- United States

- /

- Oil and Gas

- /

- NYSE:PSX

A Look at Phillips 66's Valuation Following Western Gateway Pipeline Partnership Launch

Reviewed by Simply Wall St

Phillips 66 (NYSE:PSX) just partnered with Kinder Morgan to kick off a binding open season for the Western Gateway Pipeline. This move creates a direct corridor for refined products from Texas to Arizona, California, and Nevada, expanding both companies' reach.

See our latest analysis for Phillips 66.

Momentum for Phillips 66 has been gaining traction, with a resilient 18.4% share price return year-to-date and a 5.5% gain over the past 90 days. Recent board changes and new partnerships, such as the Western Gateway Pipeline, continue to draw investor interest. Looking further back, the company’s total shareholder return of 44.8% over three years and a substantial 245.7% over five years underscores how strong execution can reward patient holders, even as short-term volatility persists.

If infrastructure moves like this have you curious to see which other energy leaders are gaining ground, check out the latest opportunities in fast growing stocks with high insider ownership.

Yet with shares already posting solid gains and trading just below the average analyst price target, the key question is whether Phillips 66 is undervalued today or if the market is already reflecting its future growth and pipeline upside.

Most Popular Narrative: 49.6% Undervalued

With Phillips 66’s last close at $135.42 and the latest narrative estimating fair value at $268.71, there is a significant gap worth exploring. This narrative, authored by mschoen25, lays out a case for much higher margins and value potential, which stands in sharp contrast to where the market is currently pricing the stock.

Phillips 66 is a major player in the energy sector, particularly in refining, marketing, and transportation. Analysts often look at the company’s ability to capitalize on operational efficiencies, asset optimization, and its integrated business model to improve profitability.

Want to know the secret behind this bullish view? The central argument involves a bold projection for future margins, profit growth, and a valuation benchmark you will not believe. See what specific financial levers drive this ambitious target and why the narrative stands out from consensus thinking.

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as persistent revenue declines or unexpected industry headwinds could challenge assumptions about margin expansion and long-term valuation for Phillips 66.

Find out about the key risks to this Phillips 66 narrative.

Another View: Market Ratios Tell a Different Story

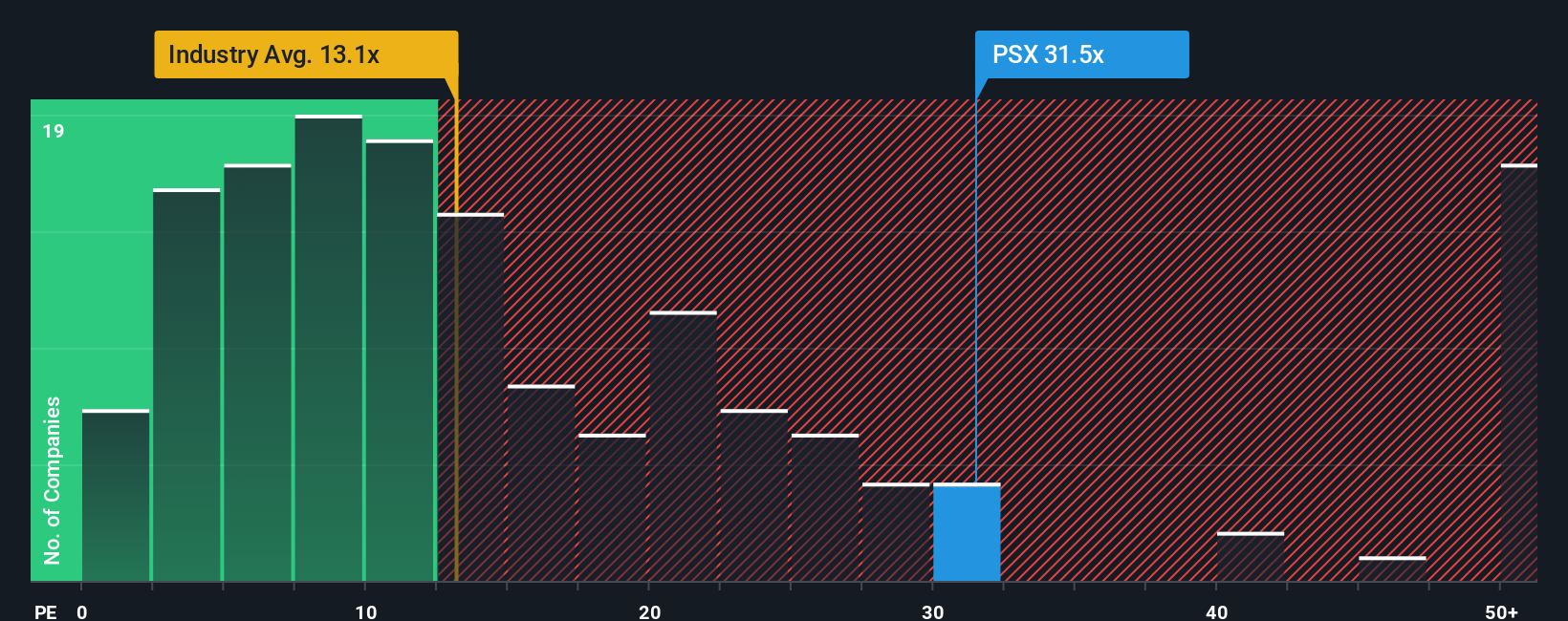

While the narrative points to undervaluation, a look at market valuation ratios suggests caution. Phillips 66 trades at a 32x price-to-earnings ratio, which is more expensive than both the industry average (12.8x) and its peers (27.9x), and is also above the fair ratio of 21.8x. Does this premium signal real quality or possible overexcitement?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you want to draw your own conclusions or dig deeper into the numbers, building your own Phillips 66 narrative is quick and revealing. Do it your way.

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Want More Opportunities? Smart Investors Look Beyond the Obvious

Do not let market moves pass you by when smarter strategies are just a click away. Use these powerful screeners to reveal tomorrow’s standouts before everyone else does.

- Unlock high-yield income with stocks offering strong payouts by starting with these 19 dividend stocks with yields > 3%. This tool is designed to showcase the most consistent dividend performers in today’s market.

- Capture the momentum of artificial intelligence breakthroughs by targeting these 27 AI penny stocks, which is packed with companies shaping how the world works and communicates.

- Seize undervalued opportunities hiding in plain sight through these 870 undervalued stocks based on cash flows and position yourself for the next big move before the crowd catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives