- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Can Phillips 66’s Strategic Shift Justify the Recent 18.7% Rally in 2025?

Reviewed by Bailey Pemberton

If you are watching Phillips 66 and wondering what your next move should be, you are definitely not alone. The energy sector has had its fair share of twists and turns, but Phillips 66 has powered ahead, gaining 5.8% in the past week and an impressive 18.7% so far this year. Even over the last three years, the stock has delivered a massive 46.2% climb. This result surpasses broader market gains and has raised a lot of eyebrows among investors who care about long-term value.

Recently, Phillips 66 made headlines with its ongoing strategic initiatives to streamline operations and reinforce its commitment to energy transition efforts. These moves have been watched carefully by the market and seem to be shifting how risk is perceived around the company, which could help explain some of the recent momentum in the stock price. With a strong five-year return of 261.6%, both loyal shareholders and new buyers are asking if there is still more fuel left in the tank or if the best days are already behind us.

From a numbers perspective, our valuation snapshot gives Phillips 66 a value score of 3 out of 6, meaning it looks undervalued in three of the six key areas we track. That middle-ground score points to a mixed picture, but it also suggests there are some real opportunities. In the next section, we will break down each of the classic valuation approaches, highlighting not just what the numbers say, but also pointing the way to a smarter and more effective way of making sense of valuation overall.

Approach 1: Phillips 66 Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and discounting them back to today’s dollars. This method considers how much money Phillips 66 is expected to generate and captures both current operations and forecasted growth, giving investors a single number to compare against the current stock price.

For Phillips 66, the latest twelve months free cash flow sits at $1.4 billion. Analyst estimates see this figure growing, with projections of $4.2 billion in 2026 and $4.5 billion in 2027. Looking further ahead, the model uses an annual growth rate to extrapolate ten years of future cash flows, reaching approximately $6.3 billion by 2035, according to data sourced from analysts and growth trend assumptions.

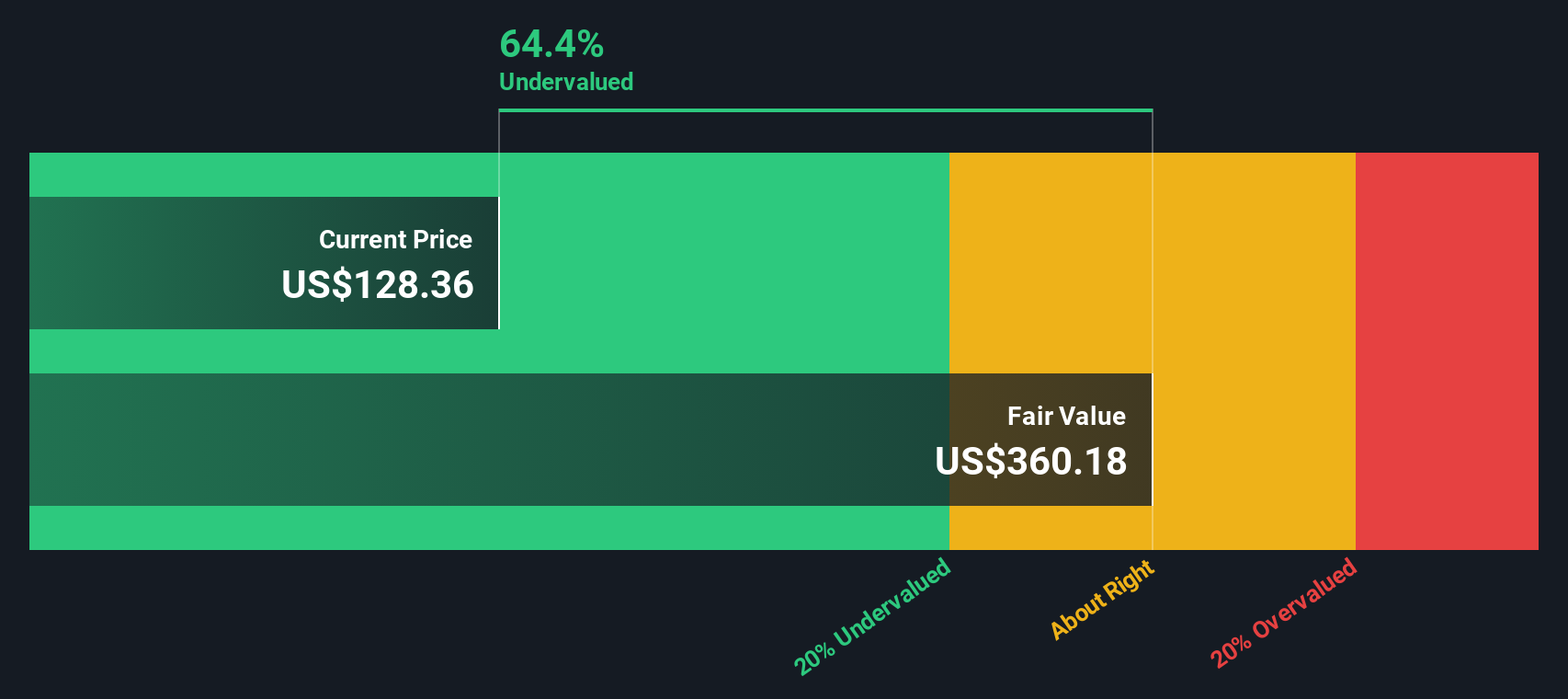

Using these projections and discounting them to present value, the DCF calculation produces an estimated intrinsic value of $280.62 per share. The DCF model indicates the stock is 51.6% undervalued at today’s market price, which suggests there may be significant upside and that Phillips 66 is potentially trading below its long-term value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Phillips 66 is undervalued by 51.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Phillips 66 Price vs Earnings

The price-to-earnings (PE) ratio is widely used to value profitable companies because it measures how much investors are willing to pay for each dollar of earnings. This metric is especially relevant for firms like Phillips 66 that consistently generate profits, as it provides an at-a-glance sense of the market's growth expectations and perceived risk.

The right PE ratio depends not just on a company’s sector, but also on factors such as growth potential, profit margins, and overall market sentiment. Companies with higher expected growth or lower risk often trade at premium PE ratios, while those with lower growth or more uncertainties warrant a discount.

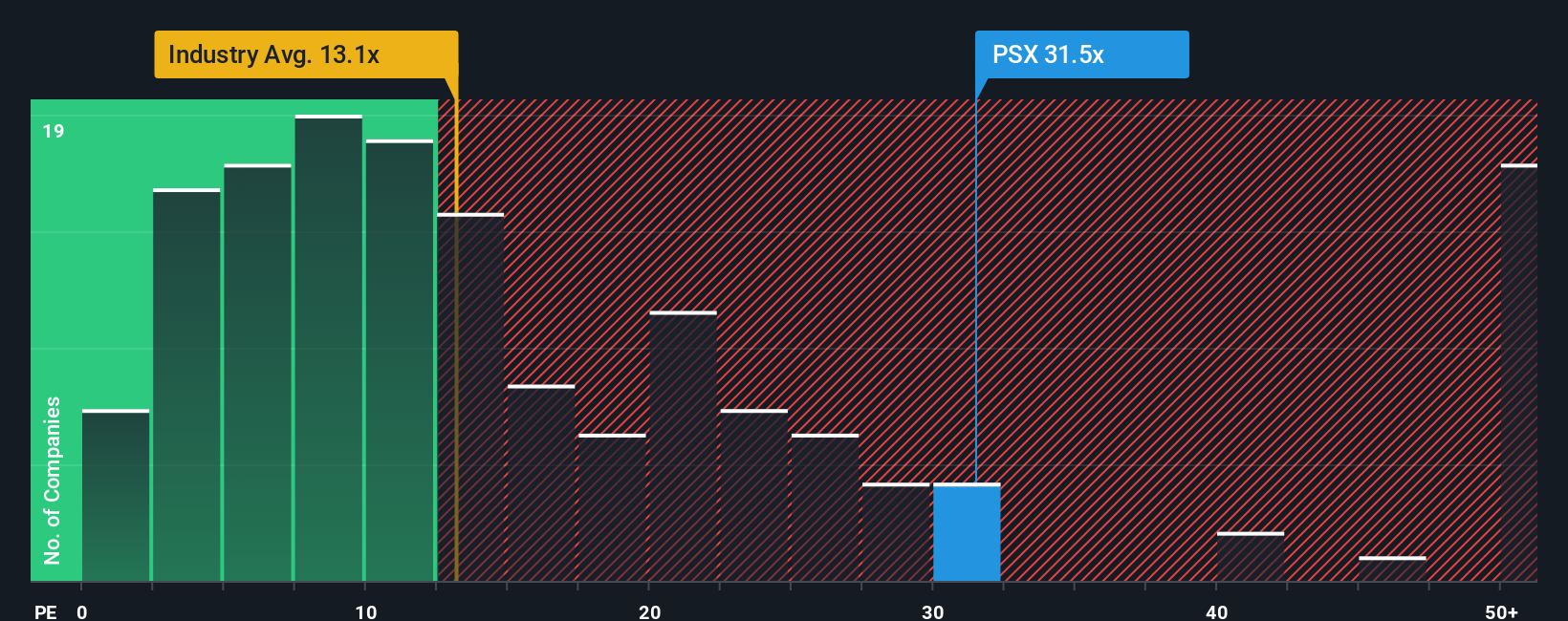

Phillips 66 currently trades at a PE ratio of 32.13x. This is slightly below the peer average of 33.88x but far above the Oil and Gas industry average of 13.09x. However, neither peers nor industry averages fully capture the company’s unique mix of growth prospects, margin profile, and risk factors.

This is where Simply Wall St’s proprietary Fair Ratio comes in. The Fair Ratio for Phillips 66 is calculated at 21.81x. This figure is tailored using key inputs like expected earnings growth, industry conditions, profit margins, market capitalization, and risk profile. Unlike basic peer or industry comparisons, the Fair Ratio gives a more nuanced and apples-to-apples assessment of valuation by accounting for key company-specific variables.

Comparing the Fair Ratio of 21.81x to the current PE of 32.13x, Phillips 66 appears to be trading at a premium relative to its fundamentals, suggesting the stock may be overvalued based on earnings expectations and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Phillips 66 Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce Narratives. A Narrative is simply your story about Phillips 66—your own perspective on its business model, growth drivers, and risks—expressed in the form of assumptions about future revenue, margins, and fair value. Narratives connect a company’s big-picture story to a financial forecast and, ultimately, a fair value; this helps you clearly see how your views map onto investment decisions.

Available directly on Simply Wall St’s Community page, Narratives are an accessible and dynamic tool used by millions of investors. Narratives let you easily compare your fair value against the current share price and help you decide whether to buy, hold, or sell. They also automatically update when key company developments or new earnings data are released.

For example, with Phillips 66, one investor’s Narrative might reflect optimism about improved operational efficiency and margin expansion, projecting a fair value of $268.71 per share. Another investor who expects more modest growth and industry headwinds may see fair value closer to $145.20 per share. Narratives make it easy to visualize these differences, allowing you to invest with confidence in your own convictions and adapt as new information arrives.

Do you think there's more to the story for Phillips 66? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives