Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies SEACOR Marine Holdings Inc. (NYSE:SMHI) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for SEACOR Marine Holdings

How Much Debt Does SEACOR Marine Holdings Carry?

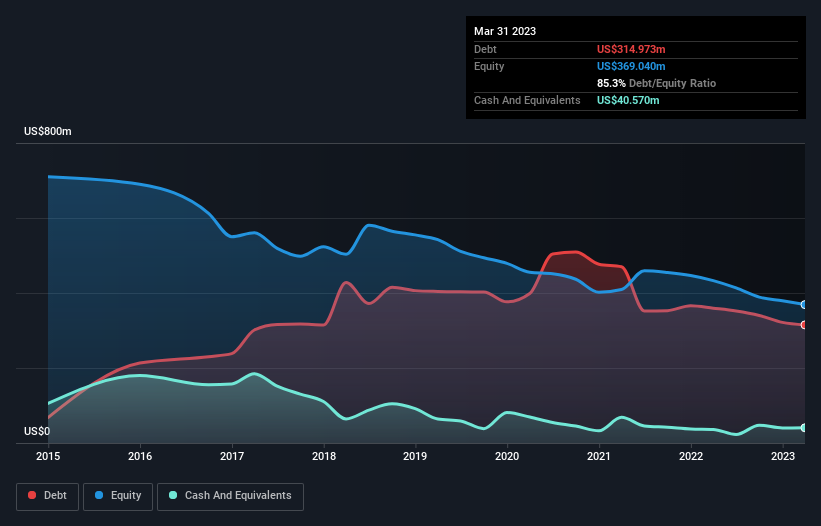

As you can see below, SEACOR Marine Holdings had US$315.0m of debt at March 2023, down from US$359.6m a year prior. However, because it has a cash reserve of US$40.6m, its net debt is less, at about US$274.4m.

How Healthy Is SEACOR Marine Holdings' Balance Sheet?

The latest balance sheet data shows that SEACOR Marine Holdings had liabilities of US$127.6m due within a year, and liabilities of US$307.0m falling due after that. On the other hand, it had cash of US$40.6m and US$82.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$311.5m.

Given this deficit is actually higher than the company's market capitalization of US$250.4m, we think shareholders really should watch SEACOR Marine Holdings's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. There's no doubt that we learn most about debt from the balance sheet. But it is SEACOR Marine Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, SEACOR Marine Holdings reported revenue of US$232m, which is a gain of 29%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though SEACOR Marine Holdings managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Its EBIT loss was a whopping US$40m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through US$17m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that SEACOR Marine Holdings is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SMHI

SEACOR Marine Holdings

Provides marine and support transportation services to offshore oil, natural gas, and windfarm facilities in the United States, Africa, Europe, the Middle East, Asia, and Latin America.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives