- United States

- /

- Energy Services

- /

- NYSE:SEI

Solaris Energy Infrastructure (NYSE:SEI) Has Affirmed Its Dividend Of $0.12

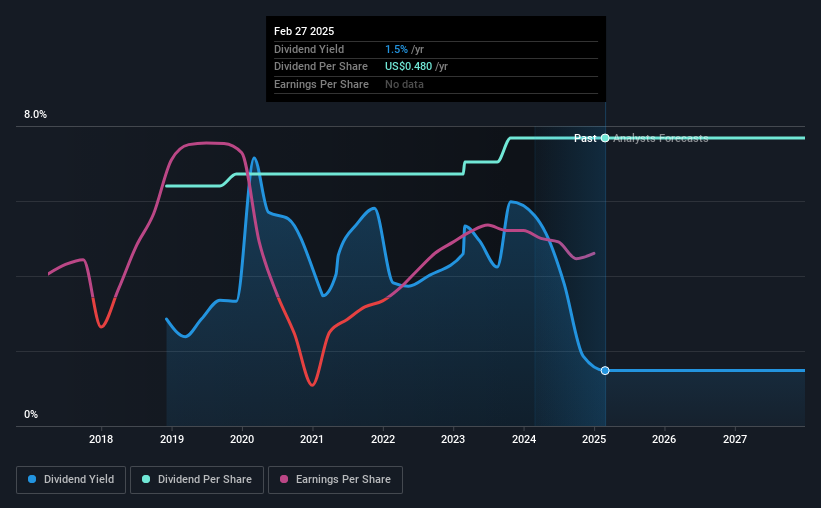

Solaris Energy Infrastructure, Inc. (NYSE:SEI) has announced that it will pay a dividend of $0.12 per share on the 21st of March. This means the annual payment will be 1.5% of the current stock price, which is lower than the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Solaris Energy Infrastructure's stock price has increased by 32% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Solaris Energy Infrastructure

Solaris Energy Infrastructure's Projected Earnings Seem Likely To Cover Future Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, Solaris Energy Infrastructure's dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. This is a pretty unsustainable practice, and could be risky if continued for the long term.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 32%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Solaris Energy Infrastructure Is Still Building Its Track Record

The dividend's track record has been pretty solid, but with only 6 years of history we want to see a few more years of history before making any solid conclusions. Since 2019, the annual payment back then was $0.40, compared to the most recent full-year payment of $0.48. This implies that the company grew its distributions at a yearly rate of about 3.1% over that duration. Solaris Energy Infrastructure hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. Solaris Energy Infrastructure's earnings per share has shrunk at 25% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

We should note that Solaris Energy Infrastructure has issued stock equal to 56% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Solaris Energy Infrastructure's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments are bit high to be considered sustainable, and the track record isn't the best. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 5 warning signs for Solaris Energy Infrastructure (3 are significant!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success