- United States

- /

- Oil and Gas

- /

- NYSE:SFL

SFL Corporation (NYSE:SFL): Assessing Value After Dividend Cut and Market Volatility Shake-Up

Reviewed by Simply Wall St

If you follow SFL (NYSE:SFL), you know that the recent decision to lower its quarterly dividend to $0.20 per share has caught the market’s attention. The move, driven by capacity constraints and ongoing volatility in the drilling rig segment, marks a shift for a company with a strong history of steady payouts. Investors looking for reliable income are now weighing what this dividend cut means for SFL’s broader financial outlook and its plans for fleet renewal and strategic partnerships.

SFL’s shares took a hit after news broke, dropping double digits in just a week. While annual performance has trailed the sector, momentum had been fading even before the announcement. Now, year-to-date returns sit around -21%, with the stock down almost 20% over the last year. This follows other headwinds, including softness in the drilling market and vessel redeliveries, but also a significant share buyback and new long-term charters that add future revenue visibility. Despite pressure on profits, SFL’s ongoing fleet upgrades and backlog growth reflect a company in transition rather than decline.

After this year’s setback and management’s defensive moves, investors may be asking whether SFL is at an inflection point for value investors, or if the recent decline simply reflects the market pricing in lower future growth.

Most Popular Narrative: 22.3% Undervalued

According to community narrative, SFL is seen as undervalued compared to its estimated fair value, with room for significant price appreciation based on future financial forecasts and strategic growth initiatives.

SFL's ongoing investment in modern, fuel-efficient, and LNG-capable vessels, along with substantial efficiency upgrades, positions the company to benefit from tightening environmental regulations and growing demand for lower-emission shipping. This supports higher utilization rates, improved charter terms, and strengthens net margins and long-term earnings stability.

Curious about why SFL is projected for a major rebound? There is a quantitative twist driving this rosy valuation, built on bold financial bets and premium earnings assumptions you would not usually expect in shipping. If you want the numbers powering analyst optimism or the formula behind this discount, the most surprising detail is hidden within the narrative’s assumptions.

Result: Fair Value of $10.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, SFL’s heavy reliance on container shipping and exposure to oil assets could undermine growth if industry demand falters or if stricter regulations take effect.

Find out about the key risks to this SFL narrative.Another View: Are the Numbers Telling a Different Story?

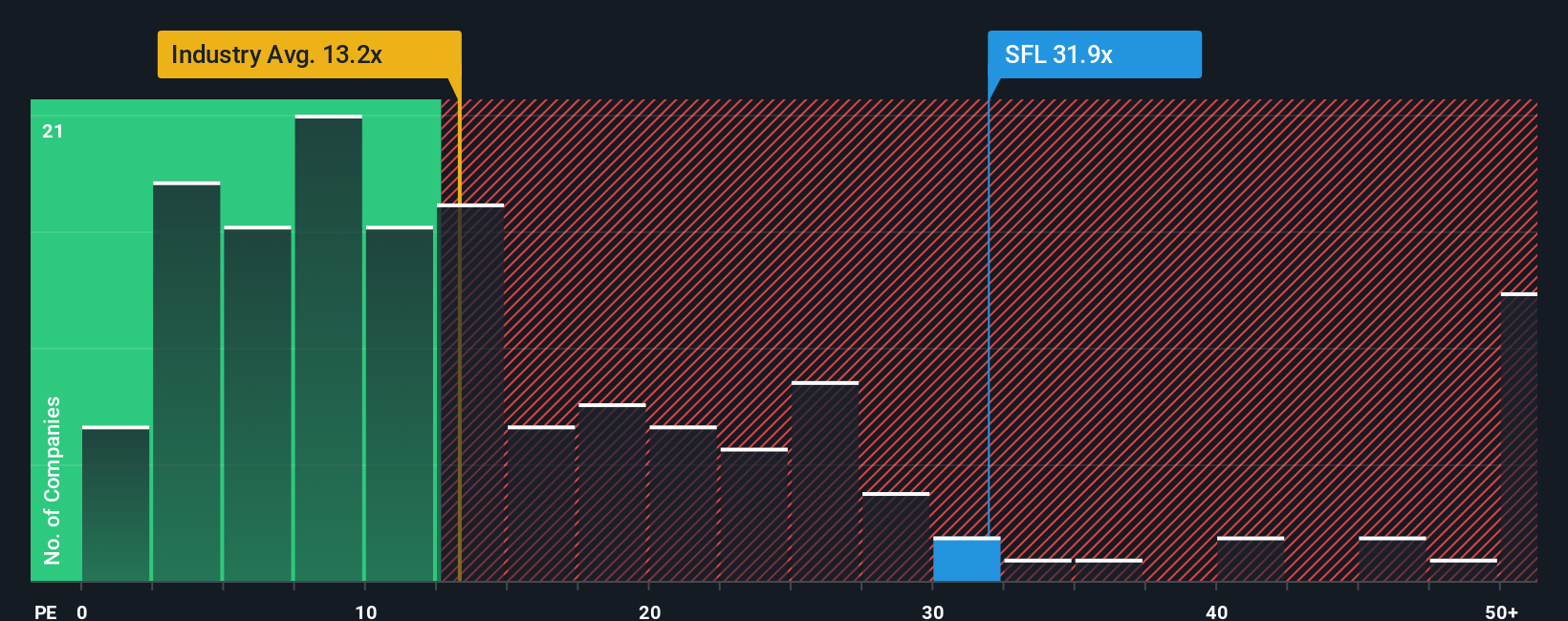

While analyst forecasts highlight upside based on future growth potential, a closer look at market pricing presents a different picture. By comparing SFL’s valuation ratio to the industry average, shares appear expensive rather than a bargain. Can both perspectives be right, or is the market missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SFL Narrative

If you see the story differently, or want to dig into the numbers yourself, it only takes a few minutes to craft your own perspective. do it your way.

A great starting point for your SFL research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Your next winner could be just a click away. Staying a step ahead of the market means spotting new trends, fresh value, and growth stories before the crowd. Broaden your horizon and make bolder investment moves with these handpicked opportunities powered by the Simply Wall Street Screener:

- Capitalize on fast-growing innovations shaping tomorrow by zeroing in on AI penny stocks. Stay up to date with the companies driving transformative change across industries.

- Target consistent income streams with dividend stocks with yields > 3%. Strengthen your portfolio with reliable yields above 3% from established market leaders.

- Catch the next undervalued breakout by sifting through undervalued stocks based on cash flows. This can give you an edge to spot stocks trading at attractive prices based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SFL

SFL

A maritime and offshore asset owning and chartering company, engages in the ownership, operation, and chartering out of vessels and offshore related assets on medium and long-term charters.

Slight risk and fair value.

Market Insights

Community Narratives