- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Phillips 66 (PSX): Margin Compression Challenges Bullish Profit Growth Narratives

Reviewed by Simply Wall St

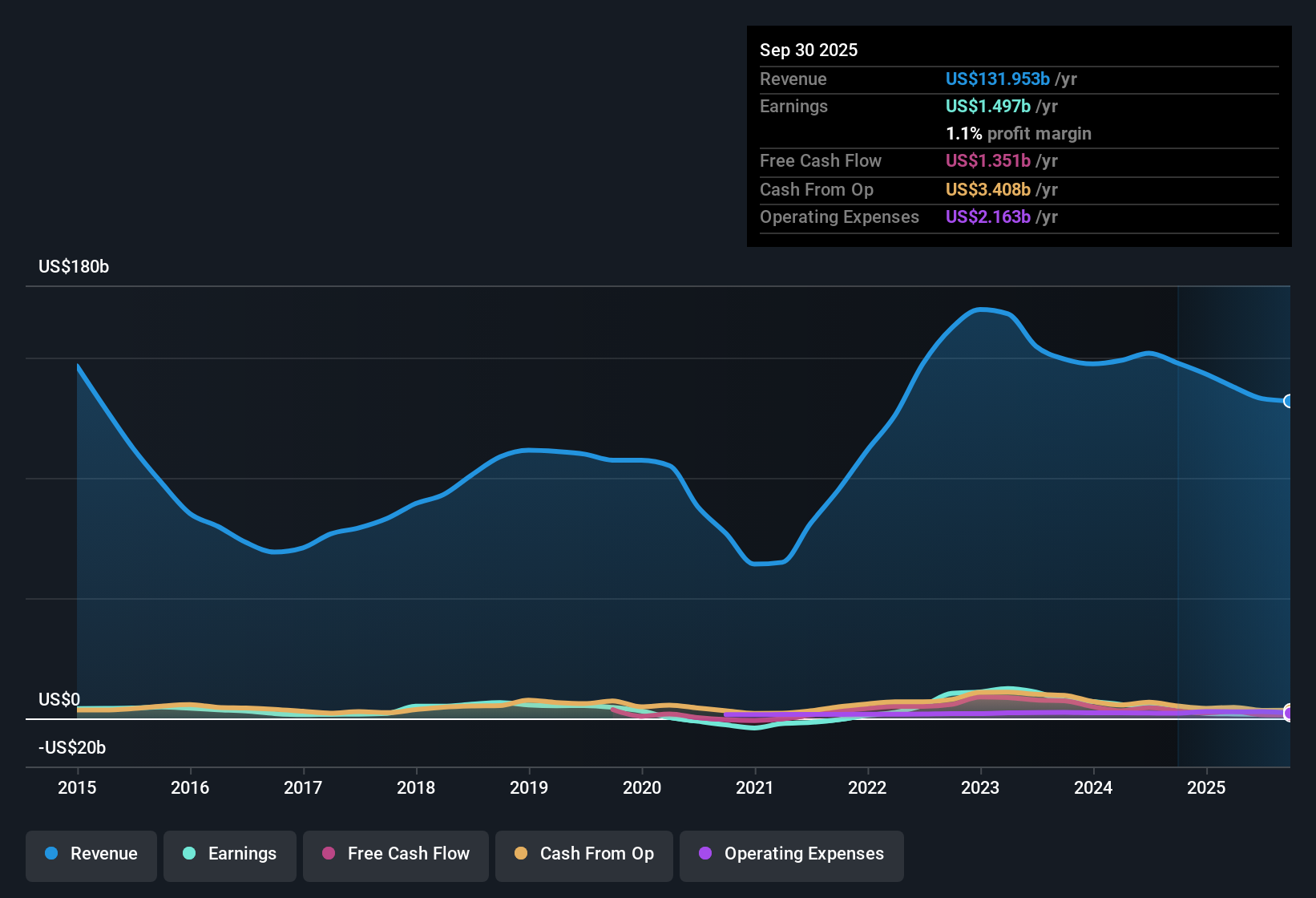

Phillips 66 (PSX) posted a net profit margin of 1.1%, down from 2.3% a year ago, highlighting recent margin compression. Looking ahead, analysts see earnings growing at 25.9% annually over the next three years, which is above the projected 15.7% annual growth for the broader US market. Despite high-quality earnings and 22.2% annualized profit growth over the past five years, revenue is forecast to decline at a 2.3% annual pace in coming years. This puts the focus on the company’s ability to sustain margins and profitability from this point forward.

See our full analysis for Phillips 66.Next up, we’ll see how the latest numbers match or diverge from the narratives that investors and analysts are focusing on right now.

See what the community is saying about Phillips 66

Share Repurchases Accelerate While Shares Outstanding Shrink

- Analysts project that Phillips 66 will reduce its number of shares outstanding by 2.15% annually over the next three years, supporting earnings per share growth even if top-line revenues decline.

- According to the analysts' consensus view, committed capital returns through ongoing share repurchases and dividend growth are expected to help drive sustainable EPS gains, even in the face of challenging macroeconomic conditions.

- Effective capital allocation, including these buybacks, is highlighted as key to remaining competitive and offsetting headwinds in core operations.

- These steps could partially shield investors from the expected 2.3% annual revenue decline by increasing per-share metrics and supporting valuation confidence.

Midstream Expansion Targets $4.5 Billion EBITDA by 2027

- The acquisition of EPIC NGL and ongoing transformational growth initiatives are aimed at driving Midstream EBITDA to $4.5 billion by 2027, supporting improved earnings stability and profitability.

- Analysts' consensus view underscores that investments in the Midstream segment, including enhancing the NGL value chain and high-return refining projects, are designed to sustainably boost margins and diversify earnings, reducing exposure to volatile refining cycles.

- Strategic divestments and realignment in Refining also aim to improve overall competitiveness and margin profiles, reinforcing the business model transformation underway.

- Still, consensus acknowledges that heavy reliance on Midstream for future growth presents risks if market or regulatory disruptions occur in that segment.

Profit Margin Recovery: 1.3% to 4.3% Projected

- Analysts forecast that profit margins, currently at 1.3%, will rise to 4.3% within three years, aligning with robust expectations for profit expansion even as revenue contracts.

- The consensus narrative highlights that this projected margin boost contrasts with recent compression, reinforcing the bullish case that efficiency improvements and targeted growth initiatives can reverse the trend, but also surfacing concerns about whether these gains are achievable amid sector headwinds.

- If Phillips 66 succeeds in increasing margins to 4.3% as forecast, it would represent a significant operational turnaround against the backdrop of waning sales.

- Nonetheless, the path to higher margins is complicated by macro challenges in Refining and Renewables, so investors are watching closely to see if operational enhancements deliver as promised.

See if analysts’ projections hold up as narratives shift and new catalysts emerge in the Phillips 66 Consensus Narrative.📊 Read the full Phillips 66 Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Phillips 66 on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? In just a few minutes, you can put your own perspective into action and shape the narrative. Do it your way

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust profit growth and share buybacks, Phillips 66 faces persistent revenue decline and margin uncertainty. These challenges are driven by sector headwinds and reliance on Midstream expansion.

If you want steadier results through changing cycles, check out our stable growth stocks screener (2113 results) to discover companies delivering consistent and reliable growth even when conditions get tough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives