- United States

- /

- Energy Services

- /

- NYSE:RIG

Transocean (RIG): Assessing Valuation After New Contracts Boost Backlog and Revenue Visibility

Reviewed by Simply Wall St

Transocean (NYSE:RIG) is back in the spotlight after announcing new contract fixtures across Brazil, Norway, and Romania. These contracts will add about $89 million to its firm contract backlog, offering clearer visibility on future revenues.

See our latest analysis for Transocean.

Transocean’s latest contract wins have coincided with solid momentum in its share price, climbing more than 38% over the past 90 days alone. While recent news has increased investor optimism about stronger revenue visibility, it is notable that the company’s one-year total shareholder return remains flat. This suggests that most of the long-term gains are from earlier years instead of recent trading. Overall, recent contract activity appears to be brightening the near-term outlook, with price action showing growing confidence in the company’s operational execution and future prospects.

If you’re weighing up new opportunities in today’s dynamic market, now is a great moment to discover fast growing stocks with high insider ownership.

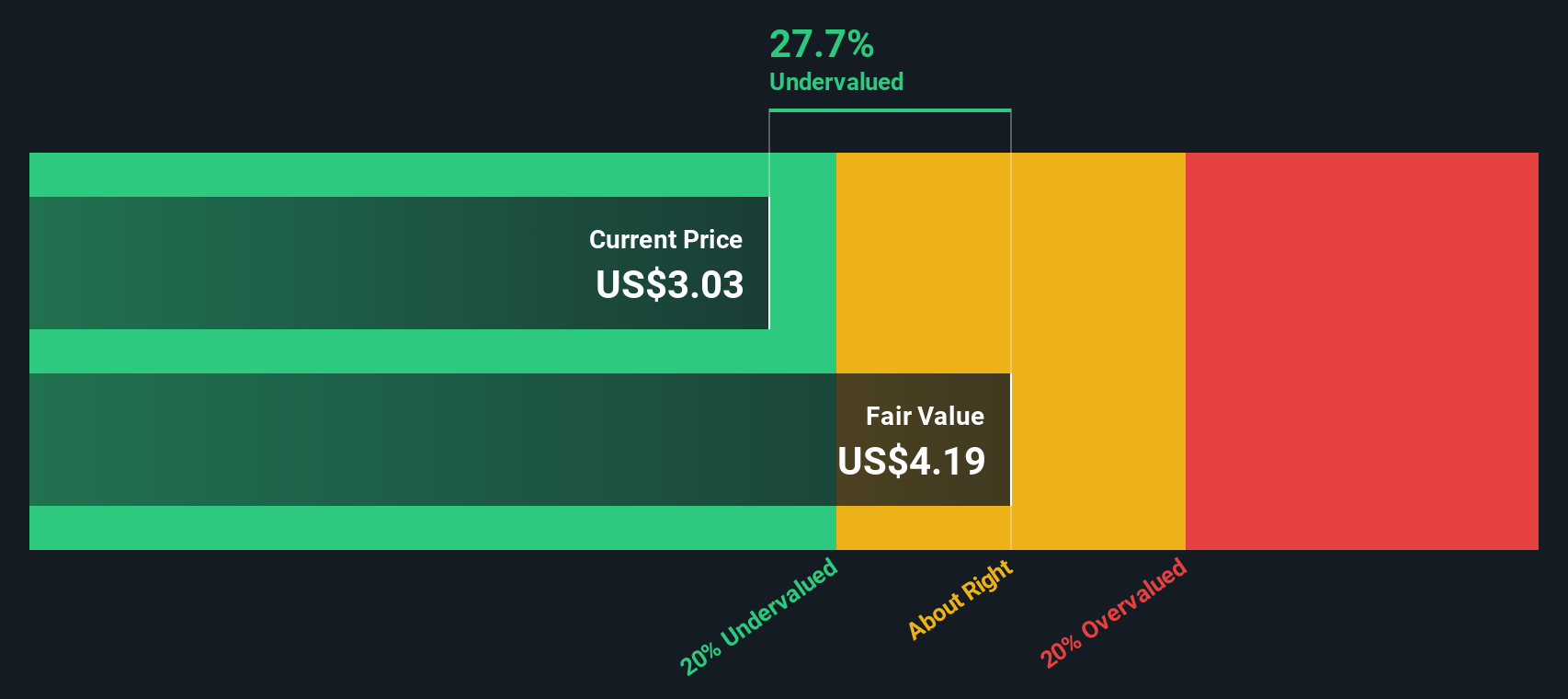

But after a sharp rally and new contract wins, is Transocean’s stock offering real value for investors? Has the market already factored in all of this growth? Is there still a buying opportunity here, or is future upside already reflected in the price?

Most Popular Narrative: 3.2% Overvalued

After the latest contract wins and a market rally, the most widely followed narrative sees Transocean’s fair value at $4.17 per share, just above the last close at $4.30. This suggests that optimism is growing, but the current price might be running slightly ahead of the company’s forecasted path.

“Rising global energy demand and the ongoing depletion of easily accessible onshore oil reserves are driving sustained investment in offshore and ultra-deepwater exploration. This is resulting in a tightening rig market and rising dayrates, which are poised to boost Transocean's revenue and EBITDA as utilization approaches or exceeds 90% in late 2026 and 2027.”

Want to know the growth blueprint behind this price target? The key debate is whether Transocean can achieve a turnaround in earnings and profit margins at a level not seen in years. Curious about the bold projections that anchor this fair value? Find out which future financial milestones the narrative relies on and see whether you agree with the numbers.

Result: Fair Value of $4.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently low crude prices or a delayed rebound in offshore demand could quickly challenge these optimistic forecasts for Transocean's recovery.

Find out about the key risks to this Transocean narrative.

Another View: Discounted Cash Flow Paints a Different Picture

While consensus price targets suggest Transocean is slightly overvalued, our SWS DCF model estimates the stock’s fair value at $9.01, which is more than double its current price. This suggests the market could be significantly undervaluing longer-term cash flows. Could this present a hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Transocean for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Transocean Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily create your own Transocean narrative in just a few minutes. Do it your way

A great starting point for your Transocean research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Staying ahead in today’s market means acting on fresh insights and untapped trends before the crowd does. Don’t wait. Seize new opportunities now with these handpicked stock ideas from Simply Wall Street:

- Uncover potential in fast-growing companies by checking out these 3580 penny stocks with strong financials that boast robust financials and are gaining momentum among savvy investors.

- Capitalize on the rise of artificial intelligence by scanning these 25 AI penny stocks, where top contenders are positioned to reshape industries with their innovation.

- Maximize your returns by targeting these 933 undervalued stocks based on cash flows poised for strong cash flow growth but still flying under the radar of the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026