- United States

- /

- Energy Services

- /

- NYSE:OII

Oceaneering International (OII) Margin Expansion Reinforces Bullish Narrative Despite Modest Share Price Valuation

Reviewed by Simply Wall St

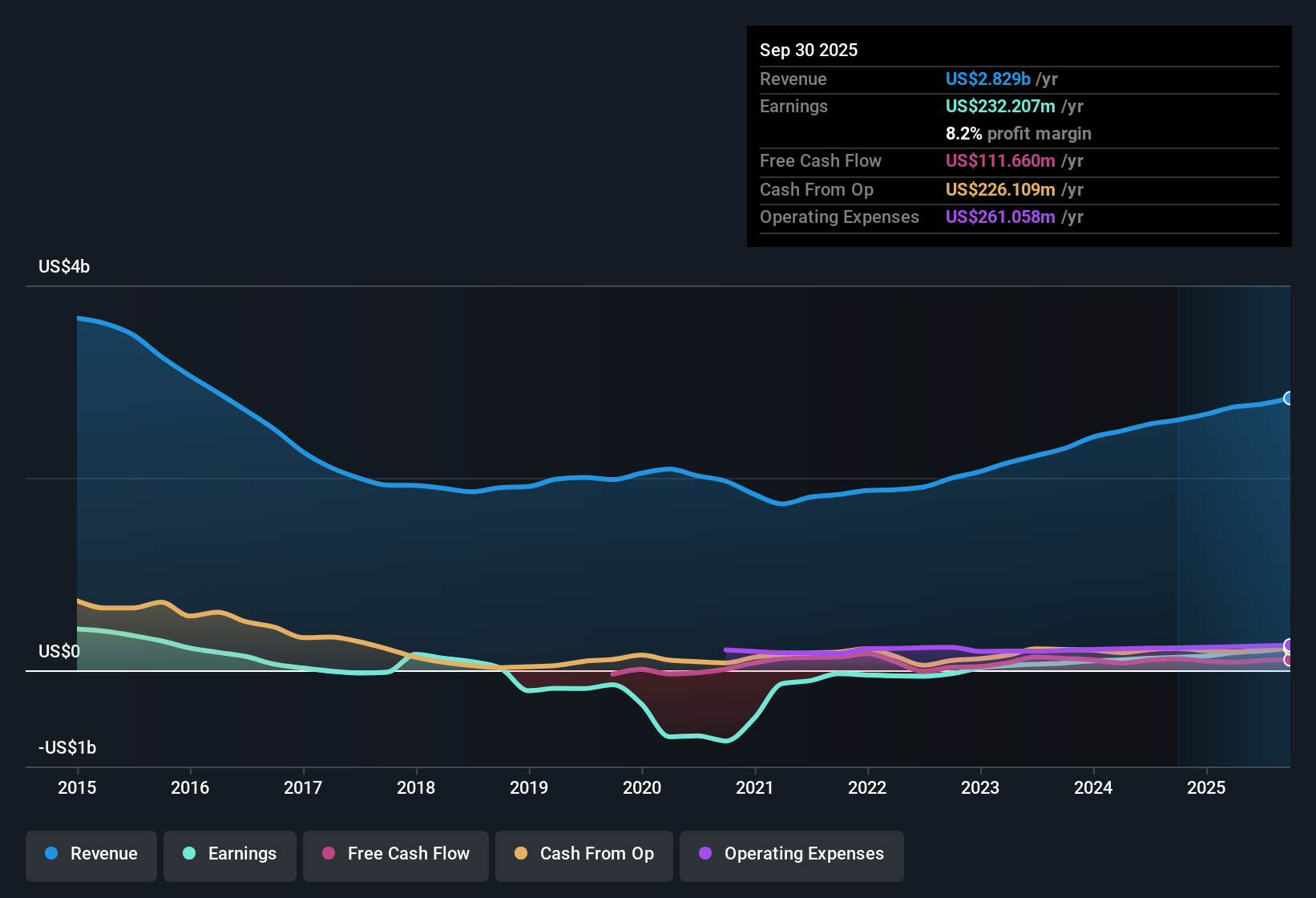

Oceaneering International (OII) reported a net profit margin of 8.2%, a healthy advance over last year’s 5.2%. Earnings have posted consistent gains, rising 70.9% year-over-year and growing at an annual pace of 81.4% over the past five years. Recent profitability metrics, together with a Price-To-Earnings Ratio of 10.3x that sits below both its peers and the broader industry average, highlight the quarter as another step in the company’s transition to high-quality earnings and perceived value for investors.

See our full analysis for Oceaneering International.Next, we will examine how these headline results compare to the prevailing narratives and sentiment that shape investor expectations, highlighting where the story stays on track or takes a new direction.

See what the community is saying about Oceaneering International

Future Margins Face Pressure

- Analysts estimate that Oceaneering’s profit margins will shrink from the current 7.3% to 5.9% over the next three years, reversing some of the improvement seen in recent periods.

- Analysts' consensus view points to increased competition and heightened investor pressure as factors that could limit margins and hinder future business growth.

- Rising competition from new entrants leveraging advanced robotics and digital solutions may put downward pressure on Oceaneering’s margins as pricing power erodes.

- Investor and regulatory moves to divert capital away from traditional oilfield services could restrain revenue and profit expansion even if operational performance stays solid.

Share Price Sits Below DCF Fair Value

- Oceaneering’s current share price of $23.80 trades at a 43% discount to its DCF fair value of $41.99, and its Price-To-Earnings Ratio of 10.3x is also well below the US Energy Services industry average of 15.3x.

- Analysts' consensus view highlights a tension between Oceaneering’s attractive valuation and cautious outlook for future profits.

- Although the share price is below fair value by some models, the analyst target price stands at $23.50, which virtually matches market value and reflects uncertainty about sustaining recent growth rates.

- This alignment suggests that while bargain hunters may be attracted by valuation, most analysts think the market is pricing in the right amount of caution given modest revenue and margin forecasts.

Diversification Cushions Oil & Gas Slowdown

- Oceaneering has expanded high-margin product lines such as Grayloc connectors and strengthened its subsea robotics business, which commands over 60% market share and higher day rates, helping offset oilfield cyclicality.

- Analysts' consensus view sees the company’s investments in recurring service revenue, long-term contracts, and government-backed aerospace and defense projects as effective ways to stabilize earnings in the face of sector headwinds.

- Expanding into less-cyclical markets such as defense and international decommissioning boosts revenue visibility and helps mitigate the risks of a slow retreat in offshore oil and gas development.

- Recurring revenue from maintenance and decommissioning projects in Europe, as well as large international offshore contracts like BP Mauritania, supports the idea of more predictable long-term cash flows amid an industry in transition.

Want more context on how analysts are weighing diversification, margin pressure, and valuation? Read the full consensus narrative for Oceaneering International and see how the latest data shapes the outlook. 📊 Read the full Oceaneering International Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Oceaneering International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique take on Oceaneering’s results? Share your viewpoint and build your own narrative in just a few minutes. Do it your way

A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Oceaneering’s shrinking profit margins and muted analyst targets highlight risk around maintaining consistent earnings growth in the years ahead.

If stability matters to you, use our stable growth stocks screener (2089 results) to discover companies delivering steady results and dependable growth through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives