- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Assessing Occidental Petroleum After Major Carbon Capture Investment and Share Price Drop of 17%

Reviewed by Bailey Pemberton

Thinking about what to do with Occidental Petroleum stock right now? You are definitely not alone. The stock has been on a bit of a rollercoaster lately, and investors are trying to make sense of where the real value lies. Just in the last year, Occidental shares are down more than 17%, and if you look back even further, the picture is mixed: down 16.2% year-to-date, but a whopping 396.1% higher compared to five years ago. That is the kind of history that makes you wonder whether the market is missing something big or overestimating some risks.

Recent news about Occidental has focused on the company's aggressive moves in carbon capture initiatives and strategic investments in lower-carbon solutions. These announcements have shifted some risk perception, as the market digests how such projects might reshape long-term growth potential, especially as energy policies worldwide continue to evolve. It is clear that management is positioning Occidental to be more than just a traditional oil company, which could be a game changer over the long haul.

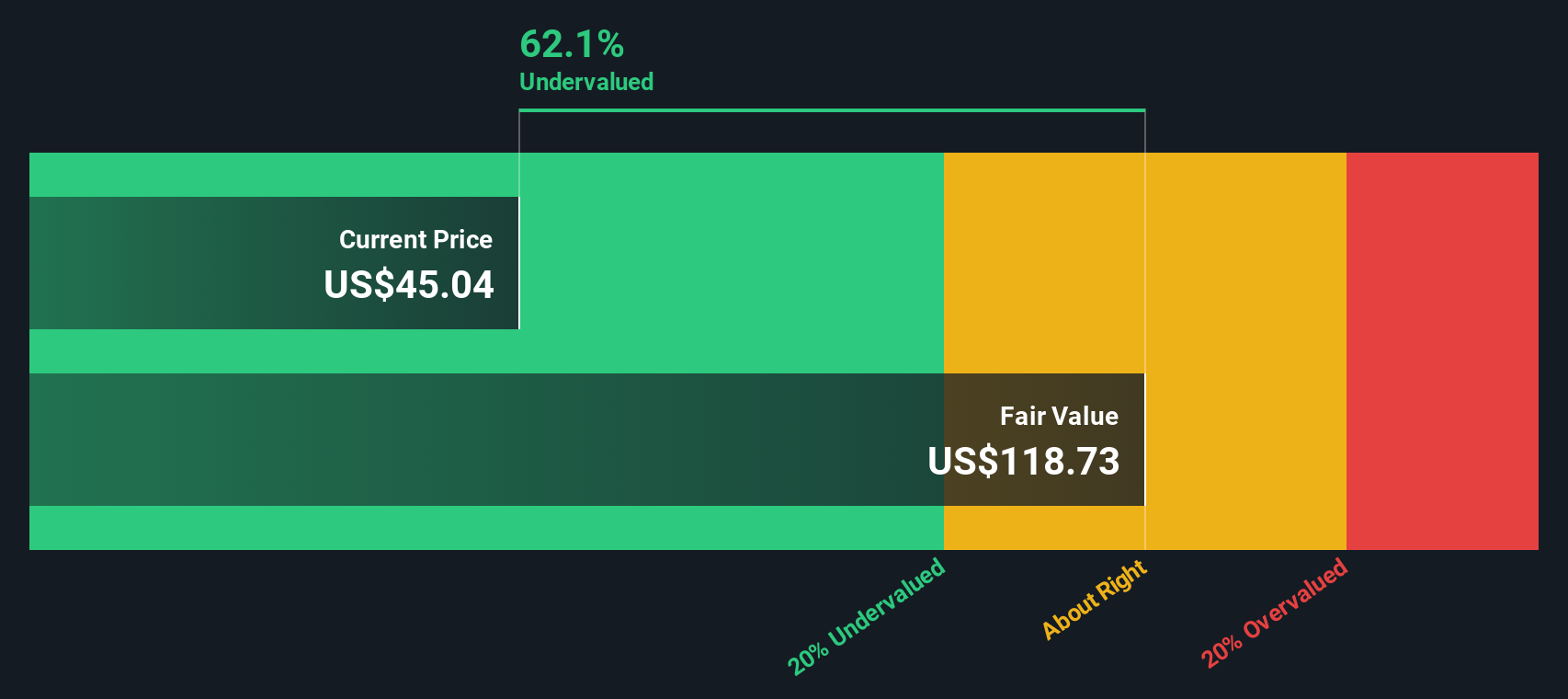

When I ran the numbers through six key valuation checks, Occidental scored a 4, which suggests it is undervalued in the majority of those categories. That is a promising sign, but digging into the specifics behind that score matters most. Next, we will break down exactly how those valuation methods view Occidental and beyond that, I will share what I believe is the most insightful way to judge its true value in today's market.

Why Occidental Petroleum is lagging behind its peers

Approach 1: Occidental Petroleum Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach aims to determine what Occidental Petroleum is truly worth today, based on its expected ability to generate free cash flow in the years ahead.

For Occidental Petroleum, the latest reported Free Cash Flow (FCF) is approximately $5.6 billion. Analyst estimates cover the next five years, with 2029’s FCF projected at around $4.9 billion. Beyond that, additional years are estimated using trend data to reach roughly $5.0 billion in 2035. All projections are in US dollars. These forecasts incorporate both expert consensus and systematic extrapolation, providing a robust picture of Occidental’s medium-term and long-term cash generation potential.

When all future cash flows are discounted to the present using the DCF approach, the intrinsic value for Occidental Petroleum shares comes out to $89.62. Notably, this is about 53.4% higher than the current market price, which suggests that the stock is significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Occidental Petroleum is undervalued by 53.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

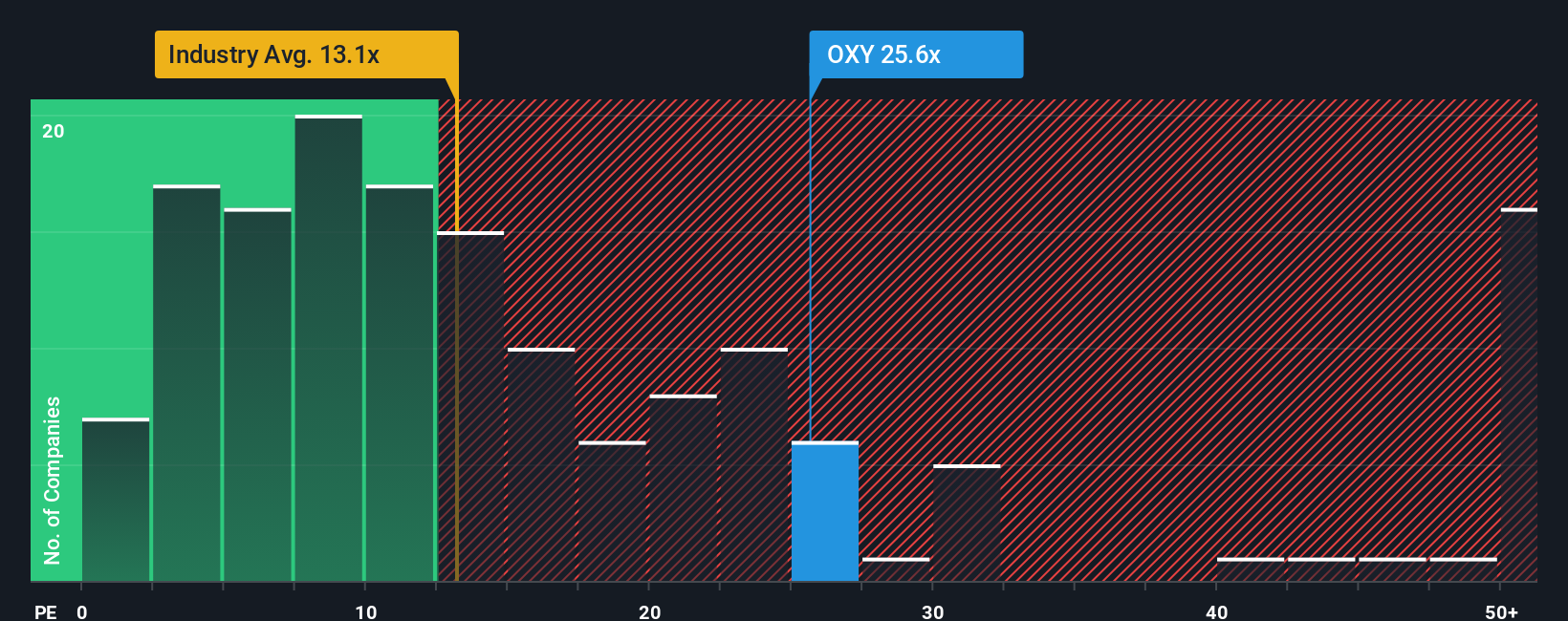

Approach 2: Occidental Petroleum Price vs Earnings

For profitable companies like Occidental Petroleum, the Price-to-Earnings (PE) ratio is often a preferred valuation tool because it directly relates a company’s share price to its per-share earnings. This metric gives investors a simple way to assess how much they are paying for a dollar of earnings, making it useful for comparisons across companies and industries.

Growth expectations and risk play a big role in determining what a fair or normal PE ratio should be. Higher expected earnings growth and lower risk profiles typically justify higher PE multiples. On the other hand, if a company’s growth outlook is flat or its earnings are perceived as risky, investors will usually assign it a lower PE multiple.

Currently, Occidental trades at a PE ratio of 23.75x. This is above the oil and gas industry average of 12.90x, but below the average for its closest peers, which stands at 31.69x. However, rather than relying solely on these comparisons, it is worth introducing Simply Wall St’s Fair Ratio, which is 20.06x for Occidental. The Fair Ratio goes beyond raw averages by factoring in the company’s unique profile, including its expected growth, profits, risk characteristics, market cap, and how it compares to the industry overall.

Comparing Occidental’s actual PE ratio of 23.75x with its Fair Ratio of 20.06x shows that the stock is priced a bit higher than what could be considered fair based on its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Occidental Petroleum Narrative

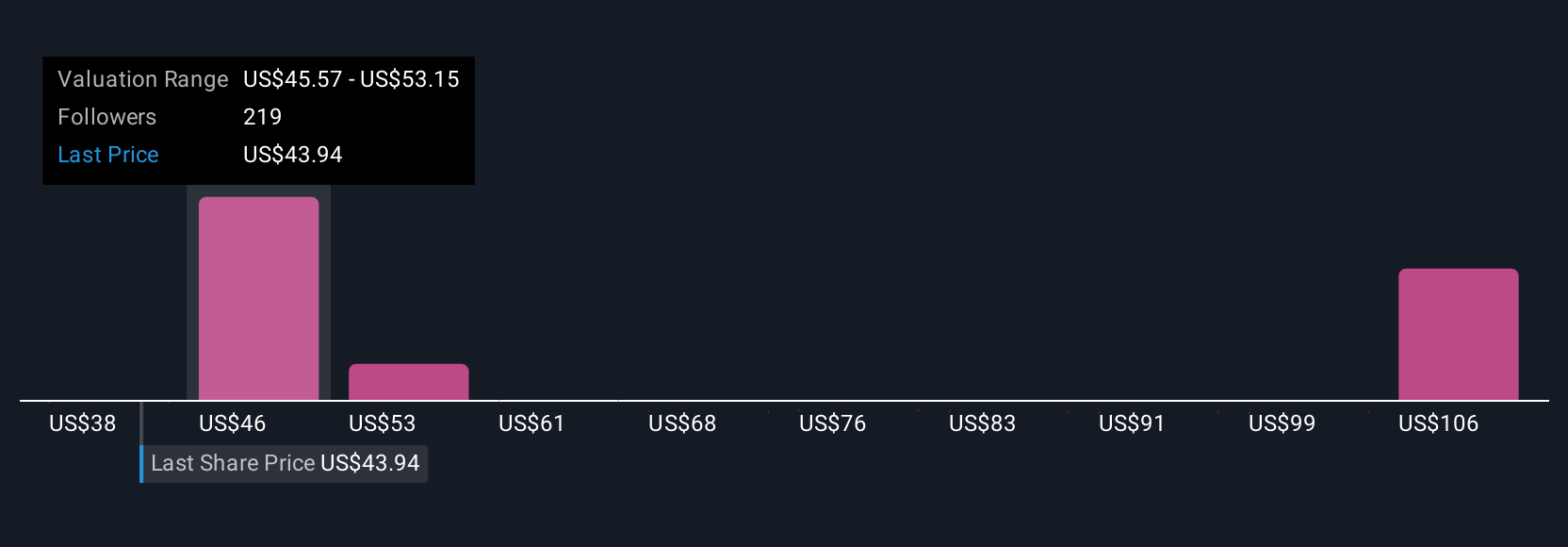

Earlier we mentioned there is an even smarter way to make sense of a stock’s value. Welcome to the concept of Narratives. A Narrative is simply your perspective on a company’s story and prospects, tied directly to your estimates for things like revenue, earnings, and future profit margins. Instead of relying solely on one-size-fits-all metrics, Narratives let you create a forecast that reflects how you believe Occidental will perform and calculate what you think is a reasonable fair value.

These Narratives link the company’s real-world story, such as Occidental’s push into carbon capture or its exposure to oil price swings, to financial estimates and an explicit valuation. This makes investment decisions transparent and grounded in your logic, not just the headlines. On Simply Wall St’s Community page, used daily by millions of investors, you can access and update Narratives at any time, making your analysis flexible and up-to-date whenever new earnings or news emerge.

By comparing the Fair Value from your Narrative with Occidental’s actual market price, you gain a clear, actionable signal about whether it is time to buy, hold, or sell. For example, some Narratives for Occidental forecast fair values as high as $55, reflecting optimism about long-term carbon capture success. Others are as low as $40, focusing on oil price risks and uncertain market shifts. Narratives invite you to invest not just in the numbers but in the reasoning behind them, giving you confidence to act in any market condition.

Do you think there's more to the story for Occidental Petroleum? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives