings remain elevated and have become a focal point, with investors watching closely to assess whether these are supporting quality, recurring profit or masking core cash flow trends.

- Consensus narrative highlights competing claims about earnings quality and risk:

- Despite strong headline profits, the principal risk analysts note is the heavy reliance on non-cash items, as recurring free cash flow is not detailed, leaving questions about the sustainability of reported margins open to debate.

- Critics observe that as non-cash earnings climb, it becomes more difficult to judge how much of earnings growth is truly durable versus accounting-driven, directly tying this concern to the sustainability of TPL’s premium valuation.

Valuation Premium Widens Over Peers

- Texas Pacific Land is trading at a 48.8x earnings multiple, significantly exceeding the US oil and gas industry average of 12.8x and its peer group at 15x, and stands well above its DCF fair value of $544.63 per share.

- Consensus narrative sees tension building between recent fundamental performance and the current share price:

- With the stock at $1,011.13 and analysts’ price target at $625.00, even improving revenue and margin forecasts may not convince skeptics that the market is pricing risk appropriately.

- Consensus cautions that unless long-term margin growth and revenue assumptions are met or exceeded, TPL’s world-leading valuation could invite a major rerate closer to industry levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Texas Pacific Land on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a different take on the numbers? Take just a few minutes to craft and share your own perspective. Do it your way

A great starting point for your Texas Pacific Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Texas Pacific Land’s stretched valuation and heavy reliance on non-cash earnings raise questions about the sustainability of its premium share price.

If you’re searching for stocks trading at more compelling prices with solid fundamentals backing them up, check out these 854 undervalued stocks based on cash flows and find opportunities that could offer better value and lower risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives