- United States

- /

- Oil and Gas

- /

- NYSE:PARR

Is Par Pacific Still a Bargain After Recent Share Price Volatility in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Par Pacific Holdings and wondering if now is the right moment to jump in, you are not alone. After a wild ride this year, the stock has become a hot topic among investors seeking value picks that still have room to run. Despite a dip of 7.7% over the past week and a mild decrease of 2.2% in the last month, Par Pacific’s broader trajectory reveals impressive strength, up 105.6% year-to-date and a remarkable 358.2% over the last five years.

So, what is fueling these long-term gains and what do the recent short-term declines signal? Some of the price movement reflects shifting sentiment about energy market dynamics and macroeconomic trends rather than company-specific fundamentals. That makes it a great time to revisit exactly how much Par Pacific is truly worth, especially as investors seem to be recalibrating their risk expectations.

When we put Par Pacific through a battery of six well-regarded valuation checks, it scores a 5 out of 6 for being undervalued. That stands out in today’s crowded market, where truly undervalued plays are tough to spot. In the next section, we will dig deeper into each of these valuation methods and what they tell us about Par Pacific’s current price. Even if you are familiar with traditional approaches, stick around, as a more insightful way to evaluate value is coming up at the end of the article.

Approach 1: Par Pacific Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. In simple terms, it helps investors figure out what a business is worth based on its ability to generate cash over time.

For Par Pacific Holdings, the most recent Free Cash Flow sits at $88.9 million. Analysts expect this to grow steadily, with projections reaching $169 million by 2028. Beyond five years, Simply Wall St extrapolates further growth, with free cash flow estimates topping $262 million by 2035. These projections are rooted in both analyst consensus for the next several years and longer-term, data-driven estimates for subsequent years.

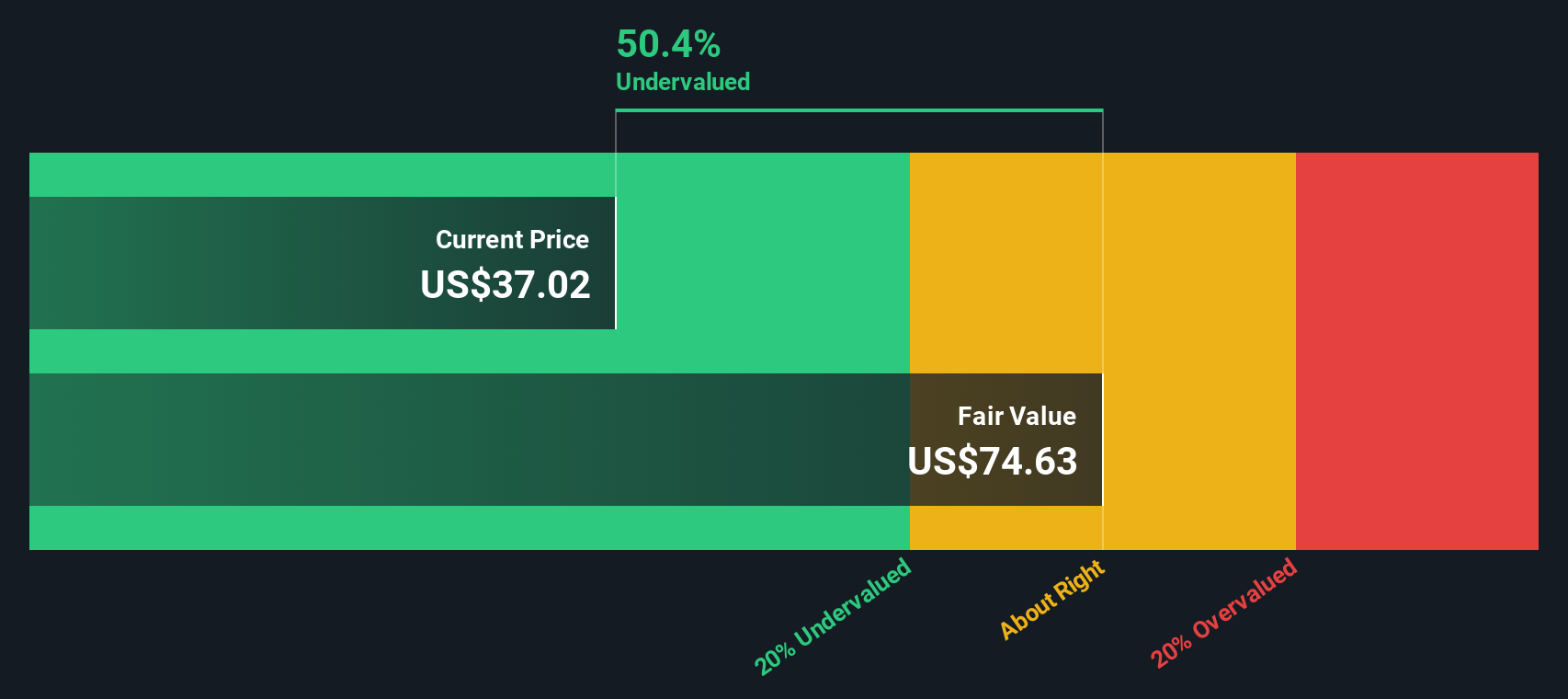

Using these future cash flow estimates and discounting them back to the present, the DCF model arrives at an estimated fair value of $74.78 per share. Given the current market price, this implies the stock is trading at a 54.1% discount to its intrinsic value. This suggests significant upside remains if these forecasts hold true.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Par Pacific Holdings is undervalued by 54.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Par Pacific Holdings Price vs Sales

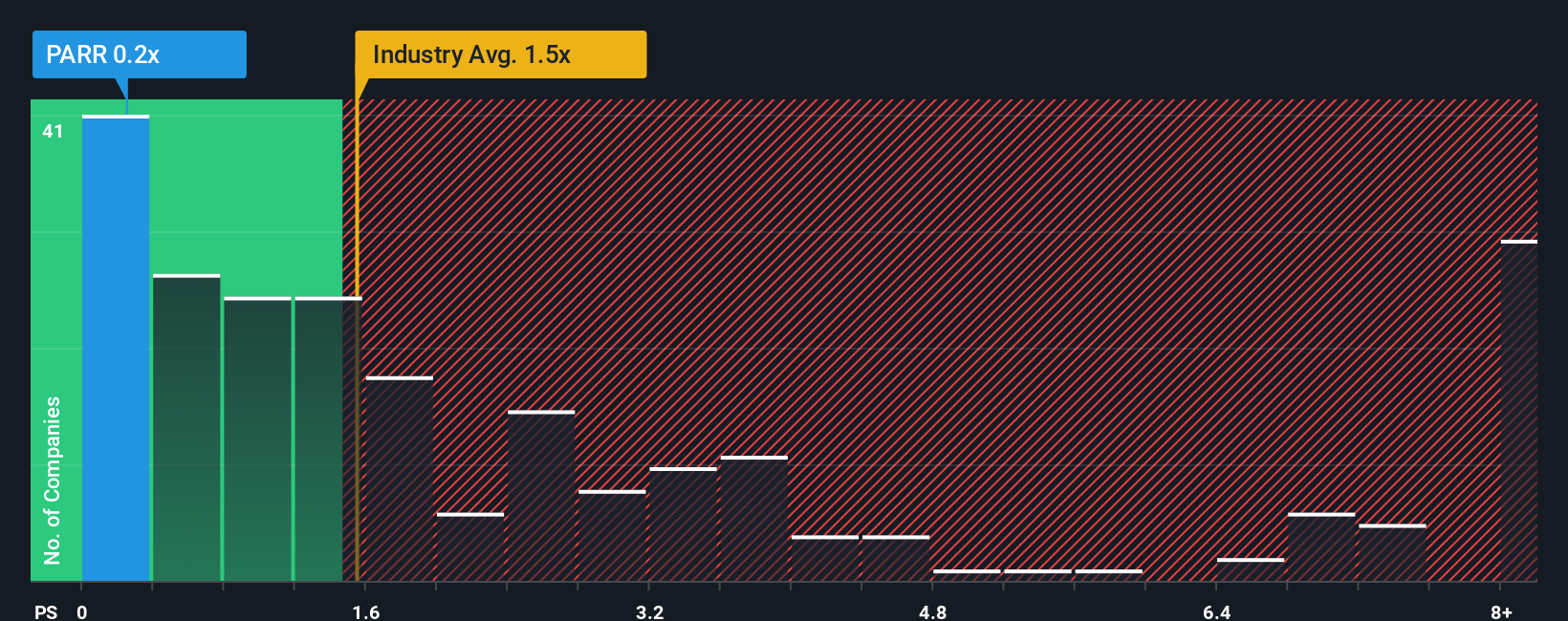

The Price-to-Sales (P/S) ratio is often a preferred valuation tool for companies in sectors like oil and gas, where earnings can swing widely due to commodity prices, and revenues provide a more stable benchmark for comparison. The P/S ratio gives investors a way to gauge how much they are paying for each dollar of revenue. This makes it especially useful for companies that may report volatile or negative earnings.

Growth expectations, risk, and profit margins all influence what a “normal” or “fair” P/S ratio should be. Companies with higher growth prospects or lower risk typically trade at higher multiples, while those facing headwinds may trade at discounts. For Par Pacific Holdings, the P/S ratio currently sits at 0.23x, which is notably below both the peer average of 0.51x and the oil and gas industry average of 1.54x. By these measures alone, Par Pacific appears to be trading at a steep discount to its sector.

Simply Wall St's proprietary “Fair Ratio” offers an even more tailored benchmark. The Fair Ratio for Par Pacific is calculated at 0.45x, taking into account not just industry and peer comparisons but also factors like profit margin, growth outlook, company size, and risk profile. This more holistic metric provides a clearer sense of what investors should reasonably pay for the stock compared with blunt industry averages alone.

Comparing Par Pacific’s current P/S ratio of 0.23x to its Fair Ratio of 0.45x suggests the stock is undervalued. In other words, the current market price is well below what its underlying fundamentals support based on all the key metrics that matter for valuation.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Par Pacific Holdings Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives, a more intuitive approach that links a company’s story to a detailed financial forecast, ultimately leading to your own estimate of fair value. A Narrative allows you to describe your perspective on Par Pacific Holdings, including what you think will happen to its revenue, margins, and earnings, and then see how that story translates into an up-to-date fair value based on your assumptions. Narratives are easy to use and available on Simply Wall St's Community page, where millions of investors share their views and update them as new information comes in. This real-time, story-based approach empowers you to decide when to buy or sell by comparing your fair value to the market price. Since Narratives react to changes like fresh news or earnings reports, your decision-making always reflects the latest reality. For example, while some investors currently forecast strong regional demand and renewable projects driving PARR's fair value as high as $39.00, others see industry risks capping fair value at just $23.00. With Narratives, you can see both stories, test your own, and act with more confidence than ever before.

Do you think there's more to the story for Par Pacific Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PARR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives