- United States

- /

- Oil and Gas

- /

- NYSE:OVV

Ovintiv (OVV) Valuation in Focus After Analyst Shifts and New Share Buyback Approval

Reviewed by Kshitija Bhandaru

Ovintiv (NYSE:OVV) drew investor focus this week after securing approval for a fresh buyback program that enables the company to repurchase up to 22.29 million shares through October 2026. This announcement followed several analyst firms revising their outlooks on Ovintiv, which led to active trading and discussion among market watchers.

See our latest analysis for Ovintiv.

Ovintiv’s recent approval for its new buyback program landed amid a stretch of flat to modest declines, with the latest share price at $40.12 after some short-term volatility. This year’s share price return is in negative territory. Long-term investors have still seen solid value delivered over the past five years as total shareholder return remains positive. Momentum has cooled lately as investors weigh evolving analyst sentiment and the company’s capital allocation moves.

If you’re looking to widen your investing lens beyond oil and gas, now’s the perfect time to see what’s happening among fast growing stocks with high insider ownership.

With analyst targets now mixed and a fresh buyback program in motion, should the recent dip in Ovintiv’s share price be seen as an attractive entry point, or is the market already factoring in future growth?

Most Popular Narrative: 25.2% Undervalued

With the narrative’s fair value estimate of $53.62 well above the last close at $40.12, Ovintiv’s shares are under the microscope. This highlights meaningful upside in the eyes of many analysts and sets the stage for debates around Ovintiv’s ability to deliver against bold margin and earnings expectations in a volatile energy landscape.

Disciplined capital allocation, including structural cost reductions, debt paydown, and aggressive share buybacks, is set to drive durable increases in earnings per share and further upside for equity valuation as capital markets recognize improved net margins and cash flow per share growth.

Curious about the key numbers powering this bullish scenario? The narrative hinges on ambitious profit margin gains and a future valuation multiple below the industry norm. Want to see what bold financial forecasts back this price target? Dive in to learn what could change the story ahead.

Result: Fair Value of $53.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation in operating costs or a faster global shift to renewables could quickly challenge Ovintiv’s margin expansion and long-term growth story.

Find out about the key risks to this Ovintiv narrative.

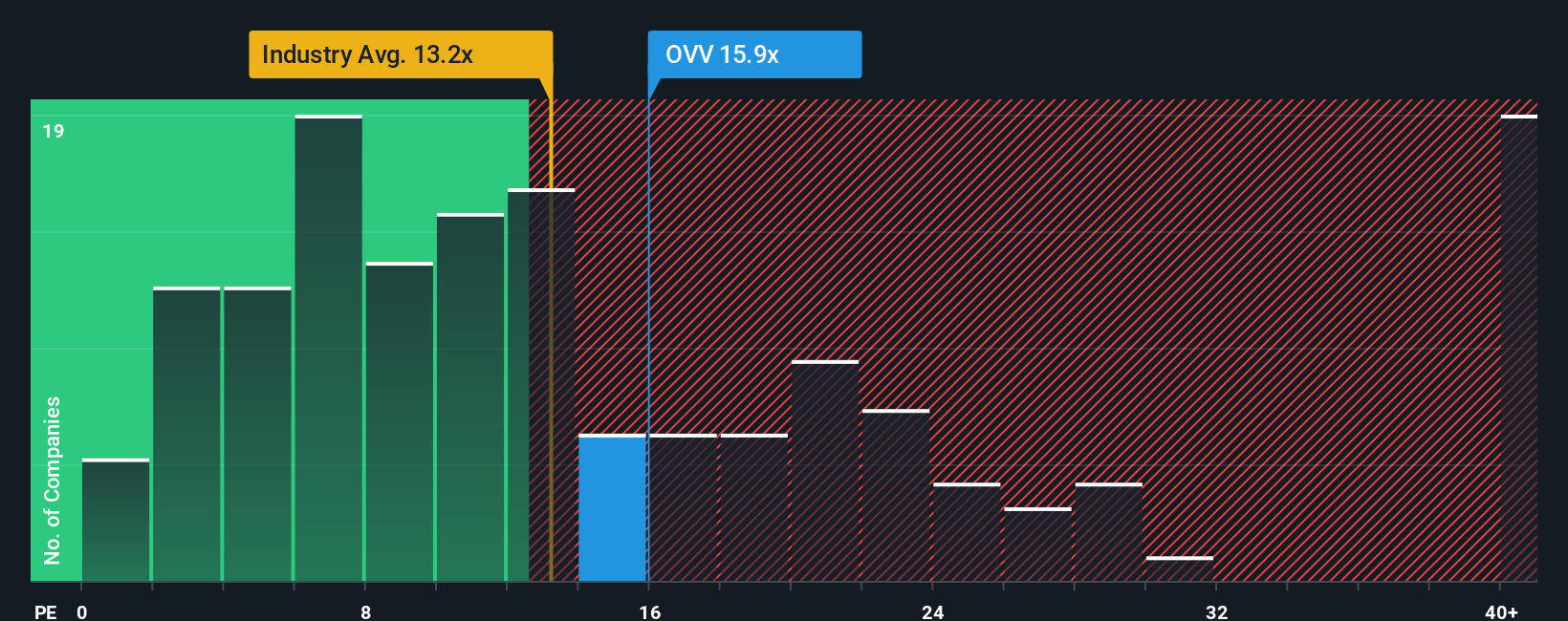

Another View: Market Ratios Tell a Different Story

While the narrative points to undervaluation, market ratios raise caution. Ovintiv’s price-to-earnings ratio of 17.3x sits above both the peer average of 15x and the US Oil and Gas industry average of 13.4x. This suggests the stock is relatively expensive compared to its competition and the sector overall.

So, is the upside already priced in, or could rapid earnings growth justify paying a premium if future expectations are met? Opportunity and risk may depend on whether the market’s ratio moves closer to the fair ratio of 25x, or if the sector’s lower averages become the anchor.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ovintiv Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own perspective and narrative in just a few minutes. Do it your way.

A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss out on stocks with exciting growth prospects and unique trends. Maximize your potential by checking out three powerful ideas below before the market moves.

- Uncover overlooked potential with these 3568 penny stocks with strong financials, where smaller companies often deliver big surprises for agile investors ready to spot the next breakout.

- Fuel your portfolio’s future by targeting innovation through these 25 AI penny stocks and gain exposure to companies powering the artificial intelligence revolution.

- Lock in consistent income streams and long-term stability by reviewing these 19 dividend stocks with yields > 3%, offering opportunities among stocks boasting yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives