- United States

- /

- Energy Services

- /

- NYSE:SMHI

SEACOR Marine Holdings Inc. (NYSE:SMHI) Stock Rockets 25% But Many Are Still Ignoring The Company

Those holding SEACOR Marine Holdings Inc. (NYSE:SMHI) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 60% share price decline over the last year.

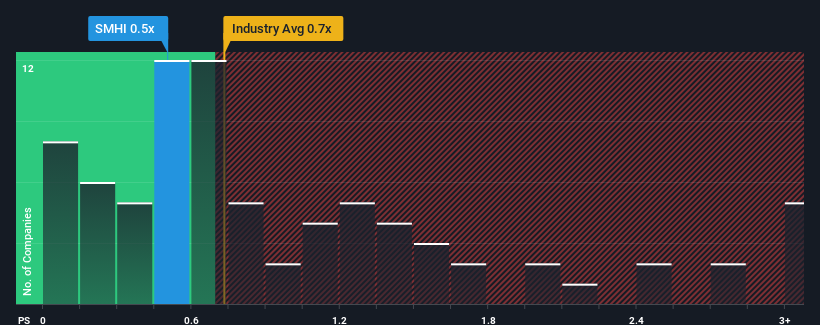

Although its price has surged higher, it's still not a stretch to say that SEACOR Marine Holdings' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Energy Services industry in the United States, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 2 warning signs investors should be aware of before investing in SEACOR Marine Holdings. Read for free now.Check out our latest analysis for SEACOR Marine Holdings

What Does SEACOR Marine Holdings' P/S Mean For Shareholders?

SEACOR Marine Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on SEACOR Marine Holdings will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For SEACOR Marine Holdings?

In order to justify its P/S ratio, SEACOR Marine Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 47% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 5.3% over the next year. That's shaping up to be materially higher than the 2.9% growth forecast for the broader industry.

In light of this, it's curious that SEACOR Marine Holdings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From SEACOR Marine Holdings' P/S?

SEACOR Marine Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that SEACOR Marine Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for SEACOR Marine Holdings that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SMHI

SEACOR Marine Holdings

Provides marine and support transportation services to offshore oil, natural gas, and windfarm facilities in the United States, Africa, Europe, the Middle East, Asia, and Latin America.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives