- United States

- /

- Energy Services

- /

- NYSE:SLB

Schlumberger (SLB) Is Up 6.8% After Analyst Caution and Downward Earnings Revisions – What's Changed

Reviewed by Simply Wall St

- In the past week, Schlumberger has faced increased analyst caution, downward earnings estimate revisions, and insider sales ahead of its July 18, 2025, earnings report. A recent fall in consensus EPS and a Zacks Rank #5 (Strong Sell) rating highlight growing bearish sentiment despite some ongoing positive analyst ratings.

- While some industry analysts remain optimistic about the company's longer-term prospects, the prevailing mood among market observers is focused on lowered expectations and heightened uncertainty around Schlumberger’s immediate earnings outlook.

- We’ll examine how recent negative earnings sentiment among analysts could influence Schlumberger’s previously optimistic investment narrative and risk profile.

Schlumberger Investment Narrative Recap

Owning Schlumberger means believing in the company's ability to leverage digital innovation, expand beyond traditional oilfield services, and maintain stable margins despite industry headwinds. The short-term outlook is now challenged by falling earnings estimates and bearish analyst signals, as the July 18 earnings report has become a critical catalyst, while persistent uncertainty about profitability from international operations remains the biggest risk. For now, these recent analyst downgrades and insider sales add pressure but do not materially change the longer-term picture for SLB's strategic transformation.

Of the recent company updates, the approval and payment of a US$0.285 per share dividend stands out: it signals ongoing shareholder return commitments despite negative earnings sentiment, and offers a counterpoint for investors gauging SLB's resilience ahead of earnings. This announcement is relevant because it highlights continuing financial distributions while short-term profit and revenue risks weigh on market sentiment.

In contrast, the persistent uncertainty around international market revenues is something investors need to keep in mind…

Read the full narrative on Schlumberger (it's free!)

Schlumberger's narrative projects $38.0 billion in revenue and $5.4 billion in earnings by 2028. This requires 1.8% yearly revenue growth and a $1.2 billion earnings increase from $4.2 billion today.

Uncover how Schlumberger's forecasts yield a $47.80 fair value, a 28% upside to its current price.

Exploring Other Perspectives

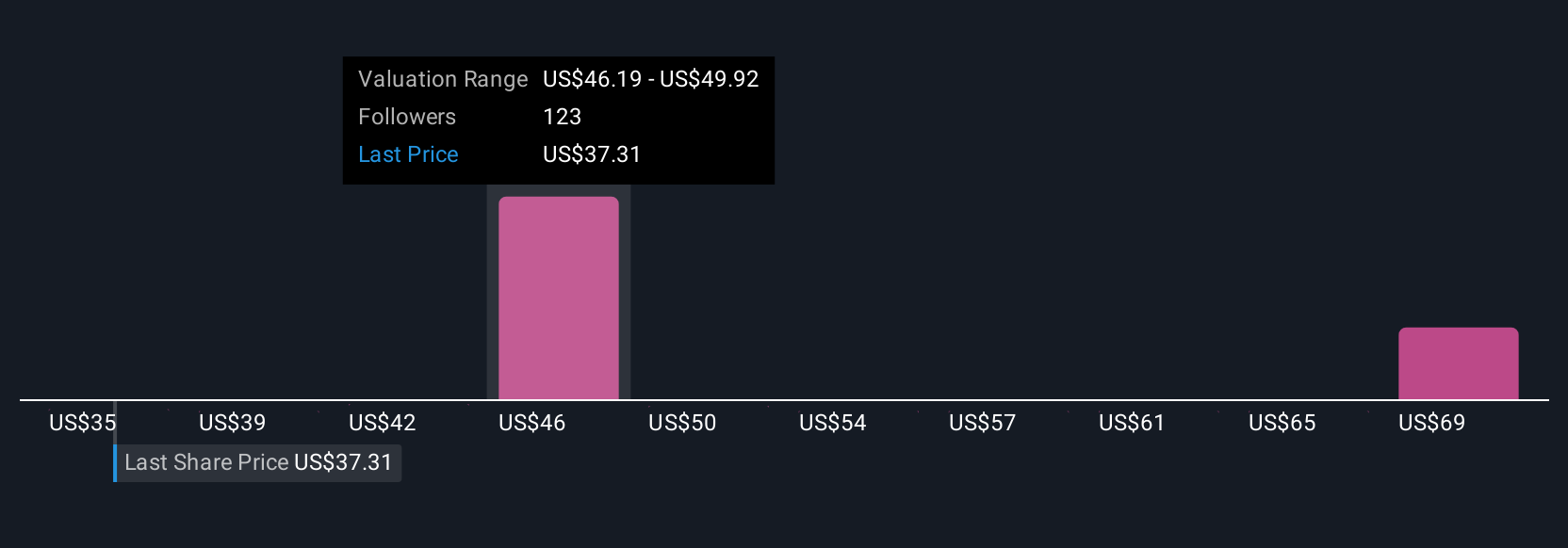

Eleven members of the Simply Wall St Community estimate SLB's fair value between US$35 and US$69.86, capturing a wide spectrum of outlooks. With recent earnings downgrades adding to volatility, taking in different viewpoints may reveal opportunities and risks that could reshape your assessment of Schlumberger's potential performance.

Build Your Own Schlumberger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schlumberger research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Schlumberger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schlumberger's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLB

Schlumberger

Engages in the provision of technology for the energy industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives