- United States

- /

- Energy Services

- /

- NYSE:RIG

Transocean (RIG): Valuation Insights After New Equinor Contract Boosts Project Pipeline

Reviewed by Kshitija Bhandaru

If you have been following Transocean (RIG), there is fresh news on the horizon that could shift the conversation around its stock. Norwegian regulators have just granted Equinor permission to use Transocean’s Encourage rig for a key drilling project at the Tyrihans East prospect. This contract not only confirms new work for Transocean, but also adds longer-term visibility to its project pipeline and has caught the attention of investors considering the company’s next chapter.

This announcement comes as Transocean’s price performance has followed two different paths. The company’s shares have climbed 19% over the past three months, signaling renewed momentum, even as the overall one-year return remains down 27%. In the context of a longer-term multi-year recovery and recent developments, the upcoming Equinor campaign shows that institutional clients continue to see value in Transocean’s assets.

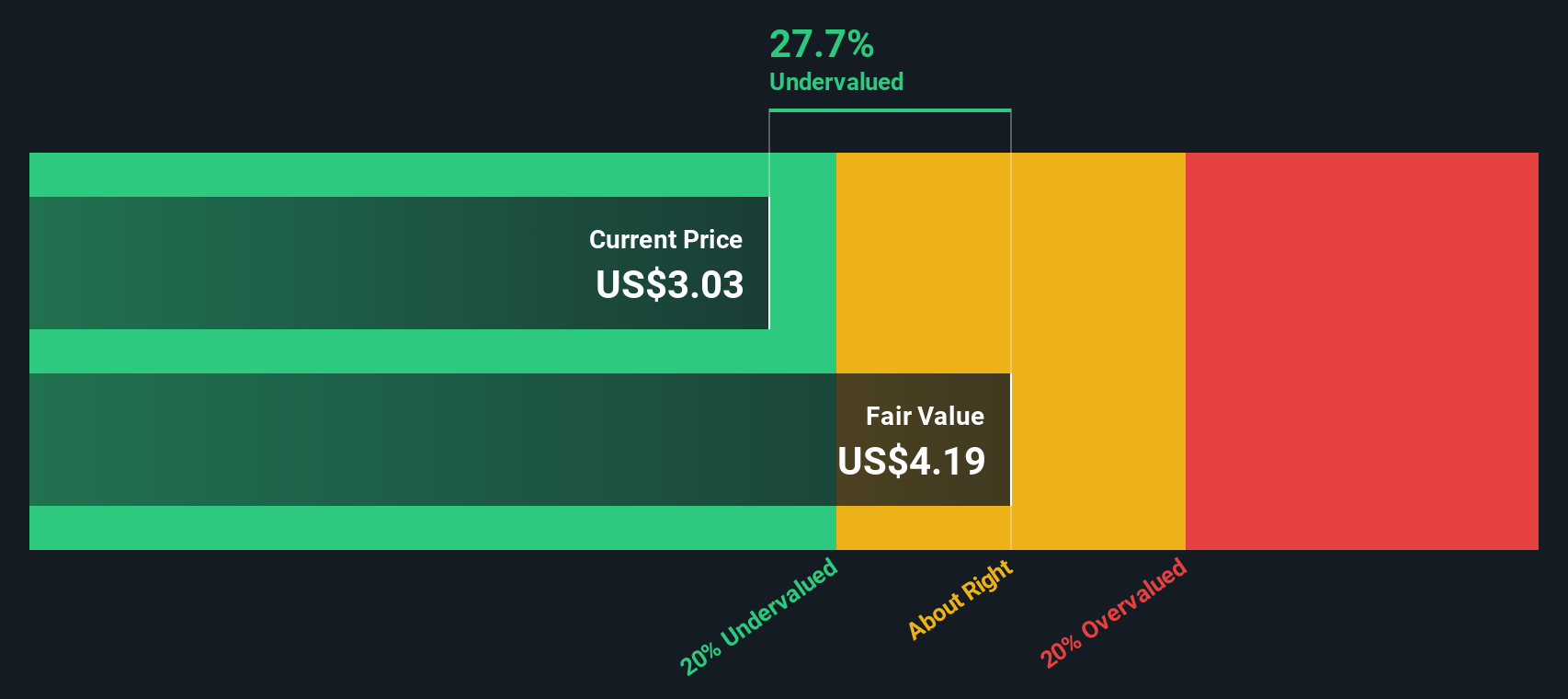

The question now is whether this contract win means Transocean is undervalued, or if the recent surge in interest has already priced in the company’s future growth. What should investors make of this moment?

Most Popular Narrative: 14.4% Undervalued

The dominant narrative sees Transocean as trading well below its fair value, with strong demand and strategic positioning seen as drivers of future upside.

Rising global energy demand and the ongoing depletion of easily accessible onshore oil reserves are driving sustained investment in offshore and ultra-deepwater exploration. This is leading to a tightening rig market and rising dayrates, which are poised to boost Transocean's revenue and EBITDA as utilization approaches or exceeds 90% in late 2026 and 2027.

What’s behind this 14.4% gap to fair value? The model assumes future profit margins that swing dramatically, a remarkable change in the company’s financials, and forward-looking multiples more often seen in fast-growing sectors. Want to know which bold projections are setting this stock apart? Discover the surprising figures that underpin the case for a higher share price.

Result: Fair Value of $3.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising debt costs or a prolonged softness in rig dayrates could challenge this bullish outlook and quickly put pressure on future profitability.

Find out about the key risks to this Transocean narrative.Another View: What Does the SWS DCF Model Say?

While multiples suggest Transocean trades below fair value, our SWS DCF model points in the same direction. This indicates the stock could be undervalued based on future cash flow assumptions. Which method do you trust more for the long run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Transocean Narrative

If you see things differently or want to dive into the numbers on your own terms, it only takes a few minutes to craft your personal view. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Transocean.

Looking for more investment ideas?

Expand your portfolio beyond the usual picks. There is a world of standout opportunities you might be missing. Make your next smart investment move now.

- Catch the potential of under-the-radar stocks with robust balance sheets and dynamic growth when you check out penny stocks with strong financials.

- Tap into the future of medicine by seeing which innovators are using artificial intelligence to revolutionize healthcare through healthcare AI stocks.

- Secure steady returns by focusing on companies offering reliable payouts above 3 percent with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives