- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Occidental Petroleum (NYSE:OXY) Reports US$954 Million Net Income For Q1 2025

Reviewed by Simply Wall St

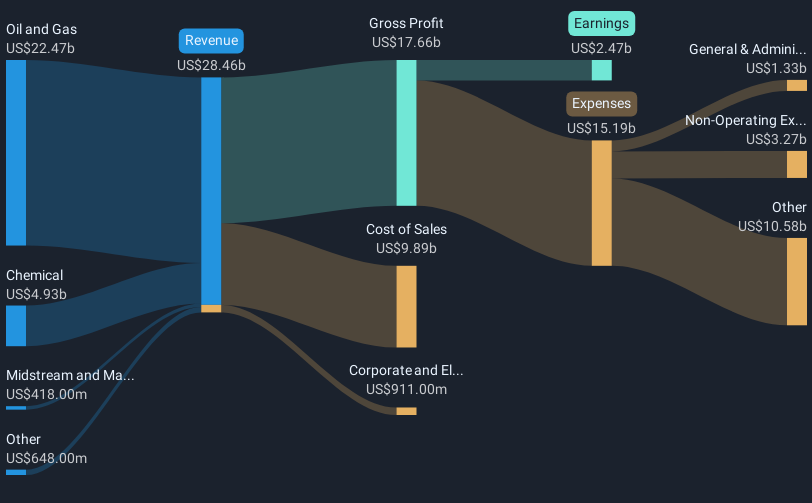

Occidental Petroleum (NYSE:OXY) has reported significant growth in its Q1 2025 earnings, with revenue and net income surpassing figures from the previous year. Despite these positive results and the announcement of a consistent quarterly dividend, Occidental's stock price performance over the past month remained largely flat, reflecting a 0.67% movement. This subdued performance aligns with broader market trends, where recent gains have been driven by macroeconomic factors, including trade agreements between the U.S. and U.K. While Occidental's earnings report could have positively influenced its stock, the effect was tempered within the broader market's movement.

We've identified 4 possible red flags for Occidental Petroleum that you should be aware of.

The release of Occidental Petroleum's Q1 2025 earnings highlights several key developments that could impact its future performance. Despite surpassing revenue and net income from the previous year, the stock's modest 0.67% movement aligns closely with broader market trends. A significant contributor to Occidental’s positive narrative includes an emphasis on enhanced production efficiency and strategic initiatives like the STRATOS project, which may potentially affect revenue forecasts and earnings growth. These efforts, coupled with ongoing challenges such as fluctuating oil prices and capital expenditures, underscore the company's current market position and forward-looking potential.

Occidental's shares have achieved a total return of 203.55% over the past five years, evidencing robust long-term performance. This longer-term gain contrasts with its recent underperformance relative to both the US market, which returned 7.7%, and the Oil and Gas industry, which saw a 10% decline over the past year. The current share price of US$39.28 sits below the consensus analyst price target of US$49.39, reflecting a 20.5% potential upside. Analysts forecast incremental revenue growth of 2.6% annually, with earnings potentially reaching US$3.3 billion by 2028, driven by increased operational efficiencies and innovative technological integration. However, the relatively high price-to-earnings ratio assumption of 21.6x required to meet these projections suggests some market skepticism, underpinning the need for careful evaluation of future company developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Occidental Petroleum, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives