- United States

- /

- Energy Services

- /

- NYSE:TDW

Tidewater (TDW): Valuation Perspectives Following Q3 Results and Guidance Update

Reviewed by Simply Wall St

Tidewater (TDW) just reported its third-quarter earnings, revealing a minor per-share loss related to a one-off debt expense. Despite this, revenue exceeded forecasts due to stronger day rates and higher fleet utilization.

See our latest analysis for Tidewater.

Tidewater’s share price has experienced its share of ups and downs lately. The solid Q3 revenue beat did little to offset investor unease over the narrower 2025 guidance and what some view as a cautious 2026 outlook. Even so, after a turbulent few months, the 1-year total shareholder return is still in positive territory at 1.8%, and its longer-term track record remains impressive with a 62.6% gain over three years and a 421% increase over five years, indicating that momentum, while choppy, is far from spent.

If this mixed momentum has you curious about other opportunities, consider checking out fast growing stocks with high insider ownership to explore companies where growth and leadership conviction go hand in hand.

With the stock trading well below analyst price targets and significant long-term gains behind it, investors now face a crossroads. Is Tidewater undervalued at current levels, or has the market already factored in every bit of future growth?

Most Popular Narrative: 12.2% Undervalued

At $52.66, Tidewater’s latest close sits solidly below the most popular narrative’s fair value estimate of $60. This substantial gap raises eyebrows, setting up a potentially pivotal story driven by projected earnings power and the market’s faith in a long-term turnaround.

"Fleet modernization and disciplined operational execution have delivered three consecutive quarters of 50%+ gross margin, underpinning the expectation of structurally higher operating margins and net earnings as the company benefits from lower repair/maintenance costs and higher reliability."

How do analysts see such a rally from here? There is a blueprint involving rapid margin expansion, efficiency tailwinds, and a profit ramp that few expect from an offshore operator. The precise numbers fueling this underappreciated opportunity might surprise you. Discover the details that have analysts sticking to their valuation guns. Find out why this narrative is so compelling in the latest update.

Result: Fair Value of $60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should remember that delayed offshore projects or failed merger integrations could quickly blunt Tidewater's expected momentum. This could present challenges to the optimistic outlook.

Find out about the key risks to this Tidewater narrative.

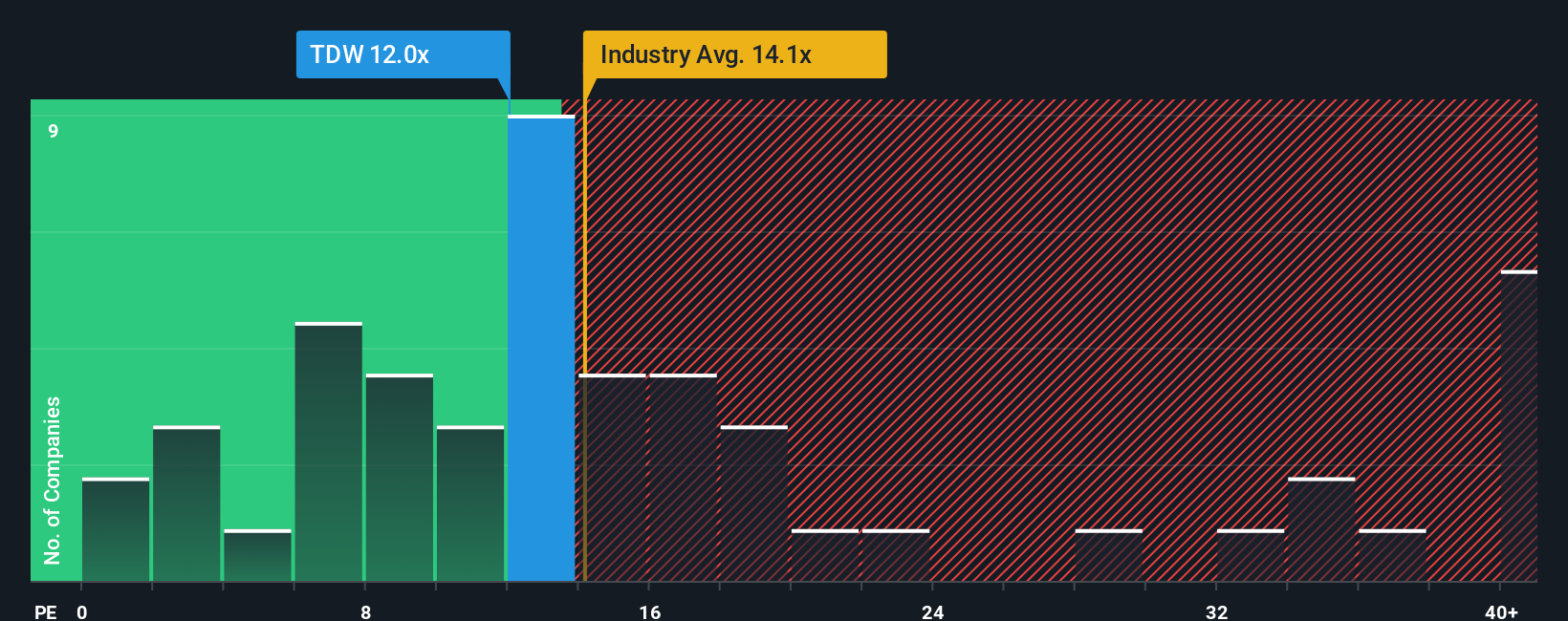

Another View: Market Multiples Perspective

Taking a closer look at Tidewater's valuation using its current price-to-earnings ratio, the picture shifts. At 17.2x, it is more expensive than both the industry average of 16.9x and the fair ratio of 16.1x. This suggests investors may be paying a premium that does not yet guarantee stronger returns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tidewater Narrative

If you find yourself unconvinced by these narratives or want to dig into the numbers firsthand, you can put together your own story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tidewater.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Broaden your portfolio and stay ahead of the market by acting on unique stock ideas that smart investors are already considering.

- Tap into impressive yields and see which companies offer potential with these 15 dividend stocks with yields > 3% delivering over 3% dividend returns to their shareholders.

- Catch the next growth trend and keep your edge sharp by checking out these 25 AI penny stocks, which are reshaping industries through artificial intelligence innovation.

- Position yourself for value by reviewing these 924 undervalued stocks based on cash flows, where the data points toward stocks trading below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tidewater might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDW

Tidewater

Provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of offshore marine service vessels worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026