- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Phillips 66 (PSX): Revisiting Valuation After Court Upholds $833M Trade Secrets Judgment

Reviewed by Simply Wall St

Phillips 66 saw renewed investor attention after a California court rejected its bid to overturn an $833 million judgment concerning trade secret use from a failed Propel Fuels acquisition. The legal ruling carries both financial and reputational weight for Phillips 66.

See our latest analysis for Phillips 66.

Despite the legal setback, Phillips 66’s share price has held up remarkably well, gaining 12.5% over the past three months and posting a year-to-date price return of 20.6%. Momentum has been steady, and with a 10.3% total shareholder return over the past year and a long-term return of 174% in five years, investors seem to be weighing the company’s long-term growth potential against near-term headline risks.

If legal drama has you curious about other areas of opportunity, now is a great time to broaden your outlook and discover fast growing stocks with high insider ownership

With so much legal noise yet continuing price strength, investors are left to consider whether recent optimism is justified or if Phillips 66’s growth story is already reflected in the share price, leaving little room for upside.

Most Popular Narrative: 48.6% Undervalued

With Phillips 66’s last close at $138.02, the most popular narrative suggests a significantly higher fair value. This notable valuation gap draws attention to what justifies such an outlook.

Phillips 66 (PSX) is often considered undervalued for several reasons. Investment analysis typically looks at various factors to determine if a company's stock might be undervalued and whether it has the potential to achieve higher profit margins. Here's a summary based on typical financial articles and analyses:

Curious what’s powering this lofty target? The heart of the story is bold assumptions on future growth and profit margins. The narrative’s calculations rely on projected efficiency improvements and ambitious financial management. Want to know what else is driving this optimistic price? Read the full narrative to unlock the key factors behind the headline number.

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in oil prices or disappointing progress on efficiency gains could quickly challenge the current positive outlook for Phillips 66.

Find out about the key risks to this Phillips 66 narrative.

Another View: What Do Market Ratios Say?

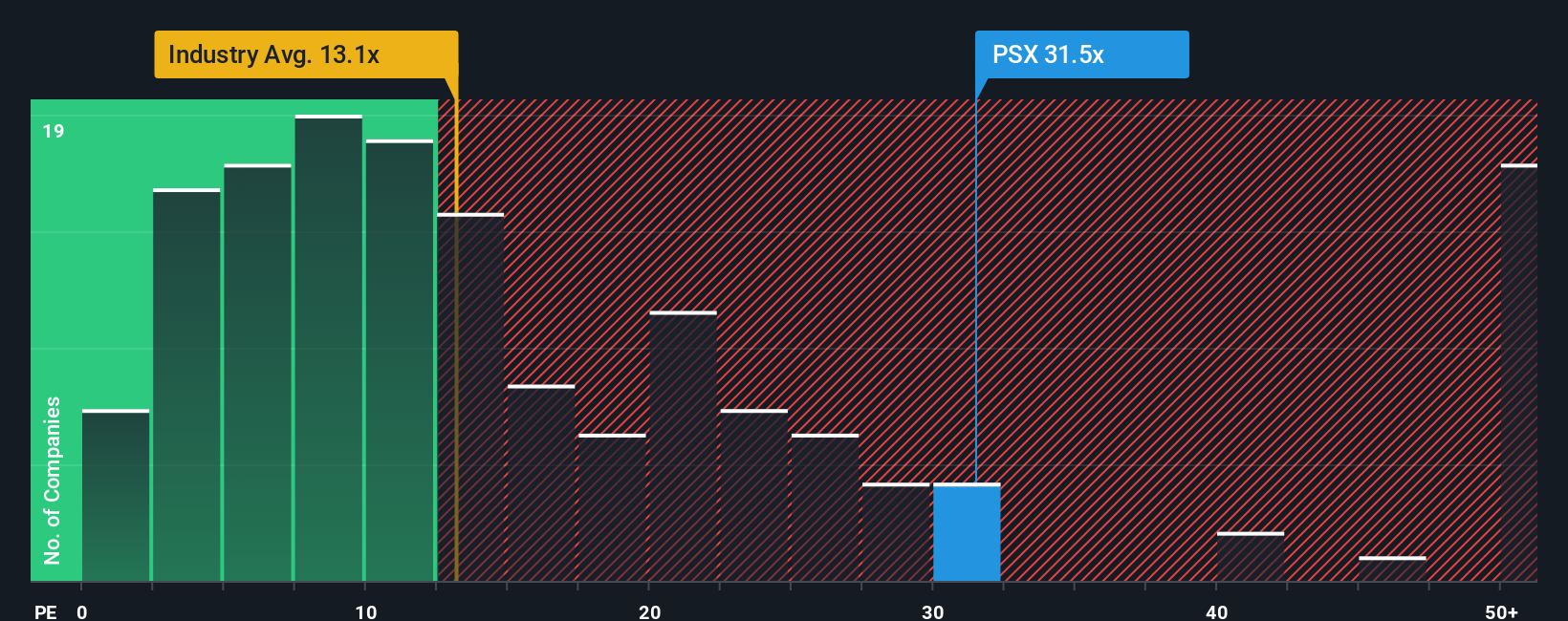

Taking a look at market valuation ratios, Phillips 66 trades at a price-to-earnings ratio of 37.1x, which stands well above both the US Oil and Gas industry average of 14.1x and peers at 25x. Even compared to its estimated fair ratio of 34x, Phillips 66 comes out as expensive. This premium suggests investors have built in a lot of optimism. The question remains: is there as much upside here as the fair value story implies?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you have a different perspective or want to investigate the facts on your own, you can dig into the data and craft your own viewpoint in just a few minutes. Do it your way

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself. Now is your chance to seize fresh opportunities being overlooked by others. Use these handpicked stock ideas and shape the future of your investments:

- Jump on income potential by tapping into these 14 dividend stocks with yields > 3%, which offers promising consistent yields above 3% for a reliable stream of returns.

- Capitalize on revolutionary advancements in digital assets and fintech with these 82 cryptocurrency and blockchain stocks powering the next wave of blockchain innovation.

- Target the next surge in artificial intelligence by considering these 27 AI penny stocks, which are redefining the intersection of tech and rapid growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives