- United States

- /

- Energy Services

- /

- NYSE:SMHI

What Can We Make Of SEACOR Marine Holdings' (NYSE:SMHI) CEO Compensation?

John Gellert became the CEO of SEACOR Marine Holdings Inc. (NYSE:SMHI) in 2017, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether SEACOR Marine Holdings pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for SEACOR Marine Holdings

How Does Total Compensation For John Gellert Compare With Other Companies In The Industry?

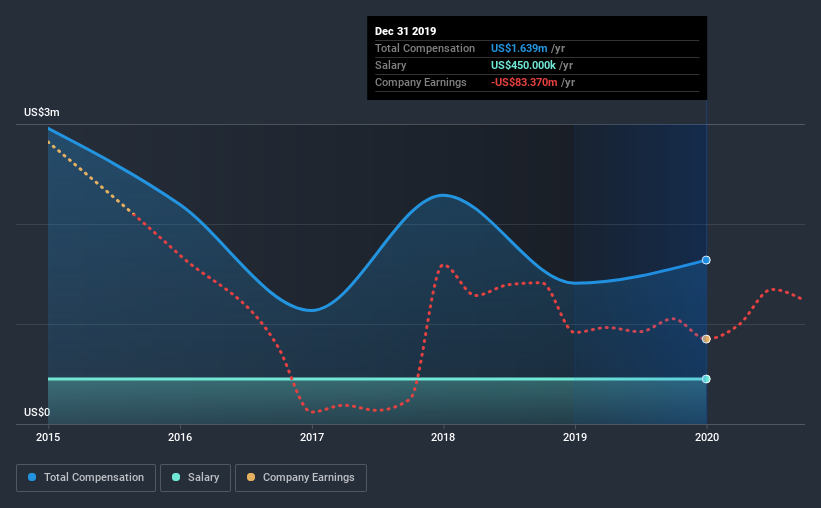

According to our data, SEACOR Marine Holdings Inc. has a market capitalization of US$62m, and paid its CEO total annual compensation worth US$1.6m over the year to December 2019. We note that's an increase of 16% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$450k.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$1.5m. This suggests that SEACOR Marine Holdings remunerates its CEO largely in line with the industry average. Furthermore, John Gellert directly owns US$1.2m worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$450k | US$450k | 27% |

| Other | US$1.2m | US$958k | 73% |

| Total Compensation | US$1.6m | US$1.4m | 100% |

Speaking on an industry level, nearly 22% of total compensation represents salary, while the remainder of 78% is other remuneration. SEACOR Marine Holdings is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

SEACOR Marine Holdings Inc.'s Growth

SEACOR Marine Holdings Inc. has seen its earnings per share (EPS) increase by 16% a year over the past three years. It saw its revenue drop 16% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has SEACOR Marine Holdings Inc. Been A Good Investment?

Given the total shareholder loss of 79% over three years, many shareholders in SEACOR Marine Holdings Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, SEACOR Marine Holdings Inc. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, shareholder returns paint a sorry picture for the company, finishing in the red over the last three years. But on the bright side, EPS growth is positive over the same period. Overall, we wouldn't say John is paid an unjustified compensation, but shareholders might not favor a raise before shareholder returns show a positive trend.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 4 warning signs for SEACOR Marine Holdings that investors should be aware of in a dynamic business environment.

Important note: SEACOR Marine Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade SEACOR Marine Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:SMHI

SEACOR Marine Holdings

Provides marine and support transportation services to offshore oil, natural gas, and windfarm facilities in the United States, Africa, Europe, the Middle East, Asia, and Latin America.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives