- United States

- /

- Energy Services

- /

- NYSE:SEI

Assessing Solaris Energy Infrastructure’s Valuation After Policy Tailwinds and Expansion in Renewable Projects

Reviewed by Simply Wall St

New government subsidies for renewable projects have put Solaris Energy Infrastructure (SEI) in the spotlight, as its expansion strategy and recent mergers and acquisitions line up neatly with this policy tailwind.

See our latest analysis for Solaris Energy Infrastructure.

That backdrop seems to be feeding into sentiment, with SEI’s share price at $44.96 after a 4.41 percent 1 day share price return and a 52.67 percent year to date share price return. Its 5 year total shareholder return of 566.67 percent points to strong long term momentum rather than a short lived pop.

If SEI’s policy driven run up has caught your attention, this could be a good moment to discover other energy and infrastructure names using fast growing stocks with high insider ownership.

Yet with SEI still trading at a sizeable discount to analyst targets despite a powerful multi year rally, investors now face a key question: is this momentum name still mispriced, or is the market already baking in years of growth?

Most Popular Narrative: 30.4% Undervalued

With Solaris Energy Infrastructure closing at $44.96 versus a narrative fair value near $64.60, the most widely followed storyline argues the rerating is not done yet.

The accelerating demand for grid resiliency, electrification of industries, and AI-driven data center power needs is creating strong, ongoing demand for Solaris's modular, scalable power generation solutions, positioning the company for significant revenue growth as delivery of new capacity ramps through 2026 and beyond. Regulatory clarity and support for distributed energy and microgrid development (for example, recent Texas legislation and PJM auction results) are driving a larger pipeline of high-value, long-duration contracts, which is expected to improve Solaris's contracted backlog, revenue visibility, and earnings stability.

Curious how sustained double digit growth, fatter margins, and a premium future earnings multiple can all coexist in one story? See how the numbers connect.

Result: Fair Value of $64.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could unravel if growth proves overly dependent on one-off project ramps, or if oil-linked logistics weakness drags on consolidated margins.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another View: Rich Multiples Test the Undervaluation Story

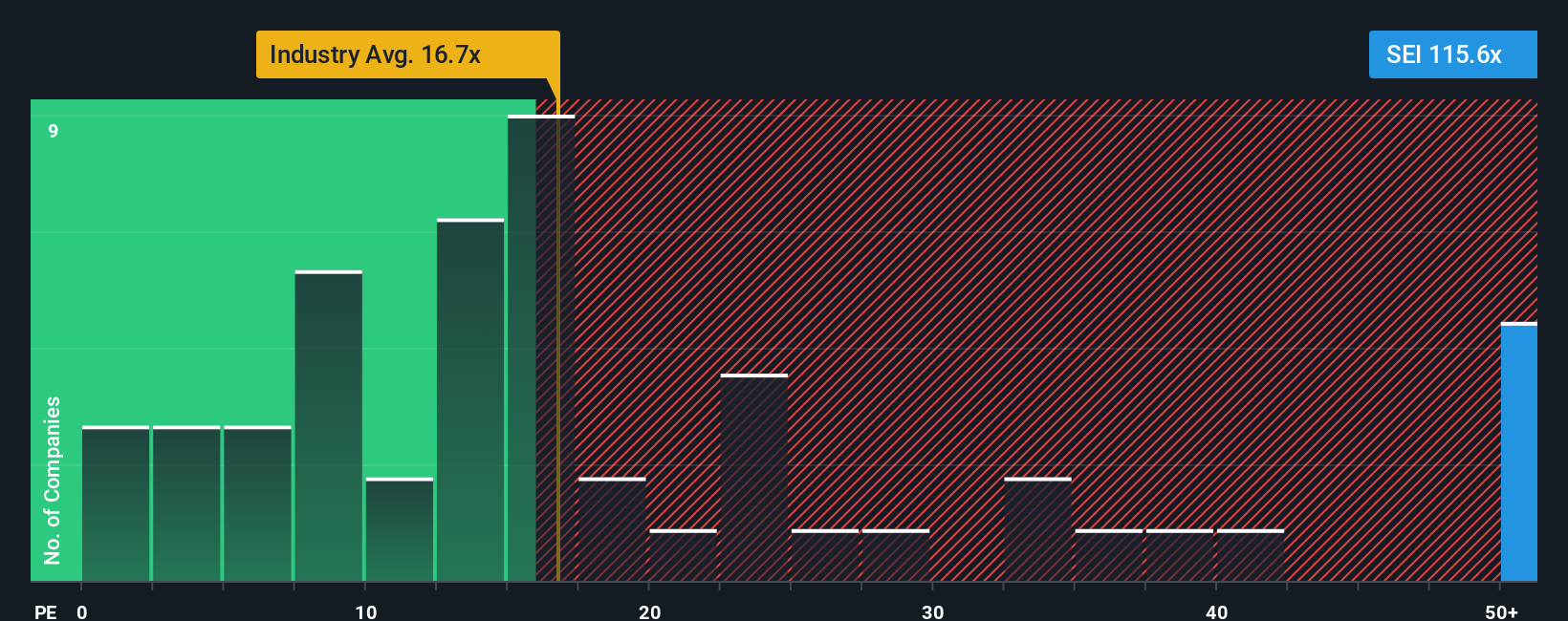

While narratives and fair value estimates point to upside, SEI’s 60.4x price to earnings looks demanding versus both the Energy Services industry at 18x and peers at 24.7x. The fair ratio is 25.3x, which hints the market could eventually compress today’s premium. Is this runway or risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If you see Solaris differently or want to dig into the numbers yourself, you can build a personalised thesis in minutes: Do it your way.

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning curated stock ideas that match your strategy, instead of waiting for the market to move first.

- Identify potential multi-baggers early by reviewing these 3632 penny stocks with strong financials that pair higher risk with improving balance sheets and strengthening fundamentals.

- Explore opportunities in the AI space through these 24 AI penny stocks that are building real products, growing revenue, and shaping how data driven industries evolve.

- Seek more dependable cash flow with these 12 dividend stocks with yields > 3% that combine meaningful yields with the financial strength needed to keep paying through the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion