- United States

- /

- Oil and Gas

- /

- NYSE:SM

A Look at SM Energy’s Valuation After Announcing Planned CEO Succession and Leadership Transition

Reviewed by Simply Wall St

SM Energy (SM) has caught investors’ attention with news that long-serving CEO Herbert S. Vogel will step down in March 2026, making way for Elizabeth A. McDonald to take over as Chief Executive Officer. The announcement arrived alongside McDonald’s appointment as President and Chief Operating Officer, signaling that the company is set on a deliberate path for leadership continuity. Leadership changes, especially at the CEO level, often reshape how investors view a company’s strategy, risk, and future prospects. It is no surprise that this transition is stirring up fresh debate about the stock.

In terms of performance, SM Energy’s share price has seen limited upside recently, with modest gains this past month but still trending lower for the year. While management shifts sometimes spark volatility, this move looks measured and follows a stretch of flat longer-term momentum. This may set the stage for possible reappraisal of the company’s value. As the dust settles on this high-profile change, the question becomes how much the market has adjusted its expectations for SM Energy’s direction and earnings power.

With succession plans now clear and the shares still lagging versus past highs, does SM Energy stock offer a compelling value, or is the market already factoring in any new growth ahead?

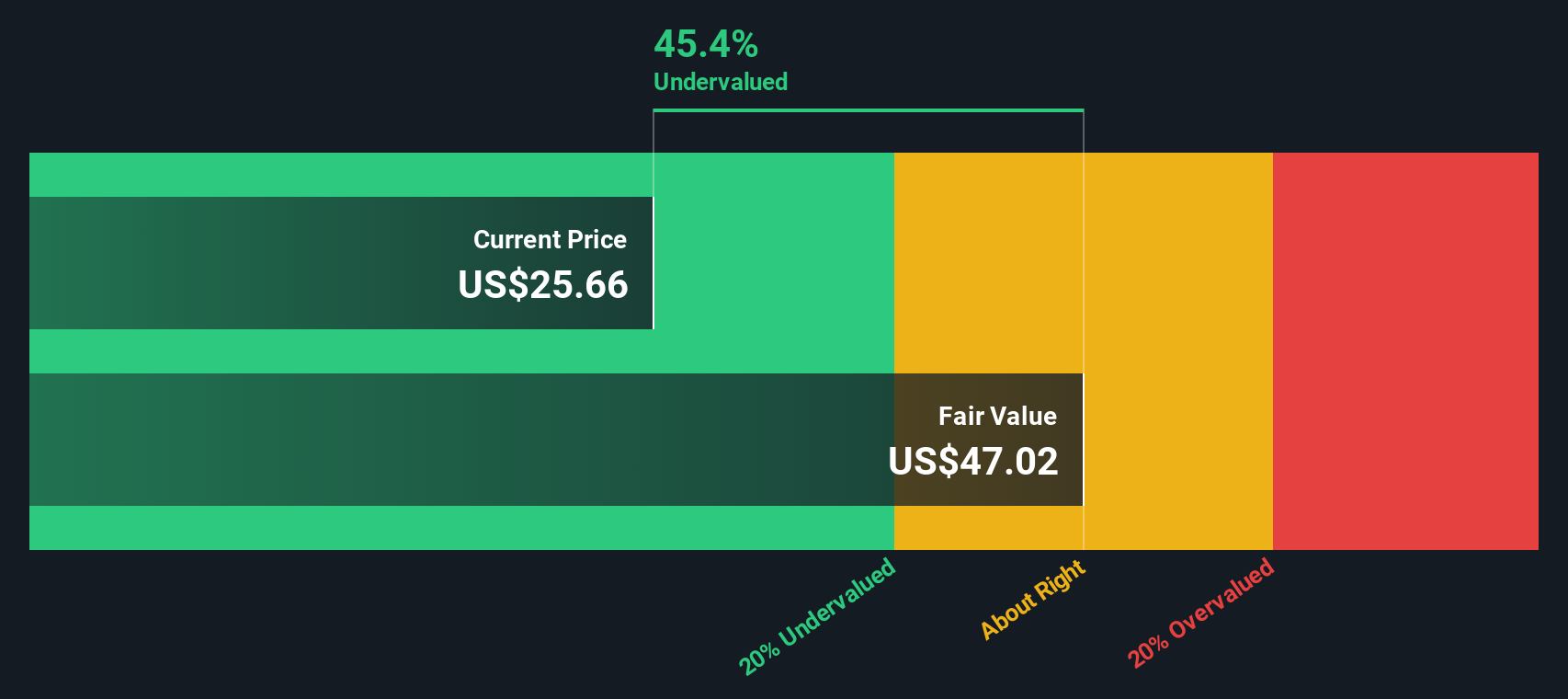

Most Popular Narrative: 31.5% Undervalued

The widely followed narrative suggests SM Energy is currently undervalued by a significant margin. This reflects a consensus that the stock’s market price does not yet reflect its longer-term potential.

The company's ability to increase both net proved reserves and net production by over 60% since 2020, while also improving production margins and keeping share count flat, demonstrates ongoing operational excellence and scale. This allows for per-share financial growth and potential improvements in operating margins and earnings.

Curious why the market may be undervaluing this energy stock? The narrative points to a potent combination of operational outperformance and future financial growth assumptions. Interested in the assumptions analysts are making around margins, top-line expansion, and profit multiples that drive this surprisingly high fair value? The quantitative reasoning behind this valuation might change how you view SM Energy’s upside potential.

Result: Fair Value of $40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as logistical bottlenecks in the Uinta Basin and unpredictable well performance could undermine SM Energy's projected production growth and margins.

Find out about the key risks to this SM Energy narrative.Another View: DCF Model Perspective

Taking a different approach, our SWS DCF model also points to undervaluation. This supports the multiple-based outlook. But could the market be missing something, or is the DCF model just confirming a bigger story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SM Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SM Energy Narrative

If you have a different perspective or want to build your own outlook on SM Energy, it takes just a few minutes to do your own deep dive: Do it your way.

A great starting point for your SM Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Confident investors never stop searching for their next big move. Make sure you do not miss out. There are plenty of standout stocks and sectors waiting for your attention right now.

- Tap into the explosive potential of next-generation machine intelligence by checking out leading innovators with AI penny stocks.

- Capture strong, reliable income streams by focusing on companies offering attractive payouts through dividend stocks with yields > 3%.

- Unearth bargain opportunities the market has overlooked and secure entries into promising businesses marked as undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SM

SM Energy

An independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives