- United States

- /

- Oil and Gas

- /

- NYSE:OVV

Does Ovintiv's (OVV) Buyback Reveal a New Direction for Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Ovintiv Inc. announced in September 2025 that its Board of Directors approved a buyback program to repurchase up to 22,287,709 common shares through October 2026, with repurchased shares to be cancelled or returned to treasury as authorized but unissued shares.

- This sizable share repurchase authorization can signal to the market that Ovintiv’s management has confidence in the company’s long-term outlook and ability to generate shareholder value.

- We’ll review how the buyback program could reshape Ovintiv’s investment narrative, particularly regarding capital allocation and shareholder returns.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ovintiv Investment Narrative Recap

To own Ovintiv, investors need to believe in the company's ability to outpace risks from regional commodity price swings and a rapidly changing energy sector by harnessing operational efficiencies, strong asset bases, and disciplined capital allocation. The newly announced share buyback program supports management’s focus on shareholder returns, but does not materially affect short-term catalysts such as production trends or key risks like regional price volatility and reserve longevity.

Among recent announcements, Ovintiv's steady quarterly dividend of US$0.30 per share demonstrates an ongoing commitment to direct capital returns. In the context of the new buyback, this underscores a capital allocation strategy centered on returning value to shareholders, even as commodity price headwinds and inventory challenges remain top of mind.

However, in contrast to Ovintiv’s emphasis on capital returns, investors should be aware that...

Read the full narrative on Ovintiv (it's free!)

Ovintiv's outlook anticipates $8.6 billion in revenue and $2.3 billion in earnings by 2028. This is based on a projected 1.5% annual revenue decline and an increase in earnings of about $1.7 billion from current earnings of $595 million.

Uncover how Ovintiv's forecasts yield a $53.62 fair value, a 34% upside to its current price.

Exploring Other Perspectives

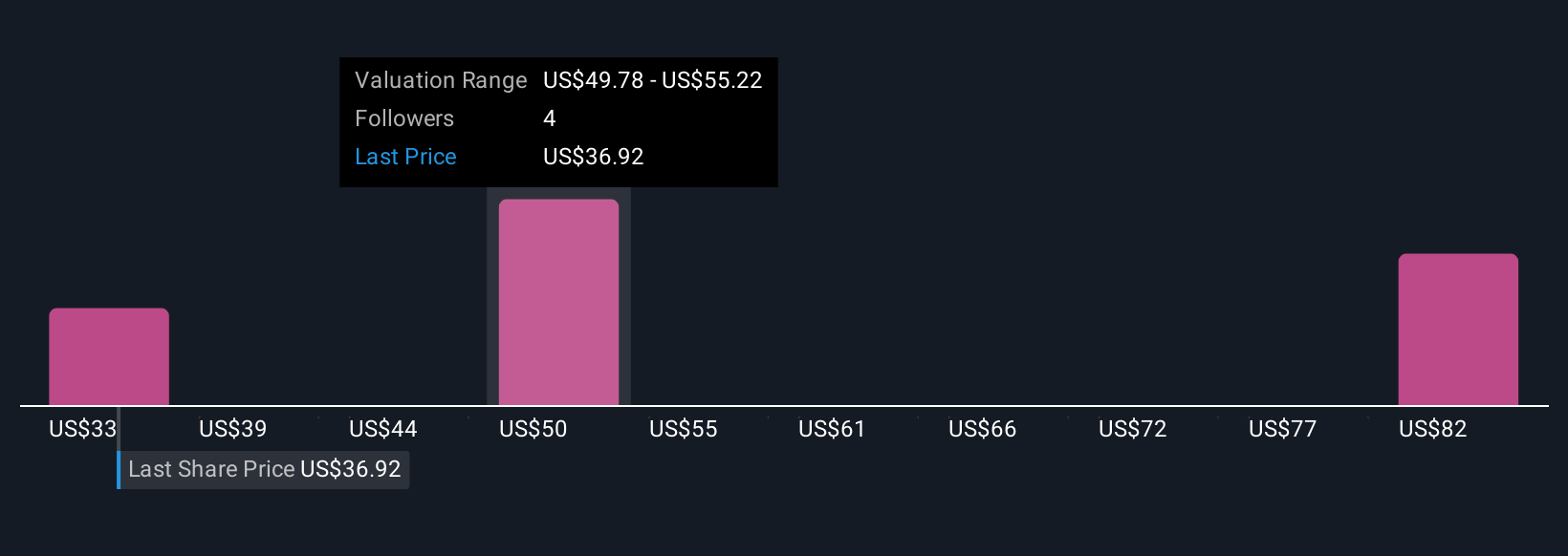

Four Simply Wall St Community members estimated Ovintiv’s fair value between US$33.47 and US$89.86, reflecting broad disagreement across retail perspectives. With regional price risks still in focus, your outlook may hinge on how you weigh short-term market volatility against Ovintiv’s buyback-driven shareholder returns.

Explore 4 other fair value estimates on Ovintiv - why the stock might be worth 17% less than the current price!

Build Your Own Ovintiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ovintiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ovintiv's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives