- United States

- /

- Energy Services

- /

- NYSE:OII

Is Oceaneering International Trading Below Its True Worth After Offshore Robotics Expansion?

Reviewed by Bailey Pemberton

- Wondering if Oceaneering International is trading at a bargain or premium? You are not alone. Figuring out whether the current price reflects the company's real value is crucial for making smart investing decisions.

- The stock has had a mixed ride lately, gaining 3.6% over the past week and 5.4% over the last month, but still down 9.9% year-to-date and 17.9% over the past year. Long-term, it is up an impressive 61% over three years and a massive 265% over five years, making it a stock to watch closely.

- Recent headlines have highlighted Oceaneering International's expanding role in offshore robotics and subsea engineering solutions. This growing industry presence has fueled investor discussions about future growth, adding important context to the company’s momentum and risk profile.

- Right now, Oceaneering International scores 4 out of 6 on the valuation checks, suggesting some areas of undervaluation remain. Next, we will unpack what these valuation scores mean in practice and dig into widely-used valuation methods. Plus, stay tuned for a smarter way to look at company value coming up at the end of this article.

Approach 1: Oceaneering International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. This method aims to determine what those streams of cash are worth in present terms, based on the company's ability to generate cash in the coming years.

For Oceaneering International, current Free Cash Flow (FCF) stands at $111.2 million. Analysts forecast steady growth, with FCF projected to reach $232 million by 2029. Estimates beyond this point are calculated by extending observed growth patterns and using industry data to maintain a realistic forecast horizon. This approach allows for a smooth estimate out to ten years, even though analyst consensus only stretches to five.

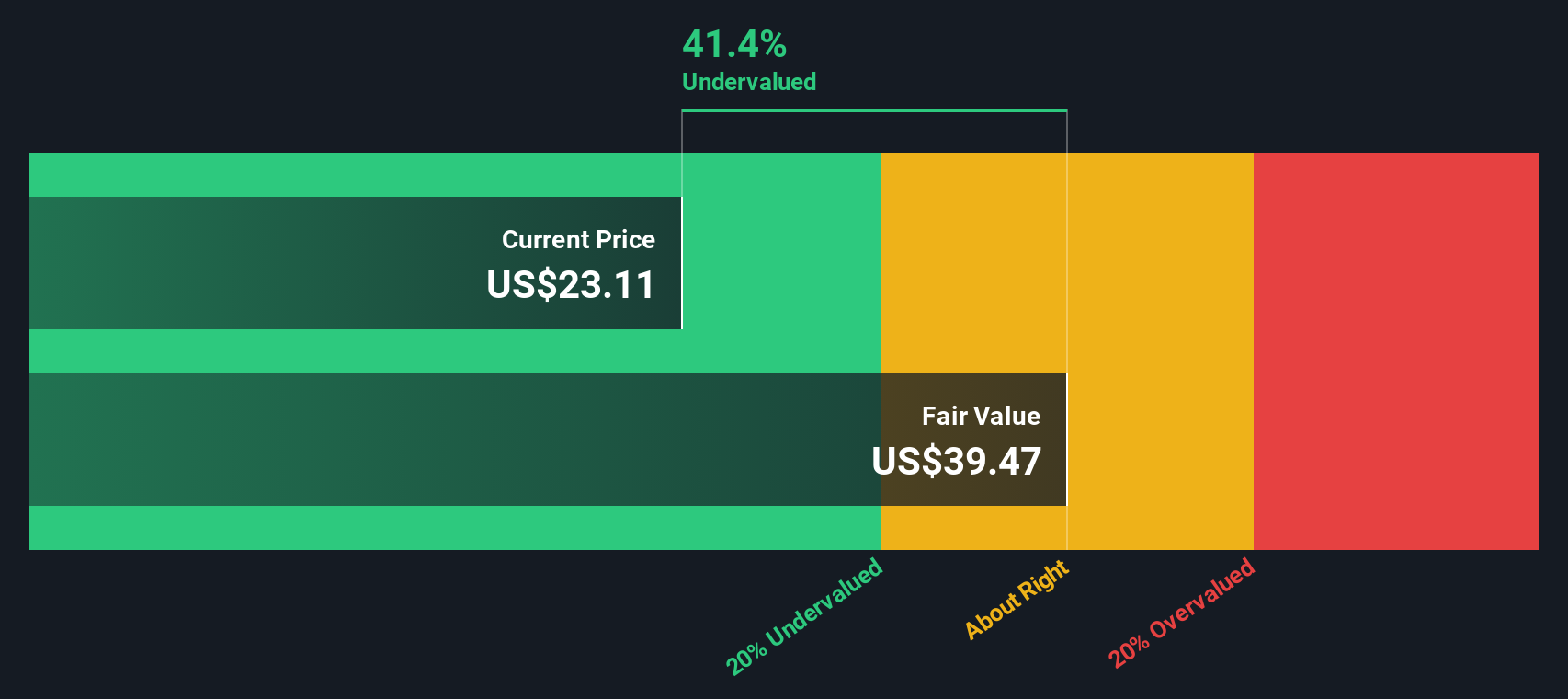

The result of this DCF analysis assigns Oceaneering International an estimated fair value of $51.16 per share. Compared to its recent trading price, this model shows the stock is trading at a 52.2% discount to its intrinsic value, suggesting there could be substantial upside potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Oceaneering International is undervalued by 52.2%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Oceaneering International Price vs Earnings

The price-to-earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Oceaneering International, as it helps investors understand how much they are paying for each dollar of current earnings. Generally, higher growth expectations or lower risks can justify a higher PE ratio. On the other hand, elevated risks, slower growth, or thin profit margins tend to drag the "normal" or "fair" multiple down.

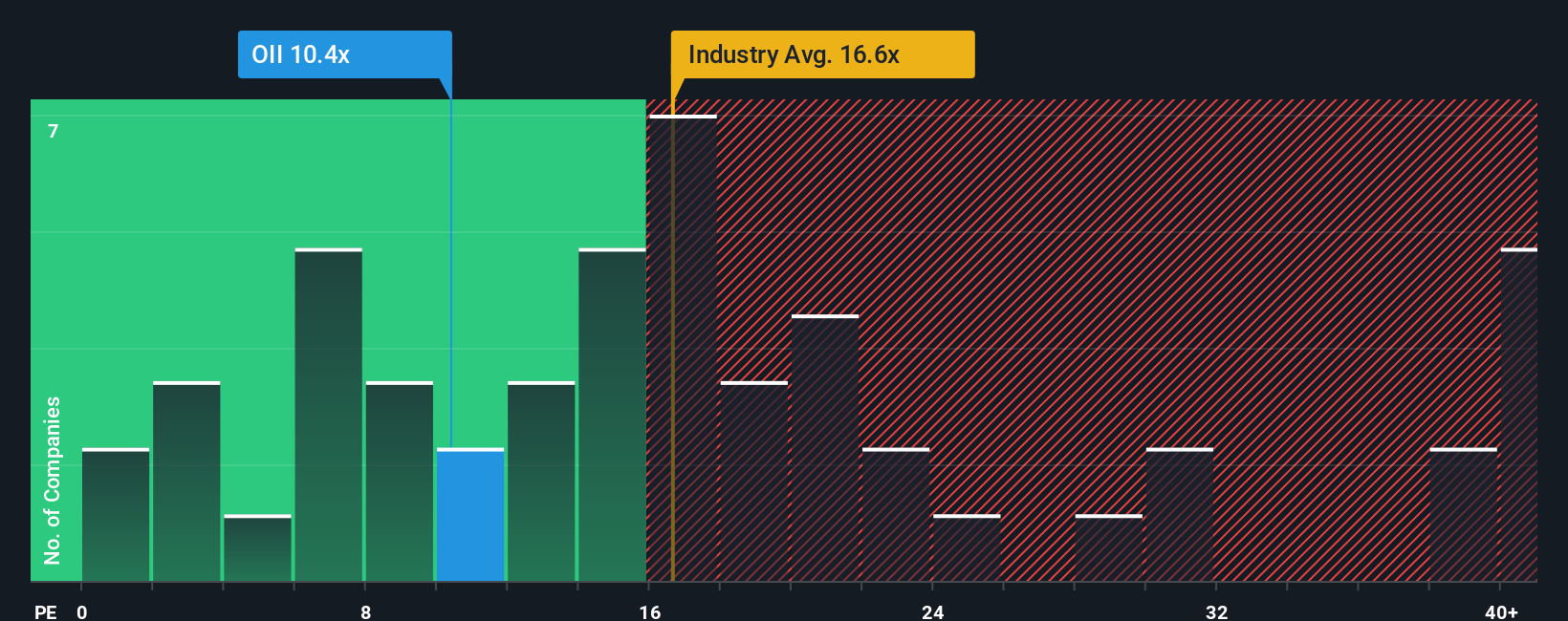

Oceaneering International currently trades at a PE ratio of 10.51x. This is well below the broader Energy Services industry average of 16.86x as well as the peer group average of 31.75x, suggesting that the company may be undervalued relative to both its direct competitors and the wider sector.

Simply Wall St’s proprietary "Fair Ratio" seeks to go a step further than traditional benchmarks. While comparing to peers or industry averages provides some context, the Fair Ratio is tailored to the company’s own profile by factoring in its earnings growth prospects, profit margins, risk factors, market capitalization, and its specific industry. By integrating these considerations, the Fair Ratio delivers a more accurate assessment of what Oceaneering International’s PE ratio ought to be in today’s market environment.

Comparing the actual PE ratio to the Fair Ratio allows us to pinpoint whether the stock is being fairly priced. If the actual PE ratio is materially lower than the Fair Ratio, this typically signals undervaluation. In this case, the gap suggests that Oceaneering International is trading below what would be expected for a business with its characteristics and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Oceaneering International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives.

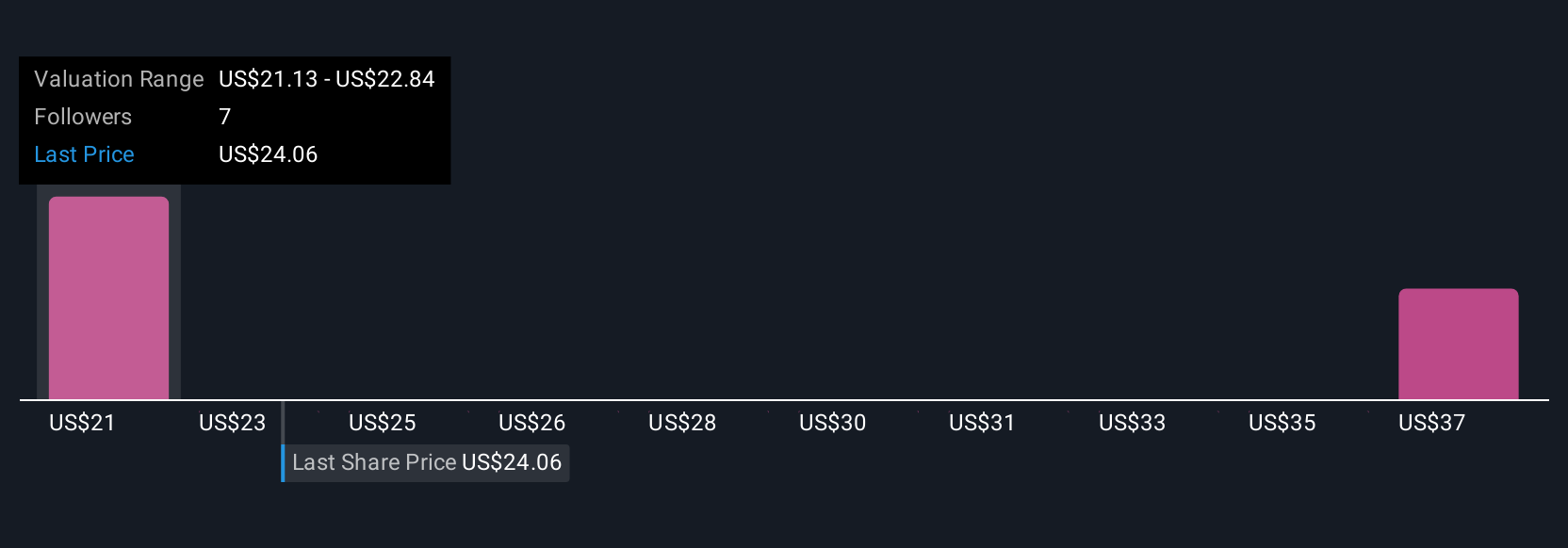

A Narrative is simply your personalized story about a company, connecting what you believe about its future, such as its revenue growth, profit margins, and business direction, to a set of informed financial forecasts and, ultimately, to a fair value estimate.

Instead of relying exclusively on past data or analyst averages, Narratives let you articulate your reasoning and assumptions, making the investing process both easier and more transparent. On Simply Wall St’s Community page, millions of investors create and share these Narratives, offering a range of perspectives that go far beyond basic ratios.

Narratives help answer the key investor question of when to buy or sell by comparing your estimated Fair Value to the current share price, and they automatically update when news, earnings, or forecasts change so your views stay relevant as the company's story evolves.

For example, some investors believe decarbonization and rising competition will keep Oceaneering International's fair value near $17.50, while others see momentum from robotics and defense contracts as key to a much higher estimate, even up to $25.00. This demonstrates how Narratives can reflect a wide range of plausible outcomes for the same stock.

Do you think there's more to the story for Oceaneering International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success