- United States

- /

- Oil and Gas

- /

- NYSE:RRC

Should Range Resources' (RRC) Expanded Credit Facility Shape Investors' Views on Its Growth Strategy?

Reviewed by Sasha Jovanovic

- On October 2, 2025, Range Resources Corporation entered into an amended and restated senior secured reserve based revolving credit agreement with a maximum principal amount of US$4.0 billion, a borrowing base of US$3.0 billion, and total lender commitments of US$2.0 billion, extending the maturity to October 2, 2030.

- This new credit agreement offers Range Resources increased financial flexibility, the potential for reduced borrowing costs if investment grade ratings are achieved, and support for ongoing operations and investment needs through flexible terms and covenants.

- We'll examine how the expanded and more flexible credit facility could influence Range Resources' growth outlook and operational plans.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Range Resources Investment Narrative Recap

For investors to be long-term shareholders in Range Resources, it often comes down to a belief in the enduring demand for natural gas from expanding power and data center infrastructure in Appalachia, alongside Range’s ability to maintain strong operational performance. The recent US$4.0 billion revolving credit agreement bolsters the company’s liquidity and flexibility, but in the short term, does not materially change the central catalyst of growing regional demand or the ongoing risk from regulatory uncertainty and market access in Appalachia.

The company’s upcoming third quarter 2025 earnings release on October 28 is closely watched, as production guidance points to steady increases, which can reinforce or challenge the outlook for sustained revenue growth, making near-term financial results particularly relevant given the intensified focus on operational execution.

However, even with enhanced credit flexibility, investors should consider the risk that remains if regulatory delays or market constraints ...

Read the full narrative on Range Resources (it's free!)

Range Resources' narrative projects $4.1 billion revenue and $804.1 million earnings by 2028. This requires 13.7% yearly revenue growth and a $325.4 million earnings increase from $478.7 million currently.

Uncover how Range Resources' forecasts yield a $42.62 fair value, a 11% upside to its current price.

Exploring Other Perspectives

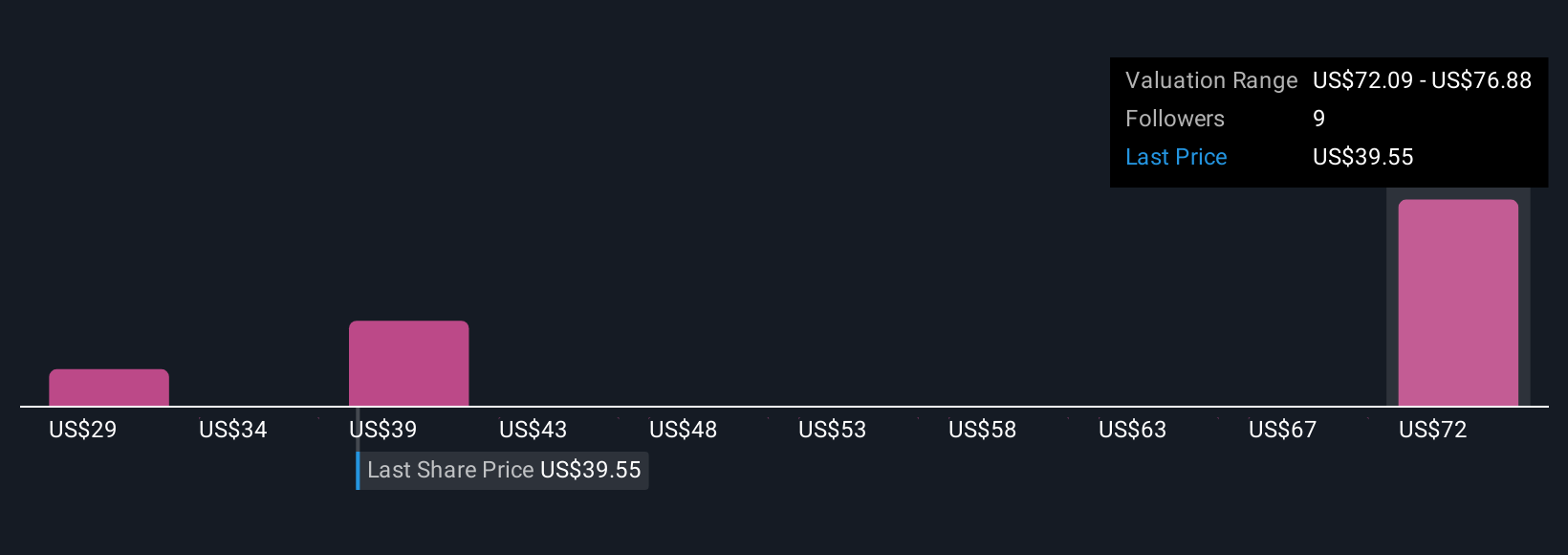

Five recent fair value estimates from the Simply Wall St Community for Range Resources span from US$29 to over US$75 per share. While some see potential for growth amid Appalachian demand tailwinds, others point to regulatory risks that could directly affect revenues and earnings. Explore how your assumptions compare to these diverse views.

Explore 5 other fair value estimates on Range Resources - why the stock might be worth 25% less than the current price!

Build Your Own Range Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Range Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Range Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Range Resources' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives