- United States

- /

- Energy Services

- /

- NYSE:OIS

Oil States International, Inc.'s (NYSE:OIS) Business Is Trailing The Industry But Its Shares Aren't

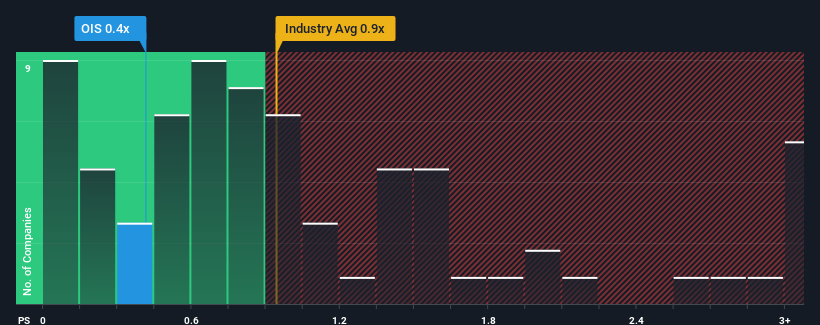

There wouldn't be many who think Oil States International, Inc.'s (NYSE:OIS) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Energy Services industry in the United States is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Oil States International

How Has Oil States International Performed Recently?

While the industry has experienced revenue growth lately, Oil States International's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Oil States International's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Oil States International's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 5.2% decrease to the company's top line. Even so, admirably revenue has lifted 34% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.3% during the coming year according to the four analysts following the company. With the industry predicted to deliver 6.3% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Oil States International's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Oil States International's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Oil States International's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Oil States International with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OIS

Oil States International

Through its subsidiaries, provides engineered capital equipment and consumable products for energy, industrial, and military sectors worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives