- United States

- /

- Oil and Gas

- /

- NYSE:TPL

Do Shifting Shareholder Dynamics at Texas Pacific Land (TPL) Signal a New Phase for Governance?

Reviewed by Sasha Jovanovic

- On November 12, 2025, Texas Pacific Land Corporation announced the results of its annual general meeting, where a shareholder proposal to reduce the ownership threshold for calling a special meeting was not approved, and the company also reported third-quarter 2025 earnings that missed analyst forecasts.

- Despite these financial and governance developments, investors displayed mixed sentiment, as evidenced by strong premarket trading activity even after the earnings miss, and ongoing small share purchases by a major shareholder.

- We’ll examine how investor responses to the third-quarter earnings shortfall, including the role of major shareholders, influence Texas Pacific Land’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Texas Pacific Land Investment Narrative Recap

To be a shareholder in Texas Pacific Land, you need to believe in the continued demand for Permian Basin oil and gas royalties and the steady growth of its water services business, despite industry volatility. The recent earnings miss may not materially impact these short-term drivers, but does highlight the sensitivity of future performance to fluctuations in commodity prices and operational revenues.

Among the recent announcements, the company’s Q3 2025 earnings report is most relevant here, as both revenue and earnings per share came in below analyst forecasts. This is especially important given the company’s high price-to-earnings ratio and investor expectations for ongoing robust royalty and water segment growth, making future quarterly results a key catalyst for sentiment shifts.

By contrast, investors should be aware that Texas Pacific Land’s high dependence on Permian activity could pose a risk if...

Read the full narrative on Texas Pacific Land (it's free!)

Texas Pacific Land is expected to generate $895.3 million in revenue and $610.3 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 7.2% and represents a $150.1 million increase in earnings from the current level of $460.2 million.

Uncover how Texas Pacific Land's forecasts yield a $921.93 fair value, a 3% upside to its current price.

Exploring Other Perspectives

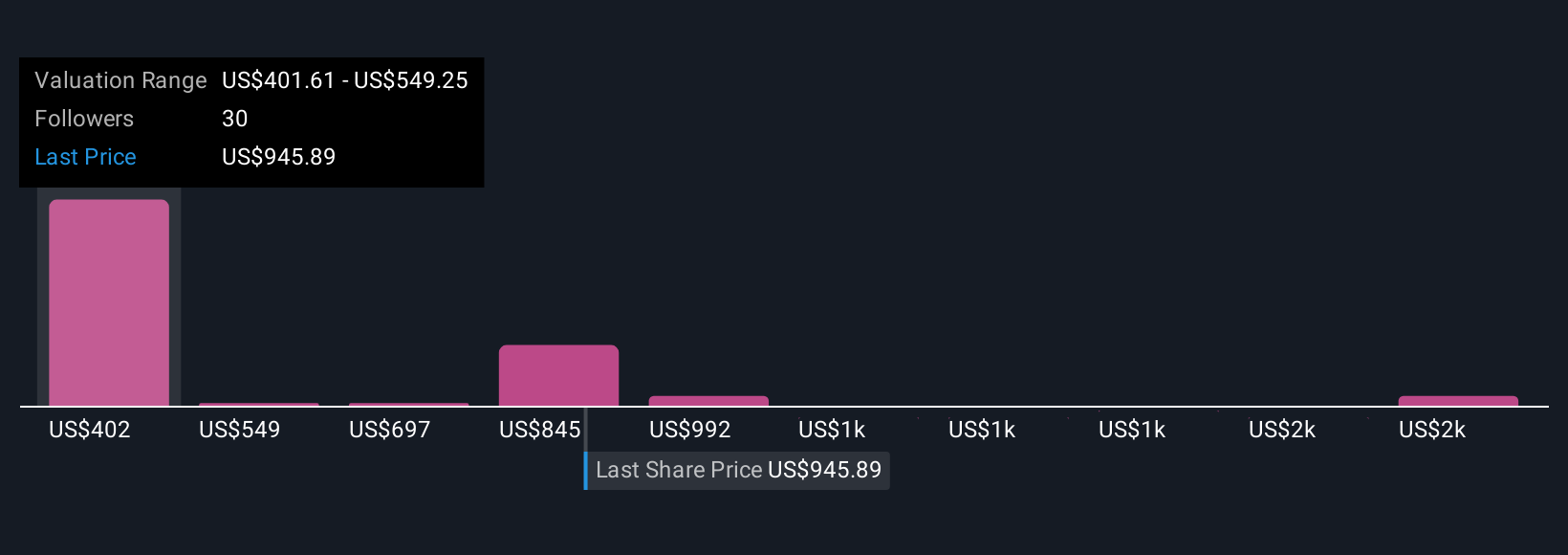

Thirteen members of the Simply Wall St Community set fair value estimates for Texas Pacific Land between US$401 and US$1,790 per share. Compare these diverse views with the current risk of overestimating sustainable royalty and water revenues for deeper insight into the company’s potential.

Explore 13 other fair value estimates on Texas Pacific Land - why the stock might be worth less than half the current price!

Build Your Own Texas Pacific Land Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Pacific Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Texas Pacific Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Pacific Land's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives