- United States

- /

- Energy Services

- /

- NYSE:SLB

Schlumberger (SLB) Is Down 7.4% After Lower Q2 and First Half 2025 Earnings Reports - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Schlumberger Limited reported second quarter and first half 2025 earnings, showing sales of US$8.55 billion and US$17.04 billion, respectively, both lower than the previous year, along with declines in net income and diluted earnings per share from continuing operations.

- This reflects a continued trend of year-over-year decreases in both revenue and earnings, underscoring pressures that may be influencing recent company performance.

- We’ll now explore how this dip in first half revenue may impact Schlumberger’s ongoing investment narrative and future outlook.

Schlumberger Investment Narrative Recap

For Schlumberger shareholders, belief in the long-term resilience of global upstream oil and gas investment and the company's ability to diversify revenue streams remains central. While the latest earnings miss surfaced continued top-line pressure, it does not appear to meaningfully alter the most important short-term catalyst: progress in digital and low carbon market expansions. The biggest risk at this stage continues to be ongoing weakness in international drilling activity, as seen in recent revenue declines.

Among recent company announcements, the launch of Electris™, Schlumberger’s new digitally enabled electric well completion technologies, stands out as relevant. This initiative directly addresses the demand for more digital and automated oilfield solutions, supporting the growth themes management has highlighted as key to medium-term performance. Investors may watch how adoption of these technologies helps offset cyclical swings in traditional upstream spending.

Yet, in light of margin pressures and lower profit contributions from certain regions, investors should also consider the fact that...

Read the full narrative on Schlumberger (it's free!)

Schlumberger's narrative projects $38.0 billion in revenue and $5.4 billion in earnings by 2028. This requires 1.8% annual revenue growth and a $1.2 billion increase in earnings from the current $4.2 billion.

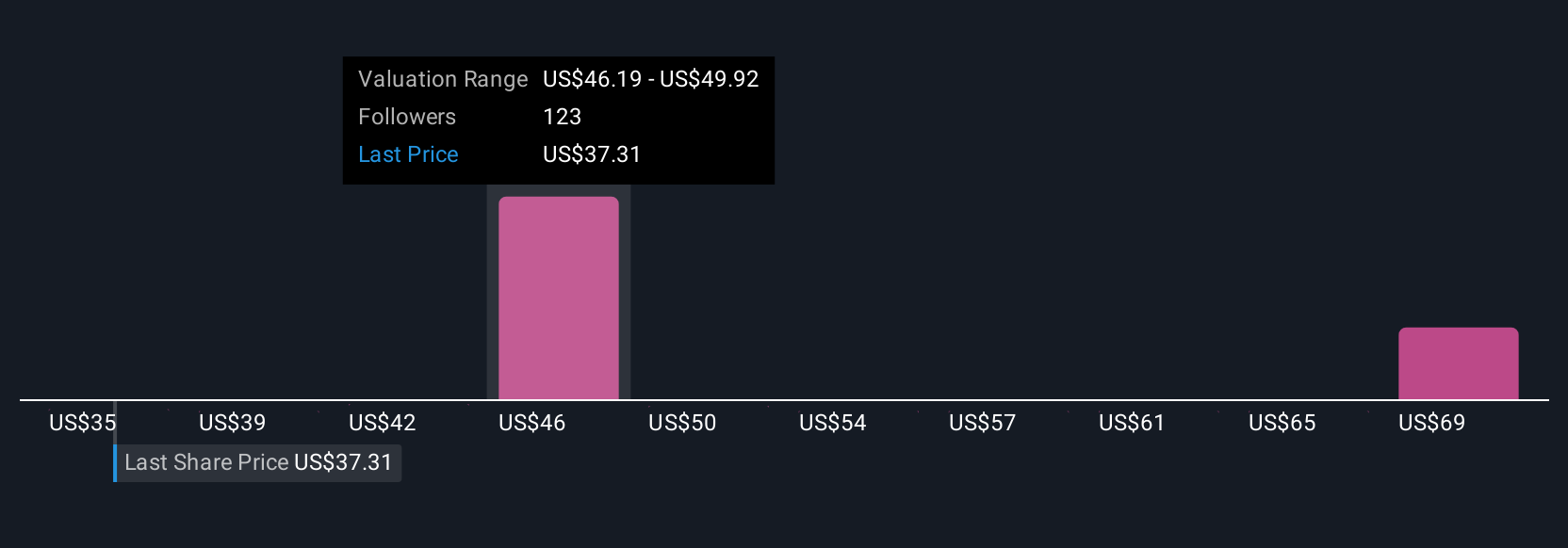

Uncover how Schlumberger's forecasts yield a $47.80 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community set Schlumberger’s fair value from US$35 to nearly US$78 across 11 opinions. With international drilling weakness still a key risk, your outlook could differ widely based on which market drivers you see as most important.

Explore 11 other fair value estimates on Schlumberger - why the stock might be worth just $35.00!

Build Your Own Schlumberger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schlumberger research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Schlumberger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schlumberger's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLB

Schlumberger

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives