- United States

- /

- Energy Services

- /

- NYSE:SMHI

These 4 Measures Indicate That SEACOR Marine Holdings (NYSE:SMHI) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that SEACOR Marine Holdings Inc. (NYSE:SMHI) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for SEACOR Marine Holdings

What Is SEACOR Marine Holdings's Net Debt?

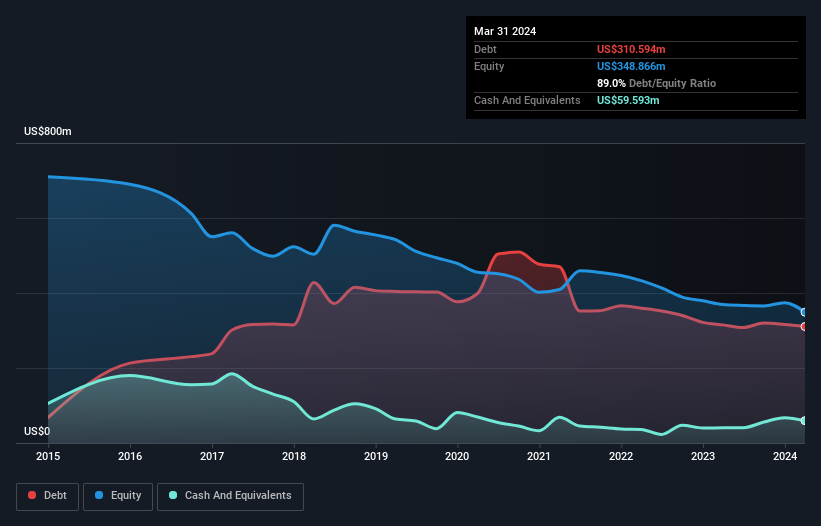

The chart below, which you can click on for greater detail, shows that SEACOR Marine Holdings had US$310.6m in debt in March 2024; about the same as the year before. On the flip side, it has US$59.6m in cash leading to net debt of about US$251.0m.

How Strong Is SEACOR Marine Holdings' Balance Sheet?

The latest balance sheet data shows that SEACOR Marine Holdings had liabilities of US$74.4m due within a year, and liabilities of US$321.5m falling due after that. On the other hand, it had cash of US$59.6m and US$71.5m worth of receivables due within a year. So its liabilities total US$264.9m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of US$401.9m, so it does suggest shareholders should keep an eye on SEACOR Marine Holdings' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While SEACOR Marine Holdings's debt to EBITDA ratio (4.2) suggests that it uses some debt, its interest cover is very weak, at 0.18, suggesting high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. One redeeming factor for SEACOR Marine Holdings is that it turned last year's EBIT loss into a gain of US$6.9m, over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine SEACOR Marine Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, SEACOR Marine Holdings saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both SEACOR Marine Holdings's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. Overall, it seems to us that SEACOR Marine Holdings's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for SEACOR Marine Holdings you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMHI

SEACOR Marine Holdings

Provides marine and support transportation services to offshore oil, natural gas, and windfarm facilities in the United States, Africa, Europe, the Middle East, Asia, and Latin America.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives