- United States

- /

- Energy Services

- /

- NYSE:SLB

Did Changing Sentiment Drive Schlumberger's (NYSE:SLB) Share Price Down A Worrying 60%?

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the Schlumberger Limited (NYSE:SLB) share price dropped 60% over five years. That's not a lot of fun for true believers. And we doubt long term believers are the only worried holders, since the stock price has declined 25% over the last twelve months. Unfortunately the share price momentum is still quite negative, with prices down 17% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Schlumberger

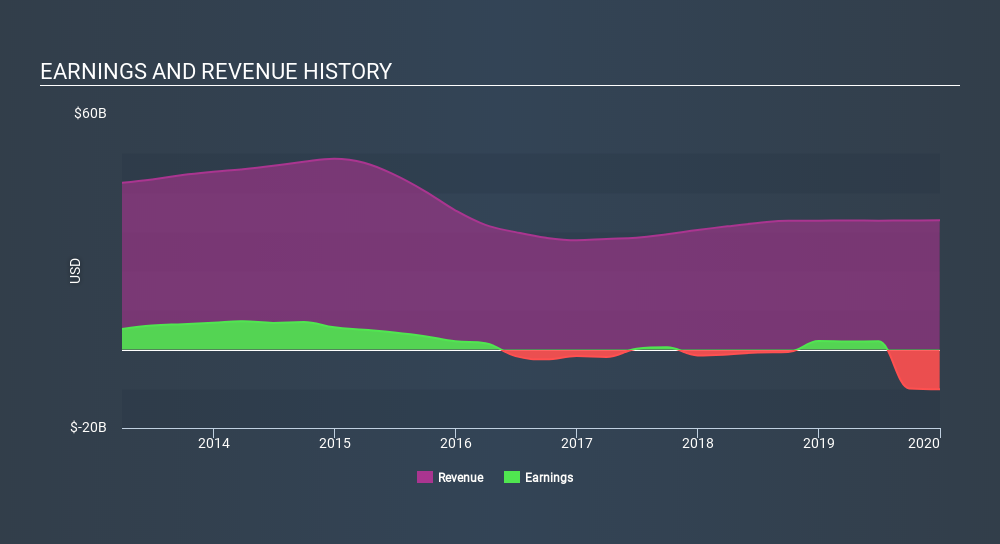

Schlumberger wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Schlumberger saw its revenue shrink by 6.5% per year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 17% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Schlumberger is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Schlumberger will earn in the future (free analyst consensus estimates)

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Schlumberger's TSR for the last 5 years was -53%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Schlumberger shareholders are down 21% for the year (even including dividends) , but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 14% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Schlumberger (including 1 which is can't be ignored) .

But note: Schlumberger may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SLB

SLB

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026