- United States

- /

- Oil and Gas

- /

- NYSE:SFL

A Fresh Look at SFL Missions (NYSE:SFL) Valuation After RADICALS Satellite Contract Win

Reviewed by Kshitija Bhandaru

SFL (NYSE:SFL) just landed a contract with the University of Alberta to develop the RADICALS small satellite, a project set to deliver new data on how space radiation impacts Earth's climate. The deal could showcase SFL's engineering strengths.

See our latest analysis for SFL.

SFL’s latest contract comes as its share price has steadily declined this year, most recently closing at $7.56. Despite the recent pullback, investors who stayed the course over the past five years enjoyed a 50% total shareholder return. This suggests the business can deliver for patient holders even during quieter stretches.

If you’re weighing other promising opportunities in the market, now is a great moment to expand your search and uncover fast growing stocks with high insider ownership

SFL’s recent momentum raises a key question for investors. With shares still well below analysts’ price targets, is this a compelling entry point or is the market already factoring in all the future upside?

Most Popular Narrative: 25.7% Undervalued

According to the most widely followed narrative, SFL's fair value sits far above its last closing price, suggesting a significant gap between analyst projections and the current market. The valuation narrative is built on forward-looking fundamentals, so let’s examine a crucial catalyst driving this outlook.

SFL's ongoing investment in modern, fuel-efficient, and LNG-capable vessels, along with substantial efficiency upgrades, positions the company to benefit from tightening environmental regulations and growing demand for lower-emission shipping. This supports higher utilization rates, improved charter terms, strengthening net margins, and long-term earnings stability.

What secret numbers does this bullish narrative hinge on? The analysts behind this view are wagering on a powerful profit turnaround, margin leap, and an earnings multiple that rarely gets assigned in shipping. The real surprises—how these forecasts collide—await in the full narrative.

Result: Fair Value of $10.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming challenges such as heavy exposure to oil markets and reliance on container shipping volumes could quickly change this outlook.

Find out about the key risks to this SFL narrative.

Another View: What Do Earnings Ratios Reveal?

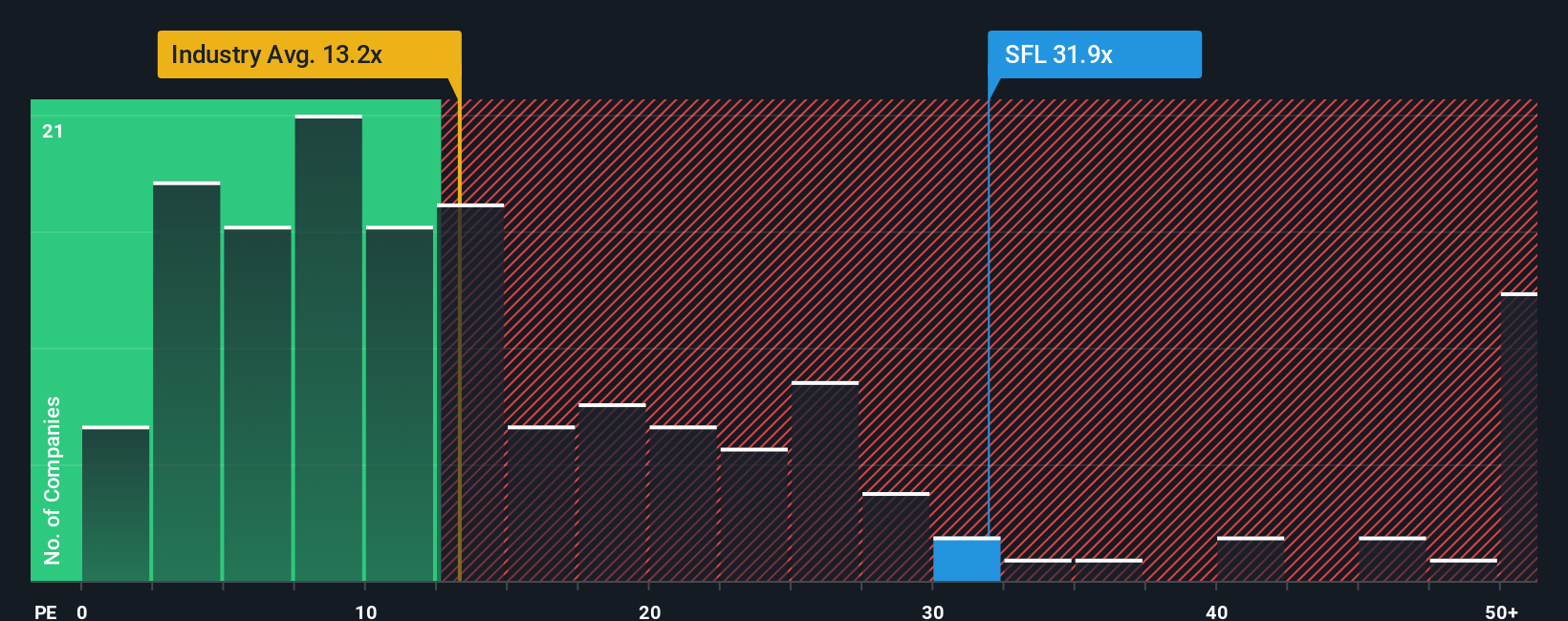

While discounted cash flow analysis suggests SFL is undervalued, a look at earnings ratios paints a different picture. SFL trades at 29.2 times earnings, which is higher than both its industry average (13.5x) and its own fair ratio of 26.4x. This gap hints at valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SFL Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can shape your own narrative in under three minutes with Do it your way.

A great starting point for your SFL research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself the edge in today’s market. Smart investors are already uncovering unique stocks with the power to transform portfolios using expert-built screeners.

- Capitalize on high yields by searching these 19 dividend stocks with yields > 3% with robust payout histories and greater reliability in times of market volatility.

- Catch the next AI breakthrough by sorting through these 24 AI penny stocks already making headlines for innovation and exponential growth potential.

- Target truly undervalued opportunities and boost your upside with these 904 undervalued stocks based on cash flows based on companies’ real cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SFL

SFL

A maritime and offshore asset owning and chartering company, engages in the ownership, operation, and chartering out of vessels and offshore related assets on medium and long-term charters.

Good value with slight risk.

Market Insights

Community Narratives