- United States

- /

- Oil and Gas

- /

- NYSE:SUN

Sunoco (SUN): Revisiting Valuation After Recent Pullback and Strong 5-Year Total Shareholder Return

Reviewed by Simply Wall St

Sunoco (SUN) has quietly outperformed many income names over the past year, and the recent drift in its unit price is giving investors a fresh chance to revisit the fuel distributor’s long term story.

See our latest analysis for Sunoco.

The recent pullback, including a 7 day share price return of negative 3.2 percent from 54.43 dollars, comes after a solid 3 month share price return of 7 percent and a standout 5 year total shareholder return of roughly 157 percent. This suggests that long term momentum remains firmly intact even as short term sentiment cools.

If Sunoco’s steady gains have you thinking bigger picture, this is a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With analysts still seeing upside from here and earnings expanding faster than revenue, the key question is whether Sunoco’s strong fundamentals are underappreciated or if the market is already pricing in years of growth ahead.

Most Popular Narrative Narrative: 15.9% Undervalued

Compared with Sunoco’s last close, the most widely followed narrative implies a higher fair value, framing today’s price as a potential discount entry point.

The NuStar and upcoming Parkland and TanQuid acquisitions are expected to deliver substantial double-digit accretion and cost synergies, further increasing operating leverage and net margins while materially enhancing Sunoco's international and midstream asset footprint.

Want to see what kind of revenue runway and profit margins are baked into that outlook, and how fast earnings must climb to justify it? The narrative maps out a precise growth path, a sharply lower future multiple, and a specific discount rate that all have to line up perfectly. Curious how those moving parts combine to reach its fair value target? Dive in to see the full playbook behind the numbers.

Result: Fair Value of $64.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained EV adoption or weaker US gasoline demand could pressure volumes and margins, challenging the acquisition-driven growth path behind today’s undervaluation.

Find out about the key risks to this Sunoco narrative.

Another Angle on Valuation

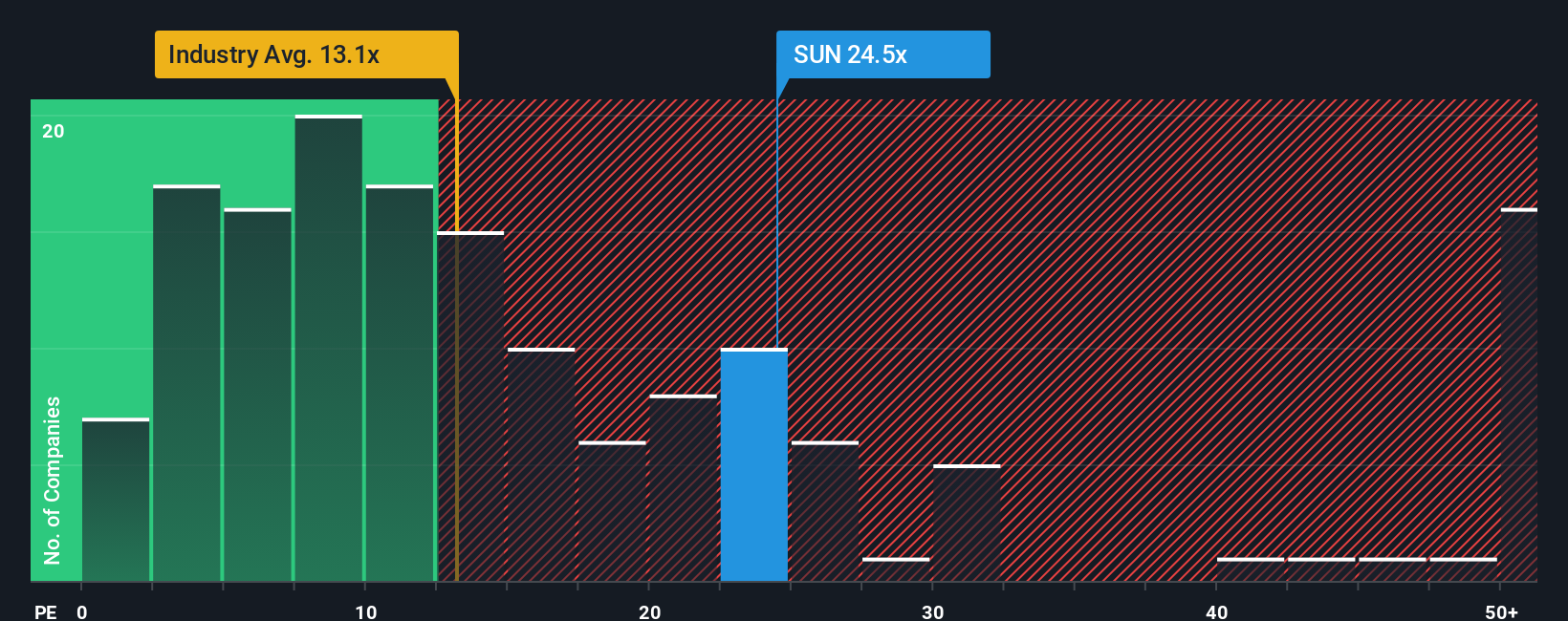

Analysts and narratives see upside, but the market is currently paying 25.5 times earnings for Sunoco, richer than both the US Oil and Gas industry at 13.8 times and peers at 22.7 times, even though our fair ratio sits higher at 29 times. Is that a cushion or a warning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sunoco Narrative

If you see the story unfolding differently or want to follow your own research trail, you can craft a complete narrative in minutes, Do it your way.

A great starting point for your Sunoco research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunity with tailored stock ideas from the Simply Wall Street Screener, built to match focused strategies.

- Target long-term growth by screening for these 906 undervalued stocks based on cash flows that the market may not have fully priced in.

- Consider cutting edge innovation by following these 26 AI penny stocks positioned within the AI theme.

- Explore income-focused opportunities with these 15 dividend stocks with yields > 3% offering dividend yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

High growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026