- United States

- /

- Energy Services

- /

- NYSE:SEI

Evaluating Solaris Energy Infrastructure’s (SEI) Valuation After Strong Q3 Earnings and 29th Consecutive Dividend

Reviewed by Simply Wall St

Solaris Energy Infrastructure delivered its third-quarter results, highlighting a strong jump in both revenue and net income compared to a year ago. The company also announced its 29th consecutive dividend, reinforcing steady shareholder returns.

See our latest analysis for Solaris Energy Infrastructure.

Solaris Energy Infrastructure’s share price has surged 53.5% year-to-date, closing at $45.21. Recent third-quarter results seem to have fueled even more momentum. Investors who held on for the long run have benefited from a 145.6% total shareholder return over the past year, underscoring renewed confidence in the company’s growth story.

If Solaris’s strong run has you wondering where the next big winner might come from, now’s an ideal time to broaden your horizons and uncover fast growing stocks with high insider ownership

But with Solaris Energy Infrastructure’s valuation climbing rapidly, investors face a crucial question: does the current price tag leave room for upside or has the impressive growth already been factored in?

Most Popular Narrative: 27.1% Undervalued

According to the most widely followed narrative, Solaris Energy Infrastructure’s fair value is estimated at $62, which is a notable premium to the recent share price of $45.21. This view signals investor optimism about Solaris’s ability to sustain rapid growth and deliver on bold earnings projections.

The accelerating demand for grid resiliency, electrification of industries, and AI-driven data center power needs is creating strong, ongoing demand for Solaris's modular, scalable power generation solutions. This is positioning the company for significant revenue growth as delivery of new capacity ramps through 2026 and beyond.

Wonder what's truly driving this jaw-dropping valuation? One essential ingredient is the combination of record-setting growth expectations and profit margins that could shift the industry. Ready to discover which bold projections back this target? The narrative reveals the numbers fueling this bullish forecast.

Result: Fair Value of $62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Solaris’s rapid revenue growth could moderate if project pipeline delays or changing energy market dynamics interrupt the current momentum.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another View: Multiples Highlight Valuation Risk

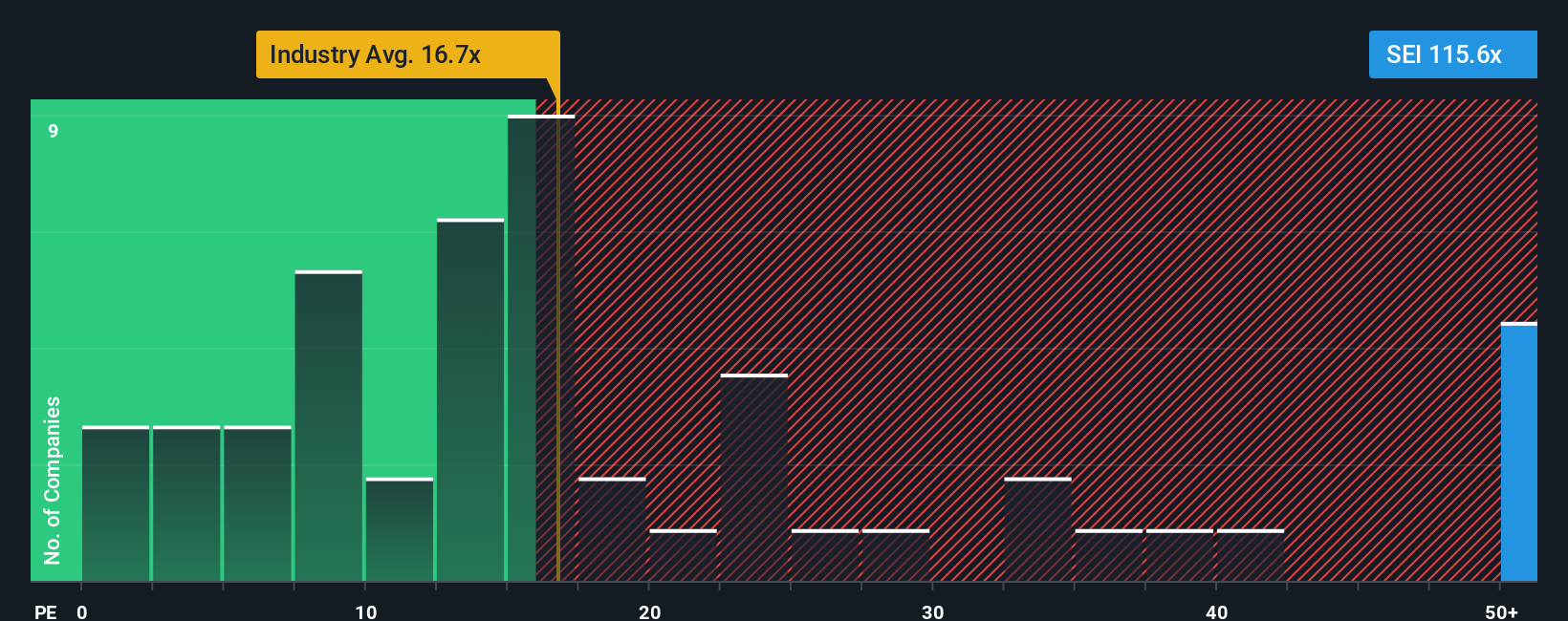

While fair value estimates and DCF models may point to significant upside, a look at Solaris Energy Infrastructure's price-to-earnings ratio tells a much more cautious story. At 60.7x, its valuation stands well above both the industry average of 16.6x and the fair ratio of 23.8x. This wide gap suggests that much of the company’s future growth could already be factored into the price, raising the stakes for anyone buying in at these levels. Should investors wait for the market to catch up, or is the premium justified by fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If you see things differently or want to dig into the numbers yourself, crafting your own perspective takes just a couple of minutes. Do it your way

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investing Moves?

You're just a click away from uncovering fresh investment opportunities tailored to your interests. Let Simply Wall Street guide you to ideas you won't want to miss out on.

- Capitalize on remarkable growth by spotting these 886 undervalued stocks based on cash flows with strong cash flow potential for your portfolio.

- Secure steady income streams when you review these 16 dividend stocks with yields > 3% yielding more than 3% each year.

- Tap into future innovation and breakthroughs by evaluating these 25 AI penny stocks with huge upside in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives