- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Is Phillips 66 Set for a Move After Renewable Diesel Expansion and 24% YTD Gain?

Reviewed by Bailey Pemberton

- Curious if Phillips 66 is undervalued or set for a breakout? You're not alone, especially as energy stocks continue to capture investor attention.

- The stock has shown some serious momentum lately, rising 3.2% in the last week and almost 10% over the last month. It is also up 24.4% year-to-date and 12.8% over the past year.

- Recent headlines highlight increased refinery utilization rates and strategic investments in renewable fuels, which have boosted market confidence in the company's long-term outlook. News of Phillips 66 expanding its renewable diesel production has also played a role in driving recent price moves by signaling an adaptability that investors are watching closely.

- When it comes to valuation, Phillips 66 currently scores 2 out of 6 for undervaluation across our key checks. Looking at the numbers is just one part of the picture. Let's explore how the usual valuation yardsticks stack up, and stick around for a smarter, more comprehensive way to assess value at the end of the article.

Phillips 66 scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Phillips 66 Discounted Cash Flow (DCF) Analysis

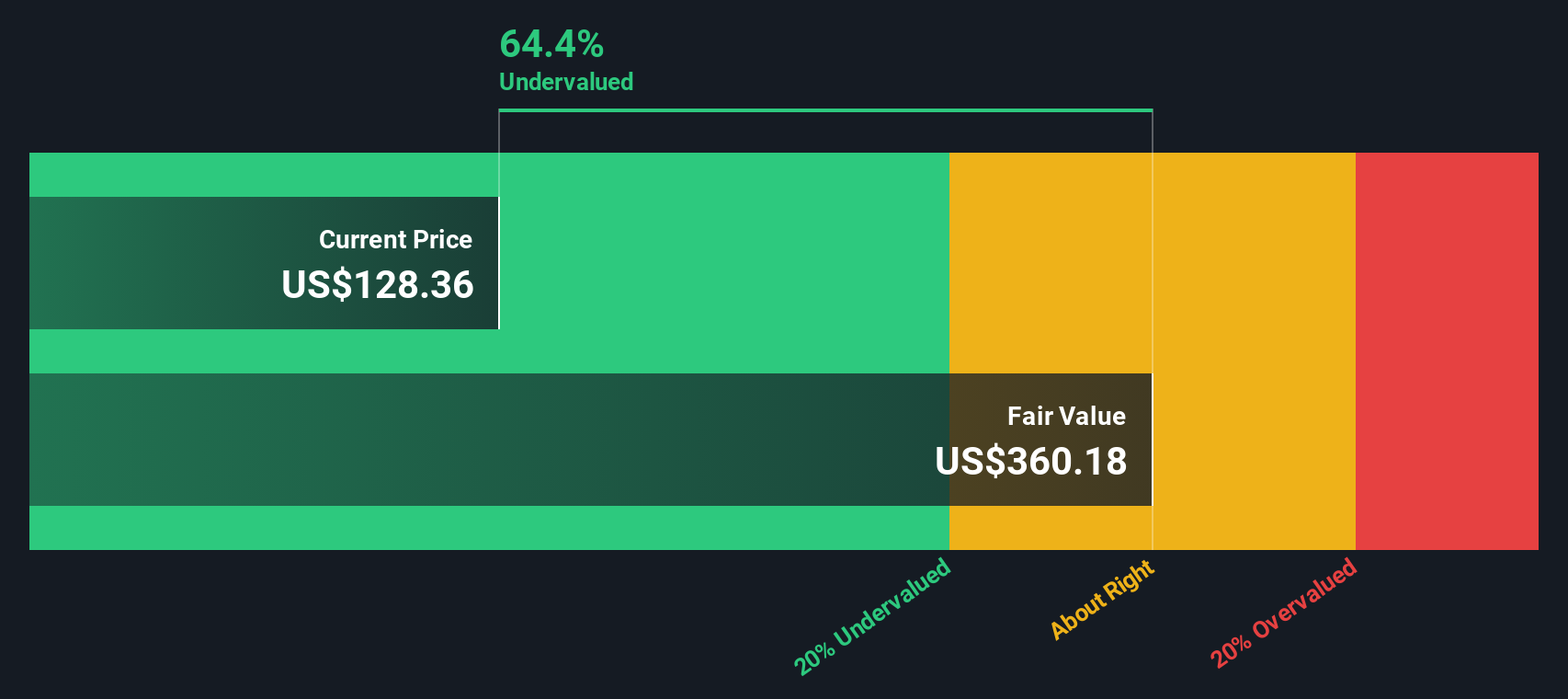

The Discounted Cash Flow (DCF) model is a commonly used valuation method that estimates the intrinsic value of a company by projecting its future free cash flow and then discounting those figures back to today's value. This approach aims to show what the business is really worth, based on the cash it can generate for shareholders over time.

For Phillips 66, analysts project Free Cash Flow of $1.48 Billion over the last twelve months. Looking ahead, projections show significant growth, with Free Cash Flow expected to reach $7.08 Billion by 2029. It is important to note that while analyst estimates cover the next five years, any figures beyond that are extrapolated to provide a fuller long-term view.

Based on these projections, the DCF model estimates Phillips 66’s intrinsic value at $405.13 per share. The current share price represents a discount of 64.9 percent to this estimated value, which indicates that Phillips 66 could be substantially undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Phillips 66 is undervalued by 64.9%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Phillips 66 Price vs Earnings

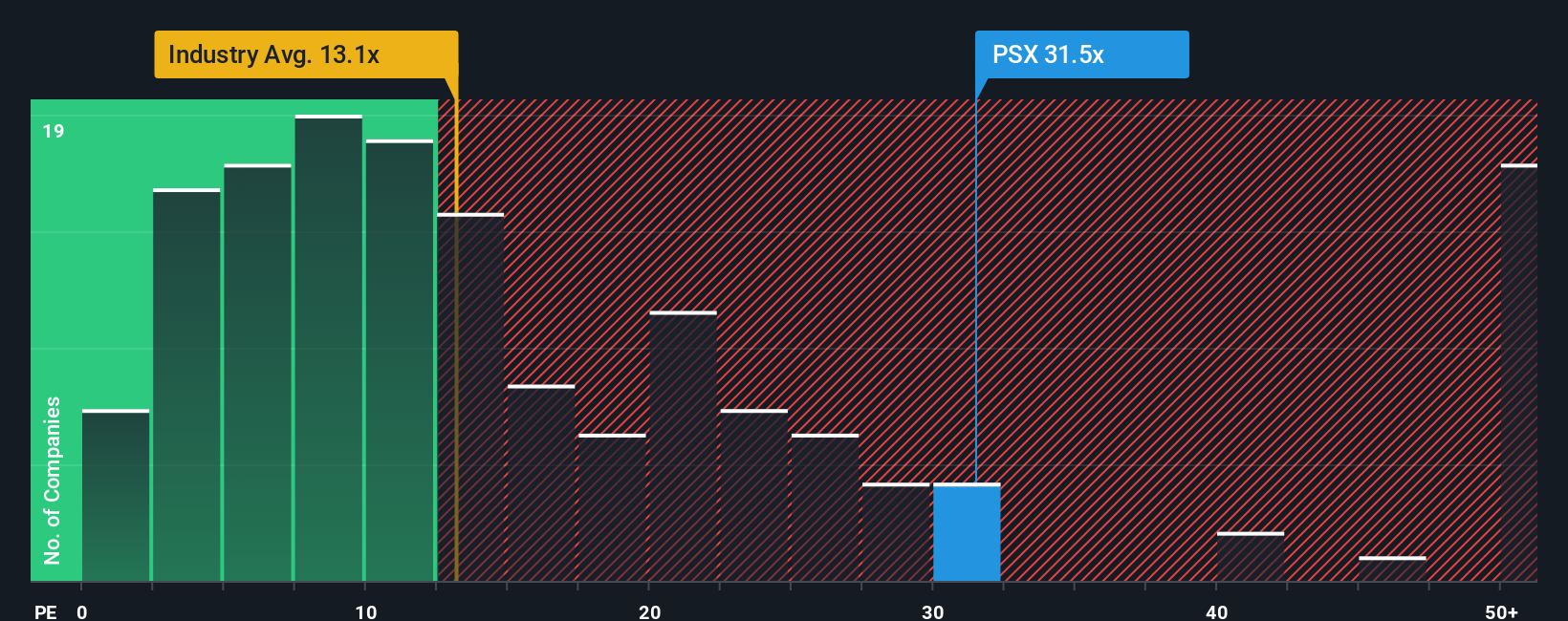

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies because it helps investors compare the price they are paying for each dollar of earnings. For companies like Phillips 66, which generate steady profits, the PE ratio is a quick way to assess whether the stock is expensive or a bargain relative to its earnings power.

However, what counts as a “fair” PE ratio is not the same for every company. Factors like future growth expectations, the stability of earnings, and overall risk profile can influence whether investors are willing to pay a higher or lower multiple. Typically, faster-growing and less risky companies can justify a higher PE ratio, while lower growth or riskier names trade at discounts.

Phillips 66 currently trades at a PE ratio of 38.3x. This is notably higher than both its industry average of 13.9x and its peer average of 25.6x. To move beyond these surface-level comparisons, Simply Wall St calculates a proprietary “Fair Ratio” that takes into account Phillips 66's earnings growth, profit margin, size, risk factors, and its position within the Oil and Gas industry. For Phillips 66, this Fair Ratio is 24.7x, which provides a more tailored benchmark for fair value than just comparing with industry averages or peers alone.

Comparing the actual PE ratio of 38.3x to the Fair Ratio of 24.7x shows that Phillips 66 is trading well above what the model suggests is reasonable for its profile. Using this approach, the stock appears to be overvalued based on its current earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Phillips 66 Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just numbers. It is your personal story and perspective about a company, expressed as assumptions for its future revenue, earnings, and profit margins, which together shape your estimate of its fair value.

This approach links the story you believe about Phillips 66's future, such as successful investments in renewables or profitability challenges, directly to a tailored financial forecast and calculated fair value. Narratives are an easy-to-use, dynamic tool built right into Simply Wall St's Community page, where millions of investors actively share and compare their views.

Narratives help you make smarter investment decisions by comparing the Fair Value based on your view, or others' views, against the current market Price. This allows you to see if there is a buying, selling, or holding opportunity according to your expectations. The best part is that Narratives update automatically as new news, earnings, or business events are released, keeping your analysis relevant and actionable in real time.

For example, on Simply Wall St, some investors expect Phillips 66 to be worth as little as $146 per share based on cautious forecasts, while others see upside to $269 by factoring in higher profit margins and better growth prospects. These estimates are all backed by their own reasoned assumptions and the latest available data.

Do you think there's more to the story for Phillips 66? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives