- United States

- /

- Energy Services

- /

- NYSE:SLB

Schlumberger (NYSE:SLB) Leverages NVIDIA Alliance and Strong Q2 Performance for Future Growth

Reviewed by Simply Wall St

Schlumberger(NYSE:SLB) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a strong second-quarter performance with a 5% sequential revenue increase, and strategic alliances such as the collaboration with NVIDIA to develop generative AI solutions. In the discussion that follows, we will explore Schlumberger's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Explore the full analysis report here for a deeper understanding of Schlumberger.

Strengths: Core Advantages Driving Sustained Success For Schlumberger

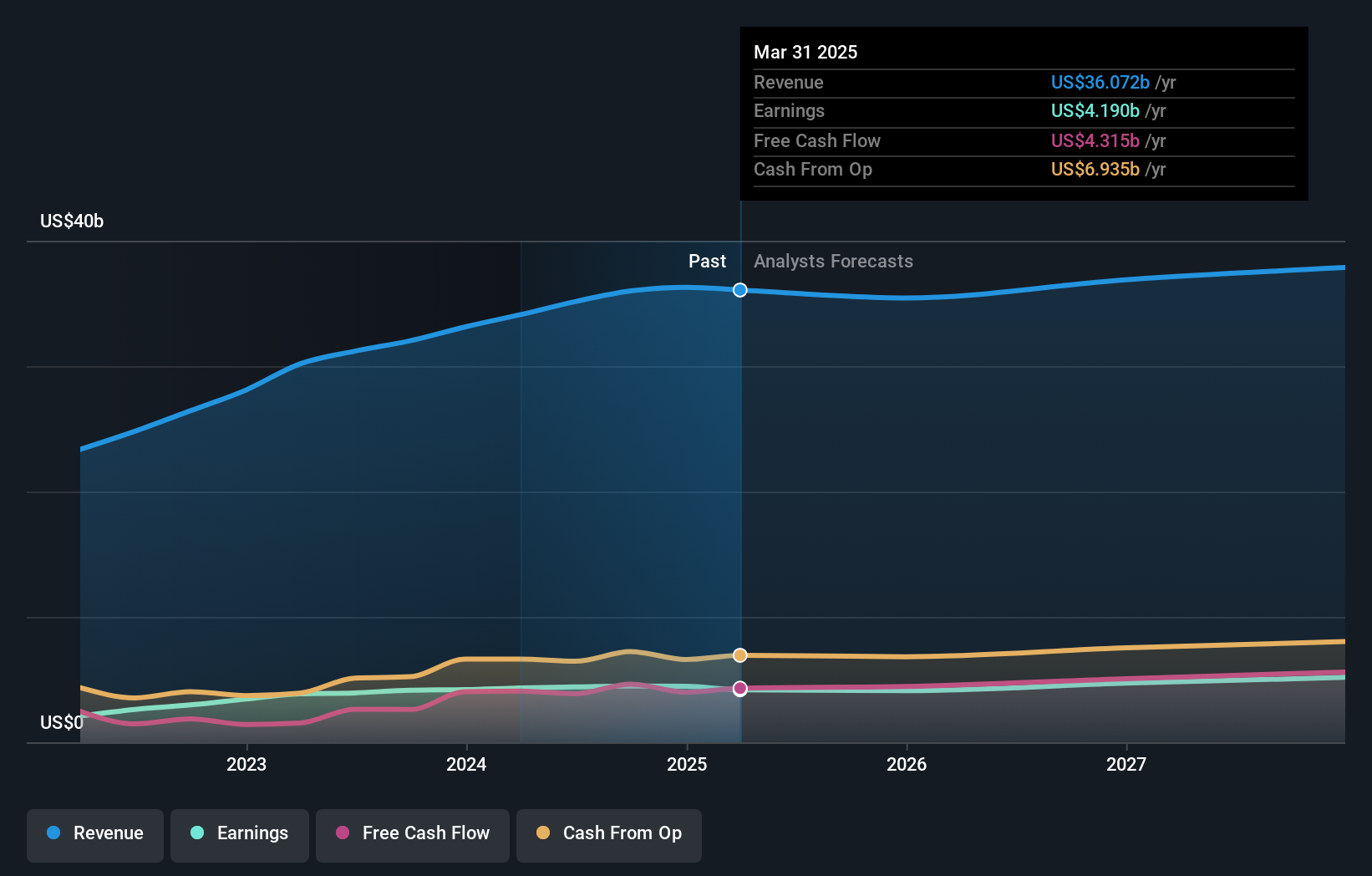

Schlumberger has demonstrated strong financial health, exemplified by its second-quarter performance where revenue increased by 5% sequentially, and adjusted EBITDA grew by 11%. This growth was driven by international revenue, particularly in the Middle East and Asia, which saw record high quarterly revenues in several GeoUnits. The company’s strategic alliances, such as its collaboration with NVIDIA to develop generative AI solutions, further enhance its market position. Additionally, Schlumberger’s management team, led by CEO Olivier Le Peuch, has effectively harnessed the ongoing growth cycle, achieving a 28% year-on-year increase in users on the Delfi platform. Notably, SLB is trading at a significant discount to its estimated fair value, with a Price-To-Earnings Ratio of 13.4x compared to the peer average of 16.4x and the US Energy Services industry average of 18.3x, indicating it is a compelling investment.

To gain deeper insights into Schlumberger's historical performance, explore our detailed analysis of past performance.

Weaknesses: Critical Issues Affecting Schlumberger's Performance and Areas For Growth

Schlumberger faces several challenges. The company’s sequential growth was partially offset by lower drilling in U.S. land due to weaker gas prices and market consolidation. Additionally, SLB recorded merger and integration charges related to the Aker subsea transaction and costs associated with realigning its support and service delivery structure. The digital revenue growth and margin expansion, although expected to continue, are not yet at desired levels, as noted by CFO Stephane Biguet. Furthermore, SLB’s current net profit margins of 12.6% are lower than last year, indicating room for improvement. The dividend yield of 2.63% is also low compared to the top 25% of dividend payers in the US market (4.3%), which may be a concern for income-focused investors.

Learn about Schlumberger's dividend strategy and how it impacts shareholder returns and financial stability.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Schlumberger has several opportunities for growth. The company’s strategic focus on key international markets and offshore projects positions it well for future expansion. Investments in digital infrastructure, particularly through partnerships with companies like NVIDIA and TotalEnergies, are expected to drive substantial efficiency improvements and innovation. The OneSubsea JV has already secured high-value contracts, such as the major contract award by Petrobras for subsea production systems. Additionally, the forecasted annual earnings growth of 17.2% per year, which is faster than the US market average of 15.2%, highlights the potential for significant profit growth. The expected high return on equity of 22.2% in three years further underscores SLB’s strong future prospects.

Threats: Key Risks and Challenges That Could Impact Schlumberger's Success

Several external factors pose risks to Schlumberger’s success. Market volatility, particularly due to capacity expansion projects and new gas developments, could impact revenue stability. The lower drilling activity in U.S. land, driven by weaker gas prices and capital discipline, remains a concern. Additionally, significant insider selling over the past three months may signal potential uncertainties within the company. The unstable dividend track record, characterized by volatility and a history of falling payments, could deter dividend-focused investors. Lastly, Schlumberger’s high level of debt presents a financial risk, necessitating careful monitoring of cash flow and capital allocation to maintain financial stability.

Conclusion

Schlumberger's strong financial health, evidenced by its sequential revenue and adjusted EBITDA growth, underscores its ability to capitalize on international market opportunities and strategic alliances, such as with NVIDIA. However, challenges like lower drilling activity in U.S. land and integration costs from the Aker subsea transaction highlight areas needing attention. The company's focus on resilient markets and digital infrastructure investments positions it well for future growth, with forecasted annual earnings growth and return on equity exceeding market averages. External risks such as market volatility and high debt levels necessitate cautious financial management. Notably, the company's trading at a significant discount to its estimated fair value, with a Price-To-Earnings Ratio of 13.4x compared to the peer average of 16.4x and the US Energy Services industry average of 18.3x, indicates it is a compelling investment with strong future performance potential.

Key Takeaways

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:SLB

Schlumberger

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives