- United States

- /

- Oil and Gas

- /

- NYSE:TNK

Should Teekay Tankers’ (TNK) Consistent Dividend and Fleet Upgrades Alter Investors’ Approach?

Reviewed by Sasha Jovanovic

- Teekay Tankers recently declared a fixed cash dividend for Q2 2025 and continued advancing its fleet modernization efforts, demonstrating a commitment to operational renewal amid industry volatility.

- This move highlights the company's focus on long-term shareholder value and resilience, even as the tanker sector faces unpredictable market and regulatory conditions.

- We'll explore how Teekay Tankers' steady dividend policy during uncertain times could influence its broader investment narrative and outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Teekay Tankers Investment Narrative Recap

To own Teekay Tankers, an investor needs confidence in the continued demand for seaborne oil transport and the company’s ability to modernize its fleet while managing market volatility. The recent steady dividend declaration supports the case for near-term shareholder returns, but it does little to shift the most important catalyst, increased global oil exports, and does not directly mitigate the main short-term risk: earnings pressure from weakening oil demand and regulatory changes.

The continued $0.25 per share quarterly dividend, confirmed despite year-over-year declines in revenue and net income, stands out. This payout signals a consistent approach to capital returns at a time when operational earnings have faced headwinds, tying directly to investor interest in income reliability while the tanker market endures cyclical swings.

However, against this backdrop, investors should not ignore the risk that if oil demand continues to underperform expectations...

Read the full narrative on Teekay Tankers (it's free!)

Teekay Tankers' outlook forecasts $464.3 million in revenue and $238.5 million in earnings by 2028. This scenario assumes a 22.5% annual revenue decline and a $43.8 million decrease in earnings from the current $282.3 million.

Uncover how Teekay Tankers' forecasts yield a $53.33 fair value, a 9% upside to its current price.

Exploring Other Perspectives

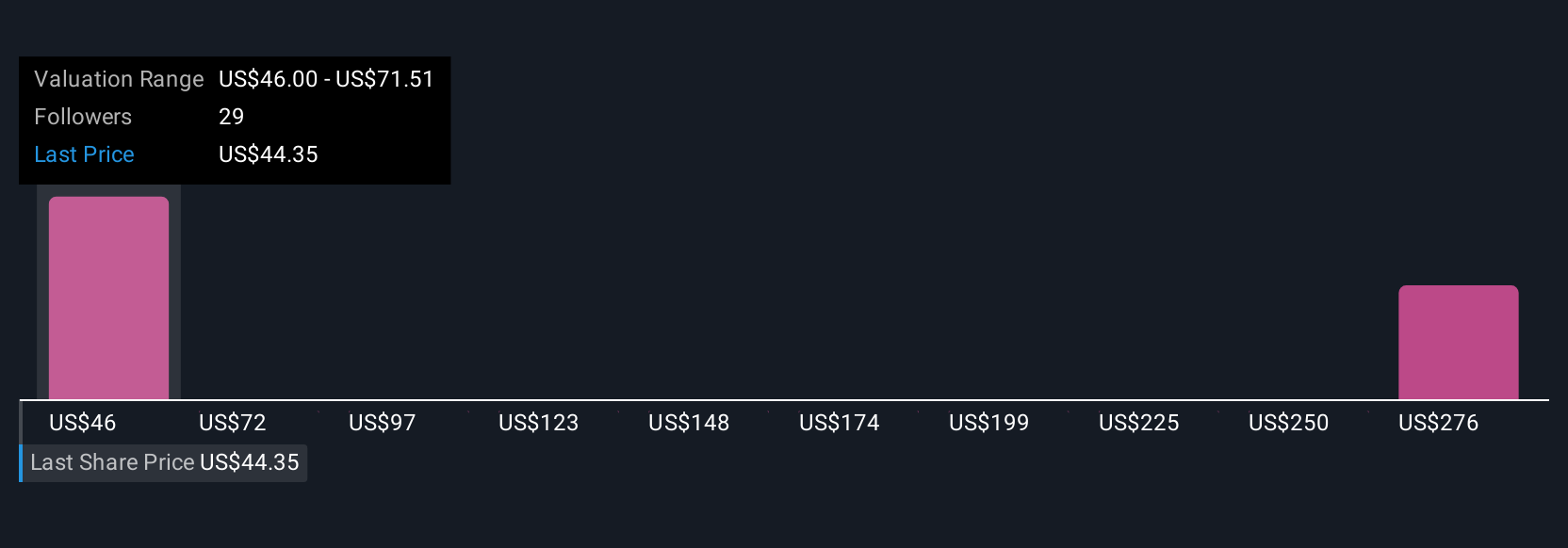

Five members of the Simply Wall St Community valued Teekay Tankers between US$46 and US$301 per share, with diverse financial outlooks. Market discipline and new regulations could test these valuations, so explore several viewpoints before deciding.

Explore 5 other fair value estimates on Teekay Tankers - why the stock might be worth 6% less than the current price!

Build Your Own Teekay Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Teekay Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teekay Tankers' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives