- United States

- /

- Oil and Gas

- /

- NYSE:SOC

Sable Offshore (SOC) Is Up 41.3% After Court Denies Cease and Desist Stay Amid Regulatory Scrutiny Has The Bull Case Changed?

Reviewed by Simply Wall St

- On July 9, 2025, the Santa Barbara County Superior Court denied Sable Offshore Corp.’s request to stay a cease and desist order from the California Coastal Commission regarding its maintenance and repair work, as Sable simultaneously filed an appeal related to the pipeline injunction.

- The company is also under investigation for potential securities law violations and has received a warning from the California State Land Commission for possibly mischaracterizing its operational status to the public.

- We’ll examine how ongoing regulatory scrutiny of Sable’s pipeline communications is influencing its overall investment narrative and future prospects.

What Is Sable Offshore's Investment Narrative?

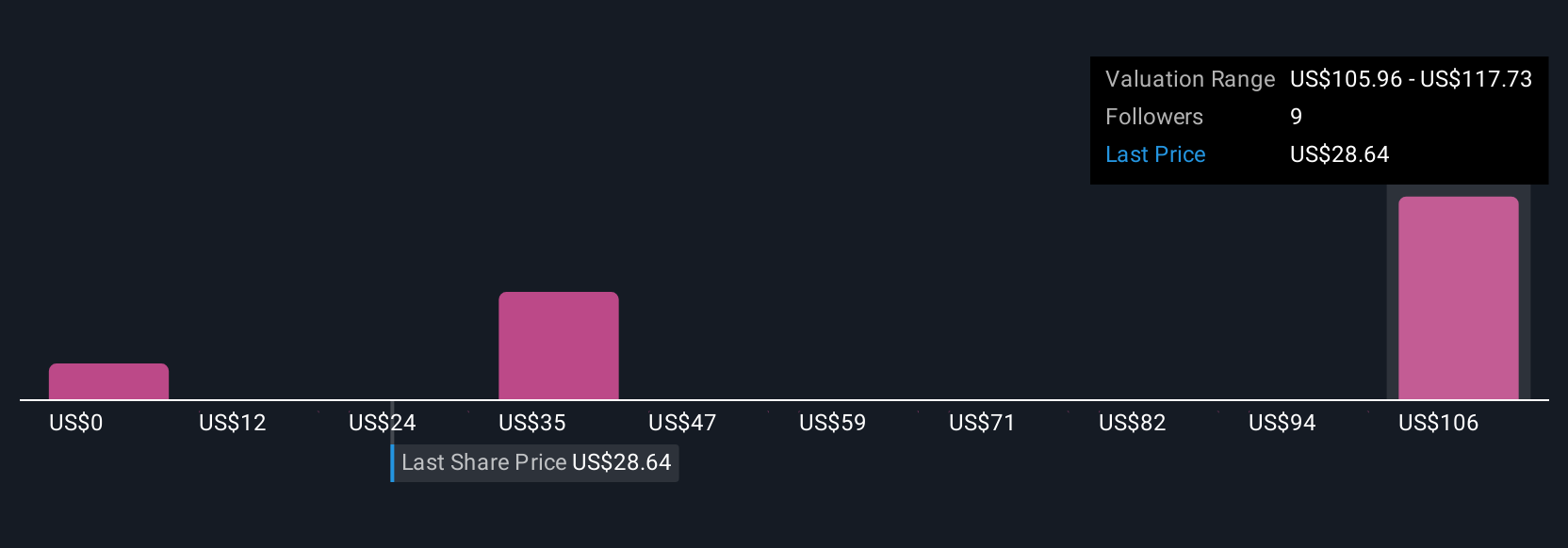

If you’re considering Sable Offshore as a potential investment, the big picture often revolves around faith in a turnaround story, one defined by high forecast revenue growth, expected profitability within three years, and a significant discount between the share price and analyst targets. However, the recent denial of Sable’s request for a stay on the cease and desist order has raised near-term uncertainty for the crucial Las Flores Pipeline restart, now a focal point for both operational and legal risks. Development timelines and sales guidance, previously seen as a major catalyst, are now less certain due to these legal headwinds. Additionally, new scrutiny from regulatory bodies and an ongoing investigation for securities law violations add a layer of complexity and risk not factored into prior forecasts or guidance. These changes heighten the importance of monitoring regulatory outcomes and management’s response in the weeks ahead.

But with court orders and regulatory investigations in play, the future is anything but simple. Sable Offshore's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Build Your Own Sable Offshore Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sable Offshore research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sable Offshore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sable Offshore's overall financial health at a glance.

No Opportunity In Sable Offshore?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives