- United States

- /

- Energy Services

- /

- NYSE:SLB

What Schlumberger (SLB)'s Major Petrobras Ultra-Deepwater Contract Means for Shareholders

Reviewed by Sasha Jovanovic

- On September 25, 2025, Petrobras announced it had awarded Schlumberger a major contract to deliver technology and completion services for up to 35 ultra-deepwater wells in Brazil's Santos Basin, deploying real-time electric completions and digital solutions to boost production and reservoir management.

- The deal deepens Schlumberger's role in Brazilian offshore development, building on its 2024 subsea production systems work and highlighting its global influence in advanced oilfield technology.

- We'll examine how this expansion into ultra-deepwater digital solutions could reshape Schlumberger's investment case and future growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Schlumberger Investment Narrative Recap

For shareholders of Schlumberger, the core belief rests on sustained international energy demand, digital adoption in oilfield services, and the company’s ability to offset cyclicality through recurring revenue streams and integrated solutions. While the Petrobras contract reinforces Schlumberger’s positioning in high-value markets, it does not materially change the immediate catalyst, which remains broader operator spending trends, nor does it mitigate the biggest risk: reduced upstream investments, especially in North America and Mexico, and ongoing earnings volatility.

Among recent announcements, the extension of the Aker BP alliance stands out in tandem with the Petrobras deal. Both signal the company’s efforts to deepen international partnerships and expand digital services, directly supporting the key catalyst of international spending and demand for advanced reservoir management. As investors weigh new wins, the focus remains on resilience amid spending shifts.

Yet, despite expanding contracts, there are still critical short-cycle risks for investors to consider if...

Read the full narrative on Schlumberger (it's free!)

Schlumberger's outlook forecasts $38.7 billion in revenue and $4.9 billion in earnings by 2028. This scenario reflects a 2.9% annual revenue growth and an $0.8 billion increase in earnings from the current level of $4.1 billion.

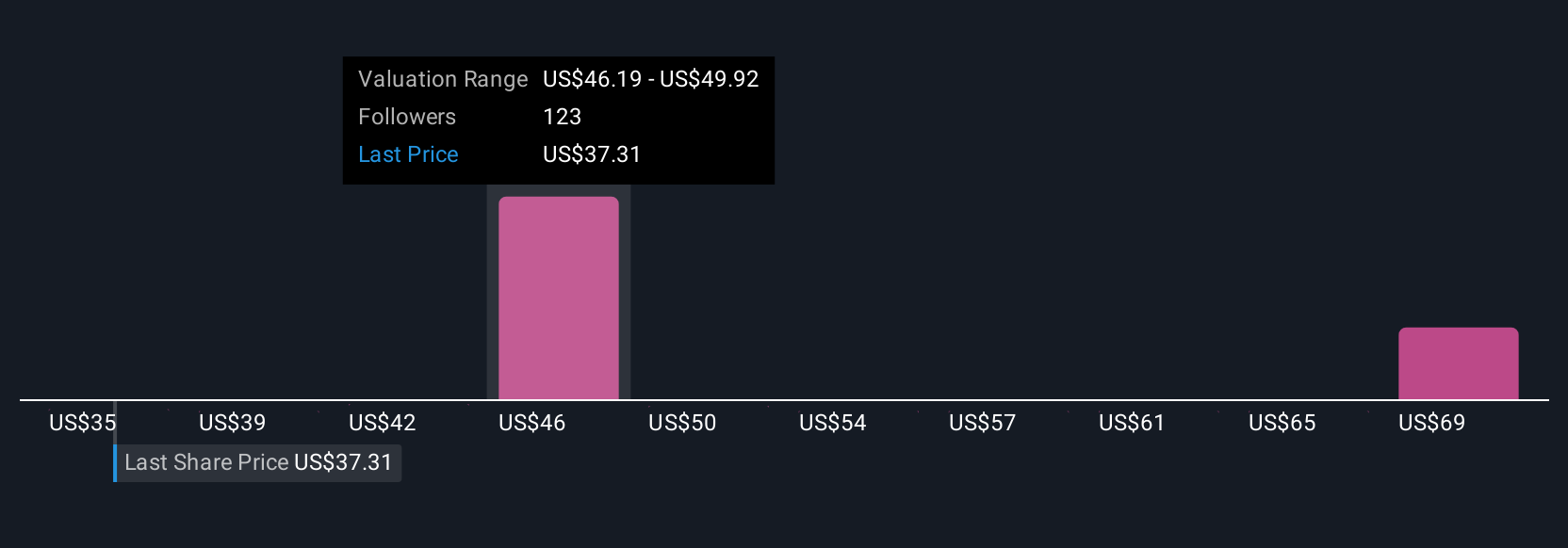

Uncover how Schlumberger's forecasts yield a $46.69 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Thirteen fair value estimates from the Simply Wall St Community span a wide US$36 to US$67 per share range. While opinions differ, global upstream spending trends remain a primary force shaping Schlumberger’s business outlook and potential return profile.

Explore 13 other fair value estimates on Schlumberger - why the stock might be worth just $36.00!

Build Your Own Schlumberger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schlumberger research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Schlumberger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schlumberger's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLB

Schlumberger

Engages in the provision of technology for the energy industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives