- United States

- /

- Energy Services

- /

- NYSE:SDRL

Do Seadrill’s (SDRL) New Gulf and Angola Deals Quietly Recast Its Offshore Risk Profile?

Reviewed by Sasha Jovanovic

- Earlier this week, Seadrill Limited announced new contract awards for the West Neptune and Sevan Louisiana in the U.S. Gulf of Mexico, alongside a five-well option exercise in Angola that keeps the Sonangol Quenguela working into February 2027 and adds about US$48 million to its backlog.

- These awards not only extend rig utilization across key basins but also highlight Seadrill’s ability to secure follow-on work and deploy new well-intervention technology in the Gulf of Mexico.

- We’ll now look at how this incremental backlog, especially the Angola extension, reshapes Seadrill’s investment narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Seadrill Investment Narrative Recap

To own Seadrill, you need to believe that tightening ultra‑deepwater supply and rising offshore activity will eventually translate into stronger utilization, pricing, and cash flow, despite recent losses and volatile sentiment. The new contracts modestly support the near term utilization and backlog story, but do not fundamentally change the key near term catalyst, which is clearer evidence that day rates can hold up against softer utilization and competition, or the main risk of margin pressure into 2026.

Of the recent announcements, the Angola extension for the Sonangol Quenguela looks most relevant here, because it directly addresses the risk of idle time in a region where approvals and timelines have often slipped. Locking in work into February 2027 reduces near term revenue volatility for that rig and slightly improves backlog visibility, but it does not remove the broader concerns around weaker pricing power and Seadrill’s recent swing back into net losses.

Yet even with better backlog visibility, investors should be aware that...

Read the full narrative on Seadrill (it's free!)

Seadrill's narrative projects $1.6 billion revenue and $231.6 million earnings by 2028. This requires 7.2% yearly revenue growth and about a $154.6 million earnings increase from $77.0 million today.

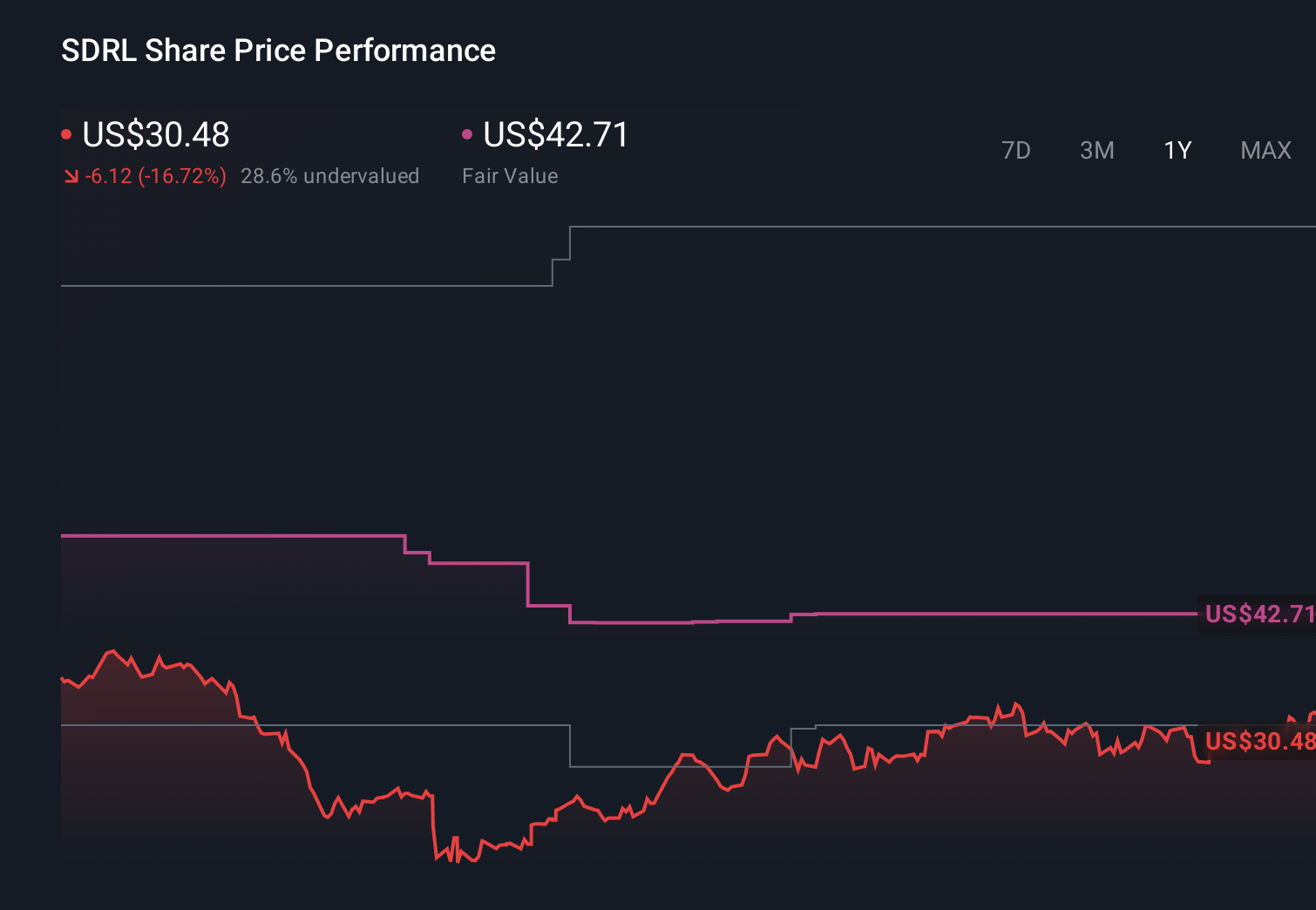

Uncover how Seadrill's forecasts yield a $43.50 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community valuations for Seadrill span about US$41.86 to US$474.73, highlighting how far apart individual views on upside really are. When you set that against ongoing concerns about softer utilization and day rate pressure through 2026, it becomes even more important to compare several of these perspectives before deciding what the recent contracts might mean for Seadrill’s longer term performance.

Explore 5 other fair value estimates on Seadrill - why the stock might be worth just $41.86!

Build Your Own Seadrill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Seadrill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seadrill's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SDRL

Seadrill

Provides offshore drilling services to the oil and gas industry worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion