- United States

- /

- Energy Services

- /

- NYSE:SLB

Here's Why Schlumberger (NYSE:SLB) Can Manage Its Debt Responsibly

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies. Schlumberger Limited (NYSE:SLB) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Schlumberger

How Much Debt Does Schlumberger Carry?

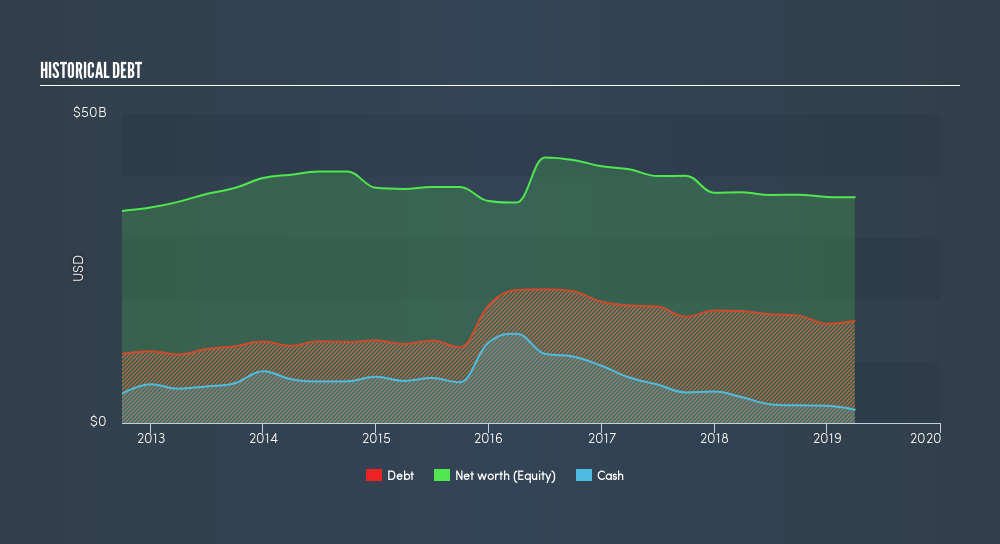

As you can see below, Schlumberger had US$14.8b of debt at March 2019, down from US$18.1b a year prior. However, it does have US$2.16b in cash offsetting this, leading to net debt of about US$12.6b.

How Strong Is Schlumberger's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Schlumberger had liabilities of US$11.7b due within 12 months and liabilities of US$22.1b due beyond that. On the other hand, it had cash of US$2.16b and US$8.17b worth of receivables due within a year. So its liabilities total US$23.5b more than the combination of its cash and short-term receivables.

Schlumberger has a very large market capitalization of US$54.8b, so it could very likely ameliorate its balance sheet if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Because it carries more debt than cash, we think it's worth watching Schlumberger's balance sheet over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Schlumberger's net debt is sitting at a very reasonable 1.89 times its EBITDA, while its EBIT covered its interest expense just 5.76 times last year. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Sadly, Schlumberger's EBIT actually dropped 2.2% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Schlumberger can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Schlumberger recorded free cash flow worth 78% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

On our analysis Schlumberger's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to grow its EBIT. Considering this range of data points, we think Schlumberger is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Schlumberger insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:SLB

Schlumberger

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives