- United States

- /

- Oil and Gas

- /

- NYSE:PBF

Should the Torrance Refinery Disruption Prompt Action From PBF Energy (PBF) Investors?

Reviewed by Sasha Jovanovic

- PBF Energy recently experienced unplanned flaring due to a mechanical or electrical issue at its 160,000 barrel-per-day Torrance refinery in California, an event that may affect refinery operations and output.

- This operational disruption highlights how refinery reliability remains critical to both near-term production and the company’s overall market stability.

- We'll explore how the Torrance refinery malfunction could influence PBF Energy’s investment narrative and long-term operational outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

PBF Energy Investment Narrative Recap

To be a shareholder in PBF Energy, you need to believe that US refinery capacity will remain tight and support strong utilization and margins, countering industry headwinds from evolving regulations and energy transition trends. The recent unplanned flaring at the Torrance refinery is an operational setback, but unless outages lengthen or intensify, its impact on the company’s key short-term catalysts and risk profile appears limited for now. However, recurring reliability issues may challenge investor confidence if not well-managed.

Among recent announcements, PBF’s updated production guidance for Q3 2025 is especially relevant to the latest disruption. The company had forecasted robust West Coast throughput, and any additional downtime at Torrance could pressure these goals, testing the resilience of near-term revenue and highlighting that operational reliability remains a cornerstone for delivering against margin and utilization expectations.

In contrast, investors should be aware of the persistent risk that ongoing operational and regulatory challenges at key refineries...

Read the full narrative on PBF Energy (it's free!)

PBF Energy's narrative projects $33.5 billion revenue and $71.3 million earnings by 2028. This requires 3.4% yearly revenue growth and a $1.05 billion earnings increase from current earnings of -$982.3 million.

Uncover how PBF Energy's forecasts yield a $26.75 fair value, a 9% downside to its current price.

Exploring Other Perspectives

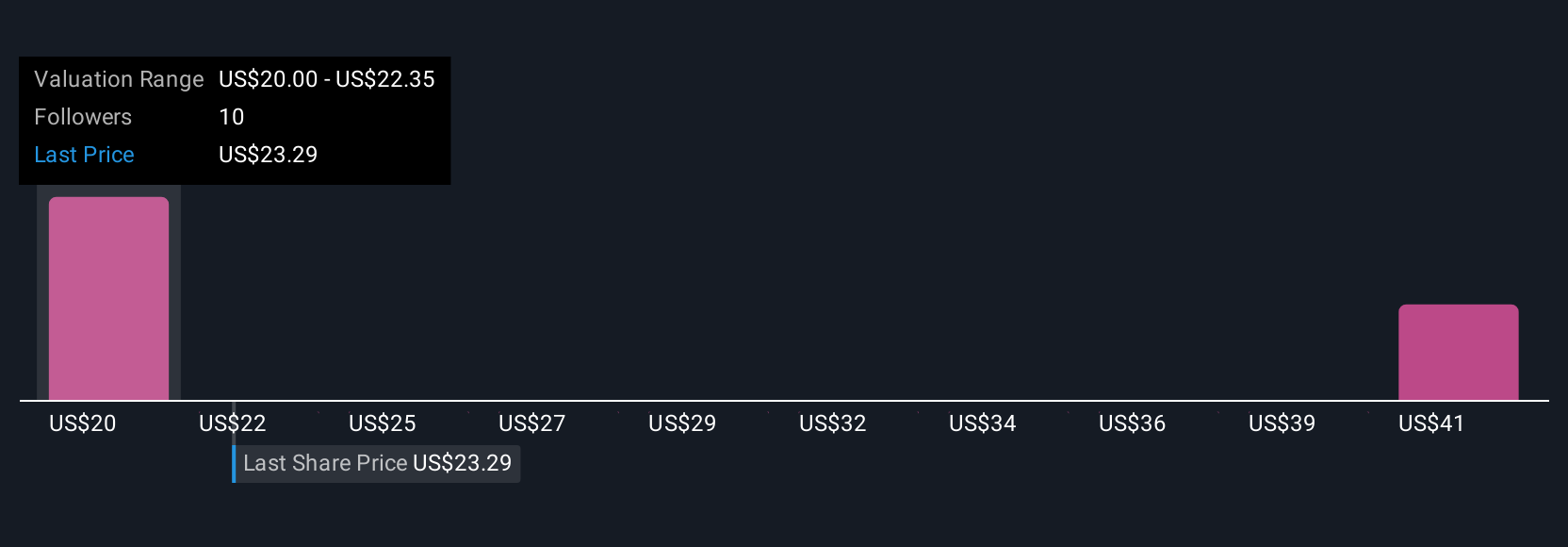

The Simply Wall St Community’s five fair value estimates for PBF Energy range from US$3.51 to US$350.33 per share. While these views reflect a wide spectrum of optimism and caution, ongoing operational and regulatory uncertainties at core refineries continue to influence how different investors gauge risk and future performance.

Explore 5 other fair value estimates on PBF Energy - why the stock might be worth less than half the current price!

Build Your Own PBF Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PBF Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PBF Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBF

PBF Energy

Through its subsidiaries, engages in refining and supplying petroleum products.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives