Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like ONEOK (NYSE:OKE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for ONEOK

ONEOK's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, ONEOK has achieved impressive annual EPS growth of 42%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

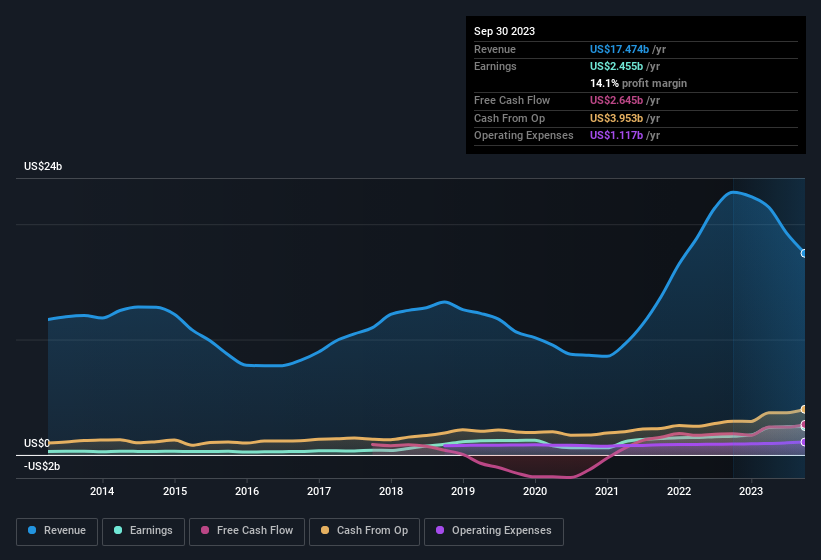

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. ONEOK's EBIT margins have actually improved by 5.2 percentage points in the last year, to reach 17%, but, on the flip side, revenue was down 23%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of ONEOK's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are ONEOK Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold US$56k worth of shares. But that's far less than the US$1.8m insiders spent purchasing stock. This adds to the interest in ONEOK because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was President Pierce Norton who made the biggest single purchase, worth US$1.5m, paying US$60.96 per share.

The good news, alongside the insider buying, for ONEOK bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth US$168m. We note that this amounts to 0.4% of the company, which may be small owing to the sheer size of ONEOK but it's still worth mentioning. This still shows shareholders there is a degree of alignment between management and themselves.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because ONEOK's CEO, Pierce Norton, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations over US$8.0b, like ONEOK, the median CEO pay is around US$12m.

ONEOK offered total compensation worth US$8.1m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add ONEOK To Your Watchlist?

ONEOK's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest ONEOK belongs near the top of your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for ONEOK you should be aware of, and 1 of them can't be ignored.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of ONEOK, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives